Bitcoin miners adopt acquisitions and AI integration as key strategies, benefiting from AI growth and diversifying to stay competitive amid market challenges.

For Bitcoin miners, acquisitions and AI integration become crucial tactics.

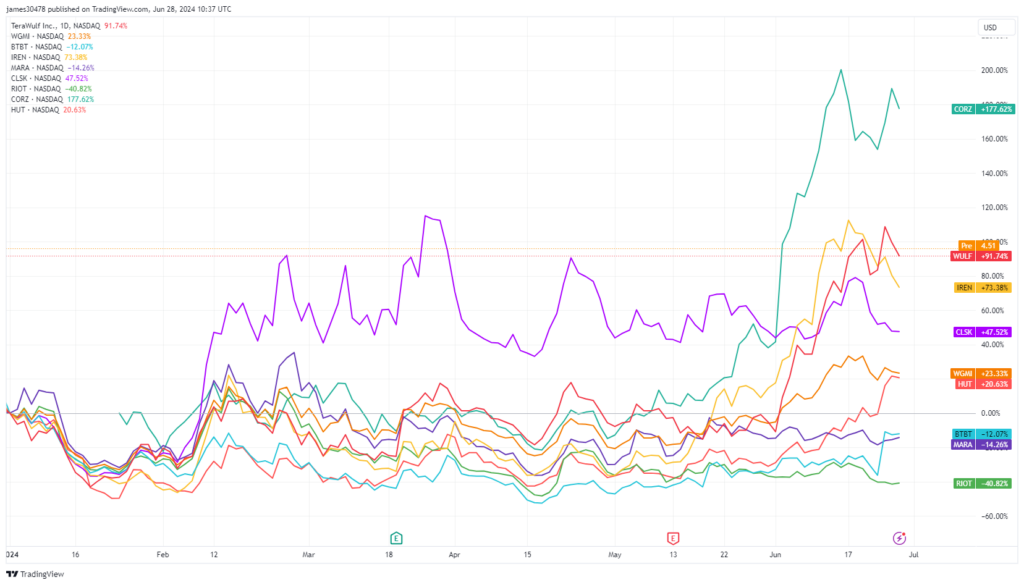

The ongoing capitulation of miners has caused a severe impact on publicly traded Bitcoin miners due to a decreasing Bitcoin price, a declining hash rate, and a small hash price. Public miners have demonstrated resiliency in this challenging climate, as seen by their market capitalization surpassing $25 billion and WGMI’s 23% year-to-date increase and 24% June increase.

A bright spot amidst these challenges has surfaced in the shape of the AI explosion. The mining industry has benefited from this rise in artificial intelligence. This tendency is shown in NVIDIA’s ascent to become the largest corporation in the world, which is advantageous for miners. A $150 million boost was given to Hut 8 to expand their AI data center, while Core Scientific increased the capacity of their CoreWeave infrastructure to 270 MW. According to CNBC, Bit Digital, a different Bitcoin miner, now gets an estimated 27% of its income via AI.

Given the actions of Cleanspark and the continuous competition between Riot and Bitfarms, the sector’s acquisition trend is anticipated to continue. According to a new JP Morgan report, these Bitcoin miners’ success can be linked to their diversification into AI data center businesses, which act as a much-needed safety net against a decline in the price of Bitcoin.

Additionally, by mining Kaspa, a proof-of-work (PoW) layer one blockchain network, Marathon Digital has expanded the source of its revenue.

This demonstrates how fiercely competitive the industry is, particularly after the halving, as miners look into different ways to increase their profits.