Ethereum ETFs could spark a new “altseason,” with Bitcoin losing market share from two-year highs. BTC and ETH prices fell 3.5% on May 24.

On May 24, the price of Bitcoin BTC ($67,380) and Ether ETH ($3,699) fell 3.5% as the market failed to rally around a much-anticipated institutional milestone.

Bulls disappointed by Bitcoin and Ether’s ETF certification.

Cointelegraph Markets Pro and TradingView data revealed that the price of ETH was $3,670, while BTC was trading close to $67,000.

When it was announced that U.S. regulators had given the go-ahead to introduce spot Ether exchange-traded funds (ETFs), both responded with restrained enthusiasm.

The ETFs were not yet available for trading, despite being a massive victory for the cryptocurrency sector and a dramatic change in direction for the Securities and Exchange Commission (SEC). The anticipated launch date was pushed back due to additional preparations, which analysts estimated may take several weeks.

While talking about the most recent developments, committed Bloomberg Intelligence ETF experts James Seyffart and Eric Balchunas discussed the possibility of a mid-June approval.

Because of this, BTC/USD and ETH/USD avoided an impulsive surge higher and even dropped from their daily close highs.

Market participants were more interested in the dynamics between the two biggest cryptocurrencies on that particular day.

Well-known trader Daan Crypto Trades predicted that Bitcoin’s market capitalization would likely face significant competition when the Ethereum ETFs went live.

He tweeted, partially on X, “With the recent $ETH rally, we’ve seen #Bitcoin Dominance head back down.”

This has been in an up trend for about 1.5 years and if there’s anything that could reverse this trend it would be ETH leading on the back of an ETF being approved. 52% and 48% are the main levels.

Other traders also noticed the risk to the upswing, which they thought would be a sign of an impending “altseason.”

Just before the block subsidy halving in mid-April, Bitcoin’s dominance reached 57%, the most in over two years.

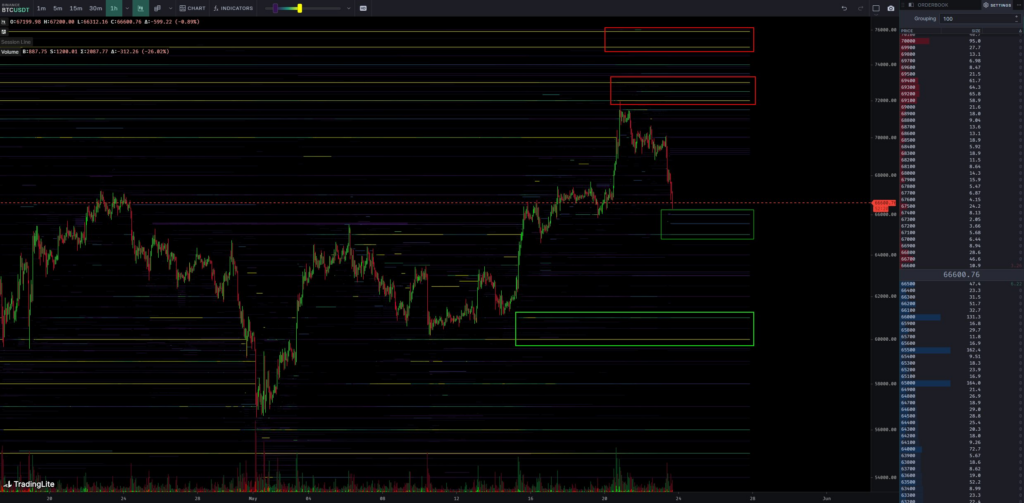

Bitcoin price “key” reaction at $66,000

Famous trader Skew identified a zone of interest at $66,000 while analyzing how low BTC price movement would go before buyers intervened.

In a May 23 research, he clarified that this was the location of adjacent areas of bid liquidity on the most significant worldwide exchange, Binance.

“Note that some initial spot demand ranges from $66K to $65K, so response is also critical to assess sellers’ absorption. He verified that the spot supply is still between $72K and $76K at the current high.

According to Skew, the price surge this week was “driven by spot exchanges,” referring to Coinbase, the biggest U.S. trading platform, and Binance.