With the right strategies, beginners can thrive in crypto trading by adopting proven strategies for crypto trading without having to be a an expert

Too many beginners make the costly mistake of diving into crypto without a plan. They get caught up in the hype, reacting impulsively to price swings, only to lose money faster than expected.

It’s easy to get overwhelmed by market noise, and without a solid strategy, even the most promising trades can go wrong. This article provides details on the 5 best crypto trading strategies for beginners.

5 Best Crypto Trading Strategies for Beginners

With a number of cryptocurrencies still entering the market today, interest in trading the asset is high as ever. Below is a list of top 5 crypto trading strategies we’ve compiled to guide beginners.

Whether you prefer a hands-off approach or want to dive into the daily action, these strategies offer something for every trader’s style:

- DCA (Dollar-Cost Averaging): Ideal for minimizing risk and investing over time.

- HODL: For those who believe in holding long-term, weathering market fluctuations.

- Arbitrage: A low-risk method that takes advantage of price differences across exchanges.

- Day Trading: A more active, high-engagement strategy focused on short-term price movements.

- Scalping: Fast-paced and focused on making quick, small profits multiple times a day.

1. Dollar-Cost Averaging (DCA)

What is DCA?

Dollar-Cost Averaging (DCA) is a beginner-friendly investment strategy where you invest a fixed amount of money into a cryptocurrency at regular intervals, regardless of the current market price.

Instead of trying to predict price movements, DCA helps you avoid market timing by spreading your investments over time.

Why It’s Beginner-Friendly:

DCA is simple and stress-free, making it perfect for newcomers who might feel overwhelmed by crypto’s volatility. By sticking to a fixed investment schedule, beginners can avoid emotional decision-making and reduce the pressure of trying to buy at the “perfect” moment.

Benefits:

- Reduces emotional decision-making: You’re not worrying about daily price swings.

- Averages out the cost of investment: Whether the price is high or low, DCA smooths out your average purchase price.

- Minimizes risk in volatile markets: It helps you invest consistently over time, reducing the impact of market downturns.

How to Implement DCA:

- Choose a reputable exchange, such as Coinbase or Binance.

- Set up an automatic buying schedule for your preferred cryptocurrency (e.g., Bitcoin or Ethereum).

Example: If you invest $100 monthly in Bitcoin, you’ll buy more BTC when the price drops and less when it rises, balancing your overall purchase price.

Tools/Platforms for DCA:

Popular exchanges like Coinbase, Binance, and Kraken offer built-in DCA features to help you automate your investments.

2. HODL (Hold On for Dear Life)

What is HODL?

HODL (Hold On for Dear Life) is a long-term investment strategy where you buy cryptocurrency and hold onto it, regardless of short-term price fluctuations. The goal is to ride out market volatility and capitalize on long-term growth.

Origins of HODL:

The term “HODL” originated from a typo in a Bitcoin forum post in 2013. It has since become a rallying cry for crypto investors who resist the urge to sell during market dips.

Why It’s Effective for Beginners:

HODL is an ideal strategy for beginners who want to avoid the stress of day-to-day market swings. Rather than worrying about timing the market, HODLers focus on long-term gains, trusting that established cryptocurrencies like Bitcoin will appreciate over time.

Benefits:

- Long-term gains: By holding through the volatility, you benefit from the overall growth of the crypto market.

- No need to time the market: You avoid the stress of daily price fluctuations.

- Lower transaction fees: Frequent trading incurs fees, but HODLing reduces these costs.

Risks:

- Not all cryptocurrencies will increase in value over time, so it’s crucial to pick solid, long-term investments like Bitcoin or Ethereum.

Example: Someone who invested $1,000 in Bitcoin in 2015 and simply held on through market ups and downs would have seen a significant return on investment today.

Which Cryptos Are Best for HODLing?

Bitcoin, Ethereum, and other well-established altcoins like Litecoin and Chainlink are solid choices for long-term holding.

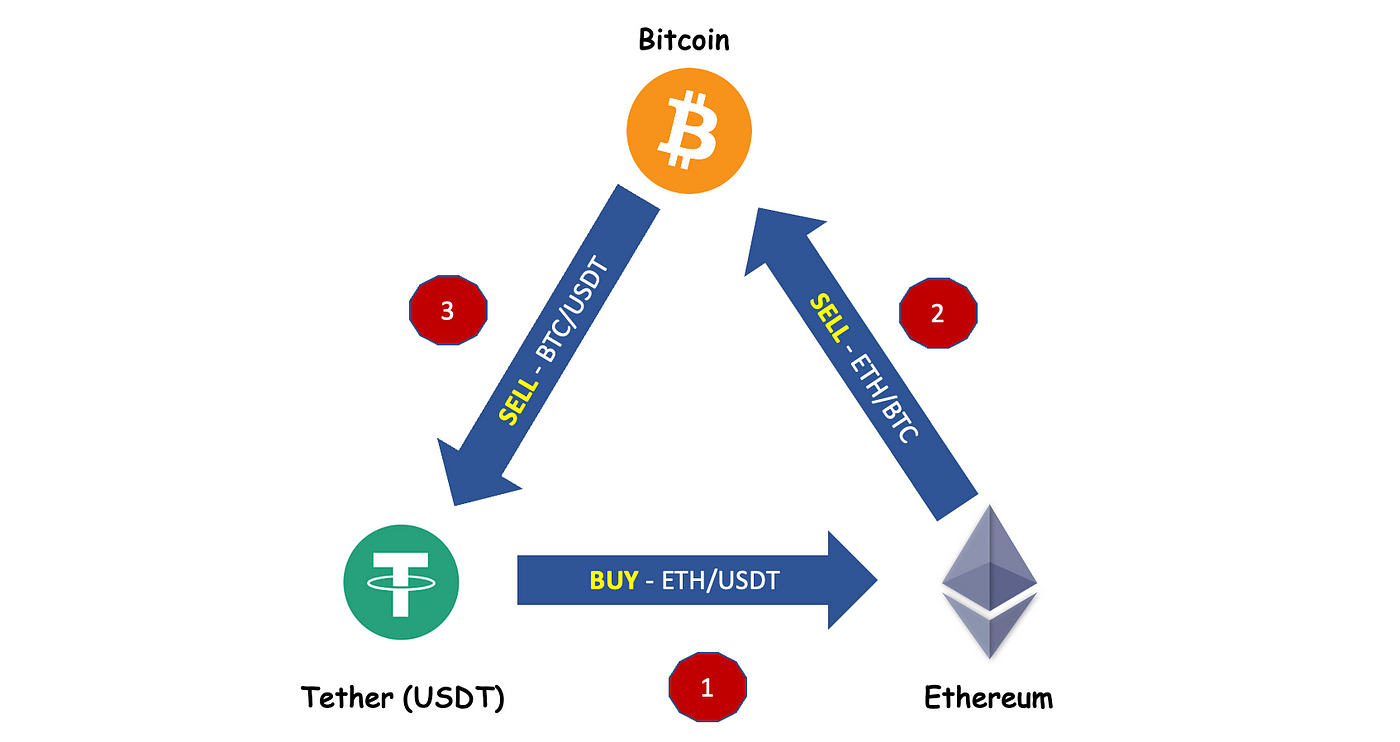

3. Arbitrage

What is Arbitrage?

Arbitrage is a trading strategy where you take advantage of price differences for the same cryptocurrency on different exchanges. By buying low on one exchange and selling high on another, you can pocket the price difference for profit.

How Arbitrage Works:

- Buy a cryptocurrency (e.g., Bitcoin) on one exchange at a lower price.

- Simultaneously sell the same cryptocurrency on another exchange where the price is higher.

- Profit from the price difference.

Why It’s Suitable for Beginners:

Arbitrage is relatively low-risk compared to other strategies since you’re not betting on price changes but exploiting discrepancies between exchanges. Beginners who are quick to act can benefit from these small, low-risk trades.

Types of Arbitrage:

- Spatial Arbitrage: Trading between different exchanges (e.g., buying on Binance, selling on Kraken).

- Statistical Arbitrage: More advanced, involving algorithmic or quantitative techniques to profit from price differences.

Tools for Arbitrage:

Use platforms like Coinarbitrage or Bitgur to identify arbitrage opportunities across exchanges in real-time.

Risks:

- Timing: Prices can change rapidly, so you must execute trades quickly.

- Fees: Transaction and withdrawal fees may reduce your overall profit.

Example:

If Bitcoin is priced at $20,000 on Binance and $20,200 on Kraken, buying on Binance and selling on Kraken could result in a $200 profit.

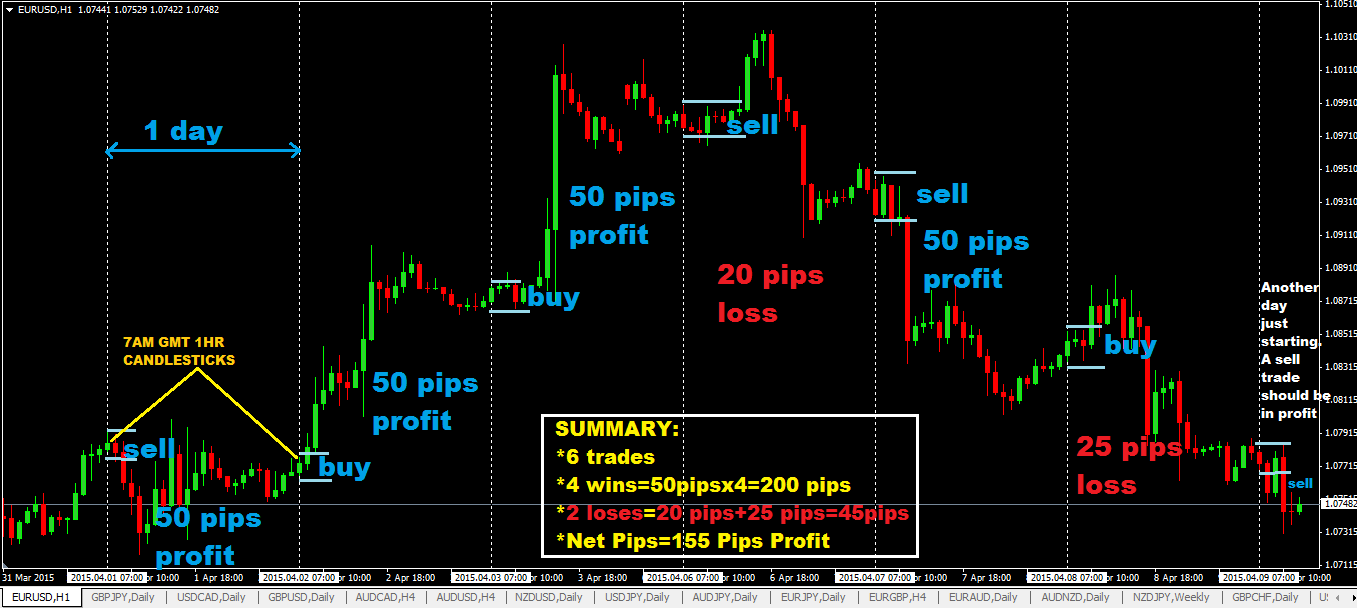

4. Day Trading

What is Day Trading?

Day trading is an active strategy where you buy and sell cryptocurrencies within the same day to capitalize on short-term price movements. This strategy requires constant monitoring of the market to profit from price fluctuations.

Why Day Trading Appeals to Beginners:

For beginners who enjoy a fast-paced environment and are willing to commit time to monitoring the market, day trading offers the potential for quick profits from small price movements.

Benefits:

- High liquidity: The crypto market operates 24/7, providing ample opportunities for trades.

- No overnight risk: By closing positions at the end of the day, you avoid the risks of holding assets overnight during market fluctuations.

How to Day Trade:

- Use technical analysis, chart patterns, and market news to inform your buying and selling decisions.

- Set strict entry and exit points to manage your risk.

Risks:

Crypto’s high volatility means significant losses can happen just as quickly as gains. Without discipline, day traders may suffer.

Tools for Day Trading:

Exchanges with high liquidity like Binance or Kraken are ideal, along with charting platforms like TradingView for technical analysis.

Example: A day trader might buy Ethereum at $1,500 in the morning and sell it when it hits $1,550 later in the day, making a quick profit of $50.

5. Scalping

What is Scalping?

Scalping is a fast-paced trading strategy where traders aim to make quick profits from small price changes, often holding a position for only a few seconds or minutes.

How Scalping Works:

- Focus on small price fluctuations.

- Execute multiple trades throughout the day, each netting a small profit.

Why It’s Suitable for Beginners:

Although scalping requires precision and fast reflexes, it’s beginner-friendly if you start small. Scalping minimizes risk by reducing exposure to market volatility—since positions are held for such short periods.

Benefits:

- Frequent profit opportunities: Scalping allows for multiple small trades daily.

- Low risk: Since trades are short-term, there’s less exposure to sudden market shifts.

Risks:

Scalping demands constant attention, and frequent trades can lead to high transaction fees, which eat into profits.

Example: A scalper might buy Bitcoin at $20,000 and sell at $20,010, pocketing a $10 profit in seconds before repeating the process.

Best Platforms for Scalping

Exchanges with low fees and fast trade execution, like Binance or KuCoin, are excellent for scalping due to their speed and efficiency.

Conclusion

Each of these strategies suits different types of traders. DCA and HODL are ideal for long-term investors who prefer a hands-off approach, while arbitrage, day trading, and scalping are better suited to active traders willing to commit more time and effort to track the market.

Regardless of your choice, thorough research and risk management are essential for success in the crypto world.

FAQs Section

1. What is the easiest crypto trading strategy for beginners?

The easiest strategy for beginners is Dollar-Cost Averaging (DCA). With DCA, you invest a fixed amount of money at regular intervals, regardless of the market’s ups and downs.

This helps reduce the impact of price volatility and allows you to build a position over time without needing to predict the perfect buying moment.

2. How much money should I start with when using DCA?

You can start with any amount that fits your budget. A common recommendation is to begin with a small amount, such as $50 to $100 per month. The key is consistency, so pick an amount that you can commit to regularly, without stretching your finances.

3. Can beginners really profit from copy trading?

Yes, beginners can potentially profit from copy trading. By automatically mimicking the trades of more experienced traders, beginners can benefit from their expertise. However, it’s important to choose reputable platforms and skilled traders to follow, as there’s still some risk involved.

4. Is crypto trading safe for beginners?

Crypto trading can be risky, especially for beginners. It’s important to start small, do your research, and only invest what you can afford to lose. Utilizing secure exchanges, enabling two-factor authentication, and educating yourself about market trends can help make your experience safer.

5. Which strategy has the lowest risk?

The lowest-risk strategy for beginners is often HODLing (holding onto crypto long-term) or using Dollar-Cost Averaging (DCA). These approaches focus on minimizing short-term market fluctuations and do not require constant monitoring or active trading decisions, thereby reducing exposure to high-risk situations.