Galaxy Research data shows $174 million was invested in Bitcoin L2s from January to September.

By 2030, over $47 billion in Bitcoin liquidity might be bridged into Bitcoin layer-2 (L2) networks, according to Galaxy Digital’s research section.

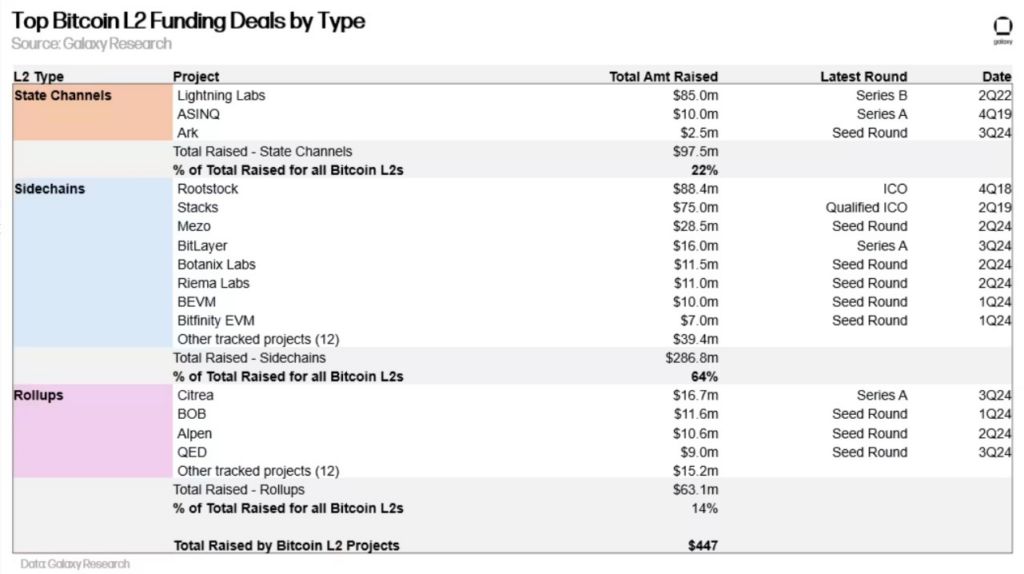

Galaxy Research examined the development of Bitcoin L2 ecosystems in 2024 in its most recent research, pointing to a seven-fold rise in projects and over $447 million in venture capital investments to date.

By 2030, Galaxy predicted that roughly $47 billion in Bitcoin liquidity might be connected to Bitcoin L2 networks.

Crypto VCs Perceive Alternative Bitcoin Investment Storylines

The researchers pointed out that 39% of all investments in Bitcoin L2s occurred in the first three quarters of 2024, and venture capital in this space has already reached $447 million.

According to Galaxy data, between January and September 2024, Bitcoin L2s raised $174 million in investment. Rollups received $63 million, and sidechains received $105 million.

The analysts also noted that there was a notable change in the second quarter of 2024, with 44% of all venture capital invested in layer-2s in the cryptocurrency business going to Bitcoin L2s.

Additionally, compared to the first quarter of 2024, investments increased by 159% in the second quarter.

According to Galaxy, the rise in VC investments demonstrated that before 2024, standard crypto VCs, excluding funds with a Bitcoin emphasis, had limited exposure to the Bitcoin ecosystem.

In the past, many of these companies had little exposure to projects centered around Bitcoin, mostly considering it to be “digital gold.” But in 2023, new investment options were brought about by the rise of Bitcoin Ordinals and BRC-20 tokens.

As the ecosystem develops, Galaxy anticipates that cryptocurrency venture capitalists will keep investing in Bitcoin L2s.

Galaxy Anticipates That $47 Billion Will Enter Bitcoin L2s

Galaxy projects that by 2030, over $47 billion in Bitcoin might enter the L2 ecosystem as it grows.

According to the report, holders will be searching for ways to increase the yield on their holdings. Galaxy wrote:

“If BTC reaches $100k in 2030, the TAM [total addressable market] for Bitcoin L2s could then reach up to $47bn, assuming that 2.3% of total BTC supply is locked in Bitcoin L2s by 2030.”

Despite the ecosystem’s rapid growth, Galaxy experts estimate that, of the 75 builders presently operating in the industry, only three to five will control the majority of the market.