Analysts caution that the optimistic price outcome that many traders anticipate may not materialize following a spot Ethereum approval. Are futures markets in agreement?

Regarding a spot ETH ETF combining the altcoin with conventional financial markets, Ether ETH$3,414 price may be about to witness its most momentous event. Still, its price needs to react as anticipated. In fact, on June 24, Ether touched its lowest level in over a month, plummeting to the $3,250 mark. Although ETH eventually recaptured the $3,400 support on June 25, both on-chain and derivatives measures show limited upside potential.

Analysts say the spot ETH ETF debut could disappoint.

According to several analysts, given the state of the market, it seems unlikely that the Ethereum spot exchange-traded fund (ETF) launch would generate significant net inflows. The regulator shelved the possibility of classifying Ethereum staking as a security and ended its inquiry into Consensys, a well-known Ethereum ecosystem company. However, the overall economic climate still needs to be improved.

Bloomberg ETF experts Eric Balchunas and James Seyffart anticipate that Ethereum ETFs might draw between $1 billion and $2 billion in the early weeks. Likewise, Stephen Richardson, managing director of financial markets at Fireblocks, told Cointelegraph that he expects much lesser inflows at the Ethereum ETF debut.

While Ethereum’s revenue is “minuscule” compared to its market capitalization, according to Markus Thielen, head of Research at 10x Research, the asset does not now represent a “viable, sufficiently cash-flow-producing investment.” Additionally, Thielen noted that the yields on Ether staking continue to be less than those on U.S. Treasury bonds.

It’s essential to pay attention to macroeconomic trends, even in the United States, where the regulatory landscape for cryptocurrencies is more favorable. According to Yahoo Finance, the U.S. Conference Board said on June 25 that its consumer confidence index declined to 100.4 from 101.3 in May, showing that people are concerned about inflation.

Also, on June 25, U.S. Federal Reserve Governor Michelle Bowman emphasized that interest rates would stay higher “for some time,” as reported by Yahoo Finance. Bowman underlined that although inflation is currently “elevated,” it might rise further if financial conditions soften or there is further fiscal stimulus. The appeal of fixed-income assets is expected to be sustained as the Federal Reserve’s median prediction calls for just one rate drop before the year concludes.

Elevated Ethereum network costs and diminished interest in ETH leverage

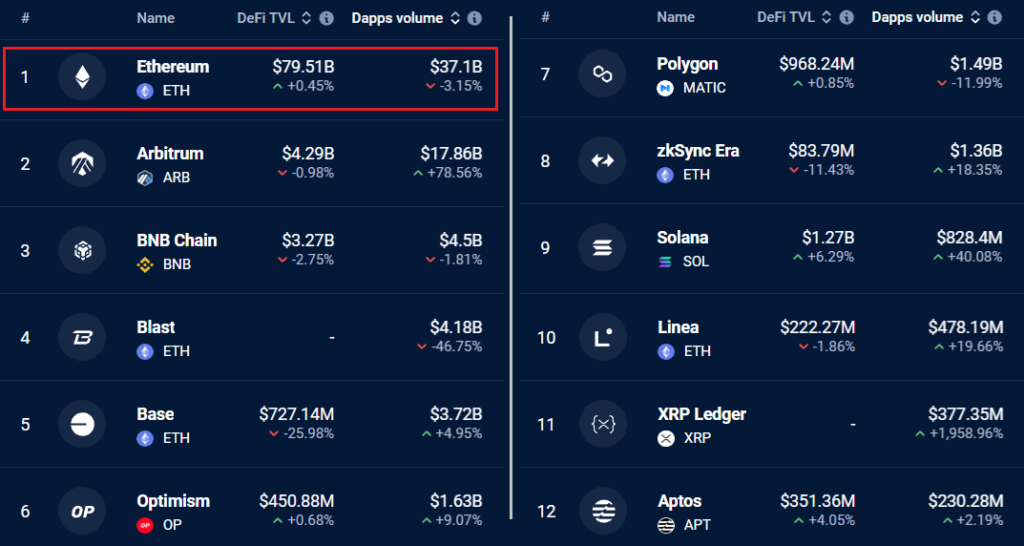

The Ethereum network has issues such as comparatively high gas fees (base layer transactions have been over $3). This problem helps to explain why rival blockchains, such as Solana SOL$139 and BNB Chain BNB$577, have been able to attract sizable quantities.

Despite these obstacles, Ethereum continues to lead in total value-locked (TVL) and decentralized application volumes. DappRadar, on the other hand, reports that demand has stayed the same over the last seven days despite higher activity and deposits at rival platforms like Solana and Aptos. Despite the strength of Ethereum’s layer-2 ecosystem, these incumbents provide some difficulties that should not be disregarded.

It is necessary to look into ETH’s future data to understand the attitude of Ether’s professional traders. The Ether futures premium represents the difference between monthly contracts in derivatives markets and the spot level on regular exchanges. A 5% to 10% yearly premium (basis) is typically anticipated to offset the more extended settlement period.

On June 21, the Ether futures premium dropped below the 10% barrier and has stayed in a neutral range ever since. After five weeks of optimistic mood, this move indicates a change in trend. It is especially worrying because U.S. Securities and Exchange Commission Chair Gary Gensler indicated that the Ethereum spot ETF will open by September.

Markus Thielen noted that defending Ethereum’s token pricing is challenging considering that, according to DefiLlama data, the network generates just $23.9 million in revenue weekly. Tron and Solana, on the other hand, produce $8.8 million and $9.8 million daily, respectively, while having significantly fewer deposits. Ether’s chances of breaking $3,700 in the immediate future seem unlikely if analysts’ predictions of low-spot ETF inflows come true.