If Bitcoin falls below $57.9k, ETF participants may need to sell, impacting investor behavior and market stability, says Bianco Research.

If BTC falls below $57.9k, participants in ETFs may have to sell off.

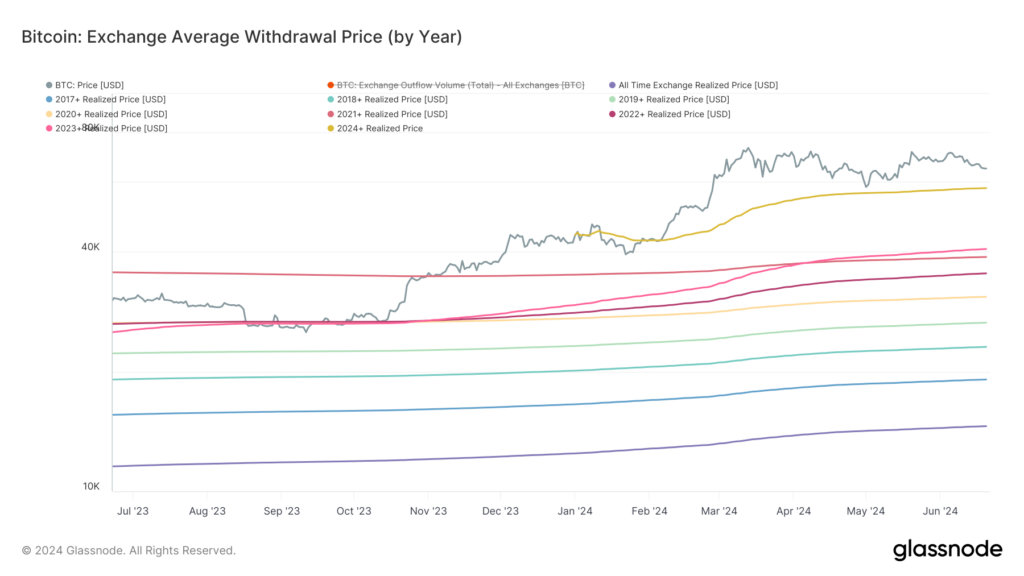

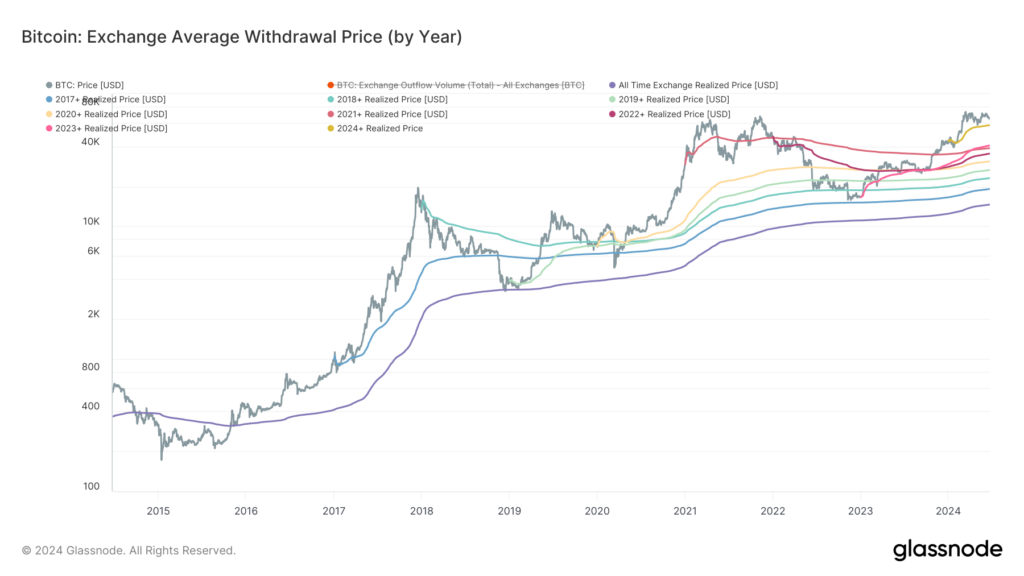

Bitcoin Withdrawal Price

Moving average analysis, such as that done on the 200-day and 200-week moving averages, can light up Bitcoin’s support and resistance levels. The realized price-by-year trend is also significant to keep an eye on. This trend tracks the average price at which coins are withdrawn from exchanges annually, providing insight into the market-wide cost basis. We may determine the state of the market and probable price swings by looking at these average withdrawal prices for various cohorts according to the year.

Based on their cost basis, BTC buyers from all years are theoretically profitable, according to the most recent Glassnode data. But this is a crucial time for the 2024 purchasing group, many of whom bought the US ETFs introduced on January 11. With a cost basis of $57.9k, these ETF purchasers are still lucrative, but if prices drop below this mark, they may come under pressure.

The chief of Bianco Research, Jim Bianco, emphasizes that most of these ETF purchasers are ordinary investors, or “retail degens,” who may lose their minds and sell if the price of Bitcoin drops below their cost basis. Consequently, $57.9k becomes a crucial milestone since it can impact investor behavior and market stability.