In a recent statement, the SEC Commissioner said his agency’s current approach to crypto does not aid capital formation or protect investors.

SEC Commissioner Mark Uyeda has criticized the agency’s approach to crypto disclosure regulations, characterizing the generic approach applied to crypto asset filings as “problematic.”

Uyeda announced the ratification of new rules and form amendments to implement the Registered Index-Linked Annuities (RILA) Act in a statement posted on the SEC’s official website on July 1. This change affects the requirements for submitting Form N-4 applications by specific firms.

The statement is wholly unrelated to cryptocurrency at first glance.

However, the footnotes contained a discreet jab at the Gensler-led agency’s approach to regulating crypto assets, particularly regarding the disclosure of information in Form S-1 filings.

In footnote 3, Udeya criticized the agency’s current approach to crypto filings as “problematic” and called for the Form S-1 filings used by firms when going public or registering new securities to be updated to reflect the unique nature of digital assets better.

Udeya wrote, “Many of these issuers and crypto digital assets have characteristics for which Form S-1 may technically require information that is not relevant or applicable, but does not require certain information that may be material.”

“This [current] approach for crypto digital assets is problematic because it neither facilitates capital formation nor protects investors.”

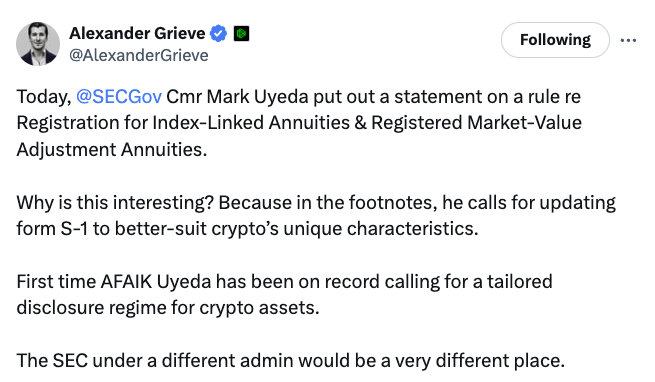

In a July 2 post to X, Alexander Grieve, the director of government affairs at crypto venture capital firm Paradigm, stated that this was the first time Commissioner Udeya had publicly advocated for a customized disclosure regime for crypto assets, to the best of his knowledge.

Grieve stated, “The SEC would be a significantly different entity under a different administration.”

In a July 2nd post to X, the Blockchain Association, a crypto advocacy organization based in the United States, also commended Udeya’s comments, stating that his “nuanced, innovation-forward approach” to crypto was precisely what the industry required.

Udeya’s statement was issued just four days after his agency filed a lawsuit against Ethereum development firm Consensys on June 28, in which it claimed that its wallet application MetaMask operated as an unregistered broker engaged in the “offer and sale of securities.”

It also targeted Ethereum staking services, such as Lido DAO and Rocket Pool, which are the platforms that MetaMask employs for Ether (ETH) staking.

After receiving a Wells notice from the SEC in April, Consensys filed a lawsuit against the agency, challenging prospective attempts to classify ETH and related staking services as securities.