A large sale of FARTCOIN, valued at $3.65 million, has caused its price to fall by 20%. The significant drop raises questions about whether the cryptocurrency can still reach its target of $2 per coin.

Solscan’s blockchain data indicates that the whale, who operated under the Solana address “24BLFj,” initially accumulated 8.89 million FARTCOIN tokens at a cost basis of $2.31 million, with an average price of $0.26 per token, between February 26 and March 21.

The trader could extricate $8.07 million in profits due to the 349% return generated by this position.

The whale continues to hold a considerable position of 1.89 million FARTCOIN tokens, valued at $2.16 million, in addition to holdings in other Solana memecoins, including Housecoin, and more than $7 million in USDC stablecoins, despite the significant sell-off.

FARTCOIN Loses Top Memecoin Status; However, Bulls See Buying Opportunity for a $2 Rebound

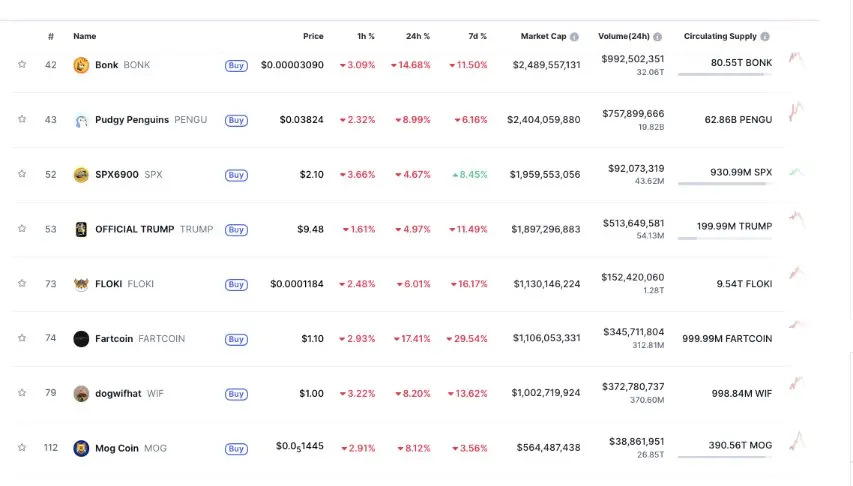

The price crash has resulted in FARTCOIN losing its position as the dominant memecoin in Solana, with BONK reclaiming the top spot. The Solana memecoin hierarchy currently places FARTCOIN at the fourth position, following TRUMP and PENGU.

The Solana-based token is currently trading at $1.09 and has lost more than 29% of its value in the past week. It is at risk of falling below the critical $1.00 support threshold.

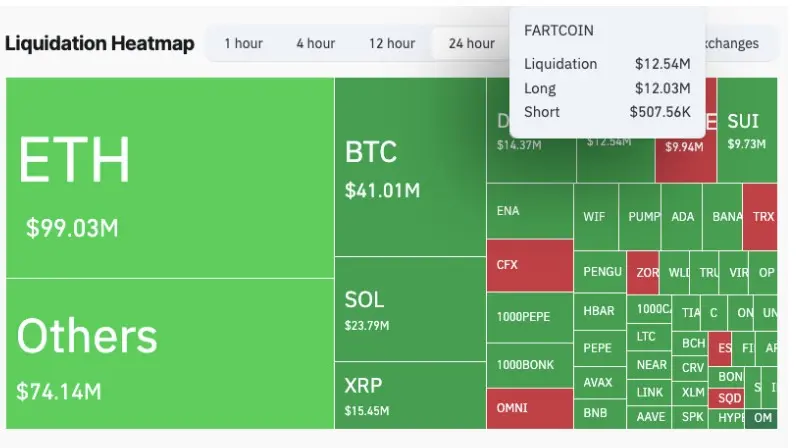

Over the past 24 hours, the steep decline has led to $12.4 million in liquidations from FARTCOIN long positions, the second-highest liquidation volume among memecoins during this period.

Nevertheless, as market sentiment data from Coinvo indicates, the current sell-off may be an appealing entry point for investors who missed the token’s 400% increase from its April lows. FARTCOIN maintains a strong 77% buyer ratio despite the current adverse market conditions.

Memecoin trader “Bmerke” observed historical parallels, stating that “FARTCOIN traded at these exact levels we are seeing today during the last two FOMC meetings (May 6 and June 18).”

Subsequently, both incidents were succeeded by new all-time highs.

He also foresaw that “everyone who panicked and sold their holdings today will be compelled to repurchase them at a higher price by the weekend.”

Smart Money Still Bullish on FARTCOIN to $2

According to Nansen’s AI wallet tracker, FARTCOIN remains the most popular memecoin among sophisticated investors, with 24 smart money wallets holding $19.03 million in tokens. This supports the bullish thesis.

This represents more than the holdings of prominent alternatives such as BONK ($2.27 million) and PEPE ($5.75 million).

According to crypto analyst Jireon0X, FARTCOIN is “coiling tightly within an ascending triangle formation, maintaining trendline support following a healthy pullback.”

Per his analysis, “the $1.1 support level must remain intact to facilitate a rebound toward $1.50, while a decisive breakout above $1.62 could propel FARTCOIN toward the coveted $2 target.”

Technical Analysis of FARTCOIN: Potential Bounce Suggested by Oversold Conditions

The ascending channel pattern that was previously established is breached on the 4-hour FARTCOIN/USDT chart.

From late June to mid-July, the price action had been bullish, progressing upward within parallel blue and red trendlines.

This technical structure underwent a significant downward break, which suggests that upward momentum is deteriorating and a trend reversal is possible.

The downward pressure escalates as the price action falls below the ascending channel and approaches the previous consolidation zone between $0.87 and $1.00.

The Relative Strength Index is currently at 27.14, securely in the oversold region.

Although bearish momentum continues, this extreme reading implies that a transient bounce or corrective rally may be on the horizon due to potential selling exhaustion.

The price is expected to test the $1.00–$1.10 zone as a short-term foundation before attempting any recovery, as indicated by the current chart structure and RSI conditions.

If a recovery occurs, traders should watch the $1.40 area as the next significant resistance level. If bullish momentum returns, the $1.543 barrier may be challenged.

Nevertheless, the near-term recovery scenario may be rendered invalid if support is not maintained above $1.00, which could result in further losses toward the $0.87 support zone indicated on the chart.