SUI, OP, and ENA face volatility as $150M+ in token unlocks hit this week, with SUI unlocking $77M, ENA $43M, and OP $16M.

Large token releases are scheduled for SUI, ENA, and OP this week, which has sparked significant interest in the crypto market and raised concerns about potential sell-offs.

What is the Future of the Crypto Market in the Presence of Significant Token Unlocks This Week?

As previously stated, market observers are eager to determine whether these tokens can maintain their dominance, particularly in light of the significant selling pressure that will accompany their forthcoming releases. Crypto investors are also anticipating macroeconomic data from the United States later this week, indications of rate guidance, and crypto policy in the regions that could have broader implications for sentiment.

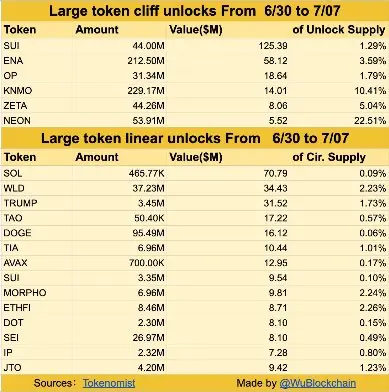

According to data from Tokenomics and WuBlockchain, the top five largest token launches from June 30 to July 7 are SOL ($70.79M), WLD ($37.25M), TRUMP ($31.52M), TAO ($17.33M), and DOGE ($11.64M, respectively). Whether linear or cliff-like, these releases account for significant portions of the total or circulating supply. They are frequently followed by downward price pressure as early holders acquire liquidity.

Token unlocks are a consistent feature of project roadmaps, which involve the distribution of previously sealed tokens to teams, investors, or community incentives. Nevertheless, such events frequently elicit market reactions, particularly when they are perceived as short-term profit opportunities by large holders.

Is a substantial sell-off imminent for these coins?

Particularly for ENA, there is a genuine risk of a short-term sell-off as a result of its substantial release in comparison to supply and price fluctuations. SUI and OP may also experience downward pressure, although their smaller unlock percentages and improved chart configurations may mitigate the effect. The SUI price is currently at a critical juncture, with a potential game-changing event.

The chart analysis for these coins also indicates a bearish prognosis as they encounter substantial resistance. The following is a concise summary of the analysis:

- SUI is encountering substantial resistance at $2.84, and traders are expected to respond with selling pressure in response to the unlock.

- ENA is currently consolidating at a price range of $0.25–$0.26, struggling to surpass this level as the unlocking process approaches.

- Additionally, a cautious sentiment is associated with the imminent unlock of OP, which is presently trading at $0.53–$0.54.

Investors are advised to exercise caution, as releases of this magnitude may lead to significant volatility and whale movement.