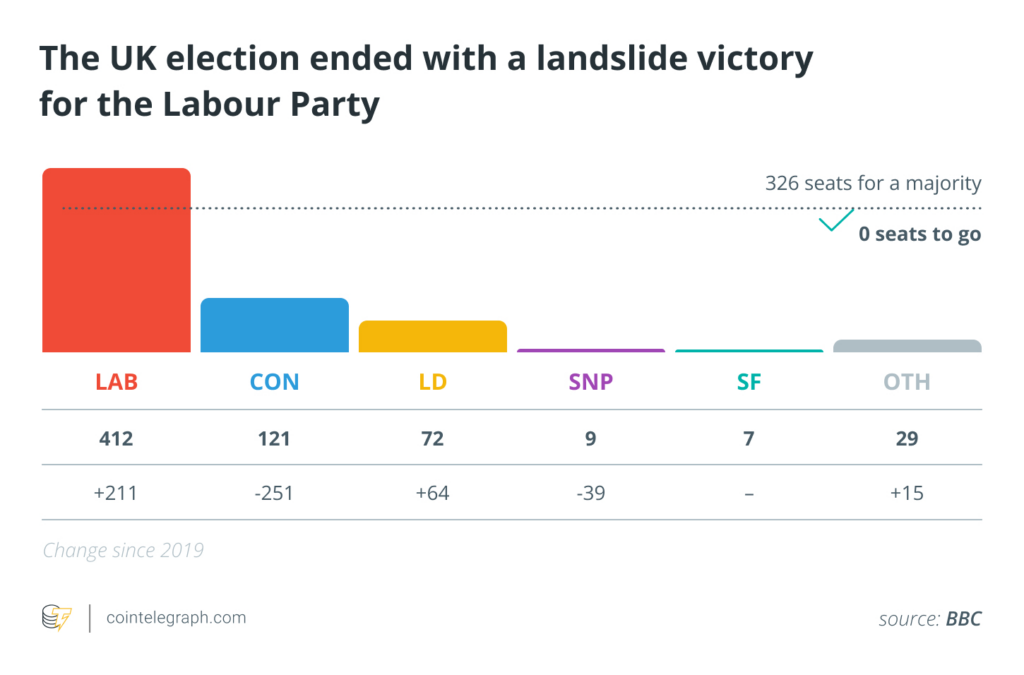

The Labour Party won the UK general election with a resounding win, toppling the 14-year Conservative Party rule.

As part of their pledge to establish the UK as “a global leader in tokenization,” the Labour Party

A resurgence of hope for constructive action and interaction with the cryptocurrency space accompanies that.

Former prime minister Rishi Sunak made much of his goals to create a “crypto asset hub,” but watchers in the business pointed out that there wasn’t much of an implementation to match his words.

Now that Labour is in control, cautious optimism is restored for constructive action. Sector association CryptoUK says:

“We have established strong relationships with Labour MPs and policymakers, and we intend to strengthen these ties going forward to advance the UK’s digital assets industry.”

The group CEO of fintech company Valereum, Nick Cowan, sees cause for hope despite the election campaign’s lack of mention of cryptocurrencies.

“They have previously recognized the benefits of tokenized securities, fintech, and even a central bank digital currency,” Cowan told Cointelegraph. That is “big talk,” if they truly focused on the advantages of the revolutionary developments in the financial, capital, and digital asset sectors, it can become a mighty pillar that draws in adoption and investment, both of which will fuel growth.

CryptoUK also emphasizes the room for expansion.

“We acknowledge that the administration of Keir Starmer has made inclusivity, growth, and jobs top goals. CryptoUK stated, “We sincerely feel that our sector can significantly contribute to these goals.

“This is a perfect opportunity for this government to seize and lay the foundation for an environment that will let the innovators innovate,” Cowan continued. There is always space for improvement and hope!

What is Labour’s position on cryptocurrency?

In contrast to the US, where the 2024 presidential race has already generated news about cryptocurrencies, the UK election remained strangely silent.

For instance, there was no mention of cryptocurrencies in the Labour Party’s manifesto. Nonetheless, Labour did refer to the sector when it unveiled its “plan for financial services” in January.

Labour claimed that tokenization, or distributed ledger technology to represent financial assets digitally, “presents a significant new opportunity for the UK.”

Tokenization “may improve risk management (by lowering counterparty risks and other operational risks),” according to Labour, and it “may increase liquidity, provide access to new asset classes and fractionalized assets.”

Because of this, “A future Labour government will therefore look to establish the UK as a global leader in tokenization by working with regulators to establish a proportionate, outcomes-based regulatory regime to oversee the technology, and by advancing work to clarify the law around tokenization.”

Labour announced plans to test tokenized gilts, a UK government liability listed on the London Stock Exchange, and regulatory sandboxes. Finally, Labour declared that to implement interoperable standards, it will look to form alliances with other financial hubs.

The ability to alter

The primary election message for Labour was “change,” and change is what supporters of cryptocurrencies want to see.

Oliver Linch, the CEO of Bittrex Global, a cryptocurrency exchange and a financial regulatory lawyer, describes how Labour conducted a major charm offensive with the financial sector before the election.

Senior Labour figures have been actively meeting with City [of London] grandees and critical influencers to reassure them of their pro-growth, pro-capitalism, and pro-innovation posture. According to Linch, they have been viewed as less robust on economic issues than their Conservative counterparts.

As Linch notes, the Conservatives’ reputation has deteriorated over the last fifteen years, but they are still frequently seen as being more “robust” on economic matters.

The Conservatives were already suffering from post-COVID inflationary pressures and austerity spending initiatives, but now they could not capitalize on any real benefits from Brexit. The 49-day premiership of Liz Truss in 2022, during which her unfunded tax cuts caused the pound’s value to plummet, may have been the low point of the Tory (Conservative) administration.

Truss was one of the 251 Conservative lawmakers who had their seats taken away. The British public is now expecting new Labour MPs, and they will expect them to perform better.

Linch believes that Labour’s electoral success offers a big chance.

“Now that the election is over and they have a sizable majority, Labour can afford to be bolder and use the numerous opportunities that digital assets present,” Linch added. “Labour has strong reasons to support comprehensive action on crypto, as a center-left party — a task the Conservatives, despite their professed enthusiasm, have mostly left unfulfilled.”

The outlook for Europe

According to Linch, there is also a chance to set the UK apart from European lawmakers presently needing help advancing the EU’s Markets in Crypto-Assets Regulation (MiCA).

“As participants grapple with unresolved legal and operational issues, dissatisfaction with the MiCA regulation is at an all-time high,” Linch stated. Based on Labour’s commitment to stay out of the EU, taking advantage of the current unhappiness with MiCA might be a calculated move to promote growth and deliver on several platform promises.

Director and head of Xapo Bank’s public affairs, policy, and regulation, Joey Garcia, believes there is also promise here.

“MiCA has been perceived by most as an unduly protective and cautious strategy that heavily favors established and established financial services companies. Garcia told Cointelegraph that for a secure ecosystem to grow in the UK, “positive intervention from the Labour government would involve avoiding the pitfalls of excessive regulation while also ensuring that there are controlled, clear, and safe boundaries.”

“In general, the strategy of the Labour government can be described as cautiously optimistic,” he continued.

A tiny window

Garcia and Linch agree that the UK has a chance, although Linch notes that this window of opportunity is limited.

“The Labour Party now has the chance, with its supermajority, to protect consumers and the public at large, to boost the UK economy in its push for growth, and to realize the socially progressive opportunities that crypto presents,” Linch stated. “All the necessary components are already in place, but quick action is needed to meet the December MiCA implementation deadline. Priorities for the new Treasury team should prioritize Web3, according to the incoming City minister (economic secretary to the Treasury).