The cryptocurrency derivatives market has experienced a significant number of liquidations in the past day following the altcoin collapse, according to data

Ethereum is the leading cryptocurrency in terms of liquidations, while altcoins are experiencing a squeeze.

The cryptocurrency market has experienced volatile conditions over the past day, with most altcoins experiencing losses exceeding 5%. This sector-wide volatility has led to stir on the derivatives side, as is typically the case.

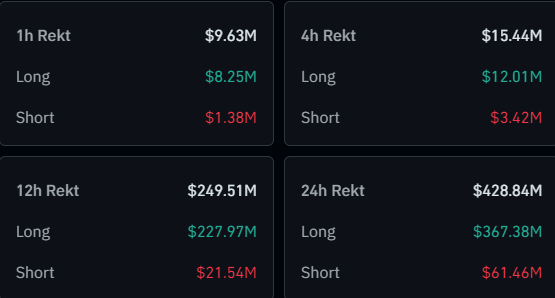

Over the past 24 hours, the derivatives market has observed contracts worth nearly $429 million fine liquidation, as data from CoinGlass indicates.

When a contract accumulates losses of a specific magnitude (the precise figure may vary between exchanges), the platform with which it is open is required to forcibly terminate it. This is referred to as “liquidation.”

Long-term contract holders experienced the majority of these coercive closures in the past day, as indicated by the table above. Specifically, these traders wagered on a bullish market outcome, which accounted for approximately $367 million of the liquidations, or over 85% of the total.

The reason for such lopsided liquidations is undoubtedly the precipitous downward trajectory of cryptocurrencies as a whole during this period.

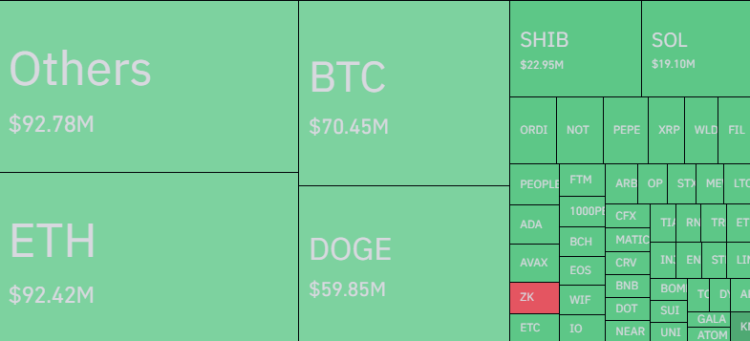

The heatmap below illustrates the individual assets’ contributions to the most recent derivatives surge.

In contrast to the norm during these violent liquidation events, Bitcoin (BTC) is not currently at the forefront of this metric. In contrast, Ethereum (ETH), the second largest cryptocurrency by market capitalization, is at the forefront with approximately $92 million in liquidations.

This could be attributed to the fact that Bitcoin has remained relatively stable during this time, whereas Ethereum has experienced a decline of over 3%. It is intriguing that the memecoins Dogecoin (DOGE) and Shiba Inu (SHIB) are the second and third most popular coins, with liquidations of $60 million and $23 million, respectively.

Each of these altcoins has experienced the most significant declines among the top cryptocurrencies, with a drop of approximately 11%. This, in conjunction with the fact that memecoins generate more speculative activity in general, may account for the fact that DOGE and SHIB are outperforming coins that are not named ETH or BTC.

However, the current market capitalization disparity between Dogecoin and Bitcoin is a mere $10 million, which is remarkable in light of the substantial market capitalization disparity between the two assets.

The term “squeeze” is commonly used to describe a collective liquidation event such as the most recent one. During these events, liquidations can cascade together in a manner reminiscent of a waterfall, resulting in even greater market volatility. The event would be referred to as a “long squeeze” due to the fact that the longs accounted for the vast majority of the most recent liquidations.

Squeezes are not an uncommon occurrence in the cryptocurrency market, as the volatility of the various coins is generally high. However, an altcoin-dominated squeeze of this magnitude is surely not a common occurrence.

Ethereum Price

Ethereum, the largest altcoin, has plummeted to $3,400 as a result of this most recent decline.