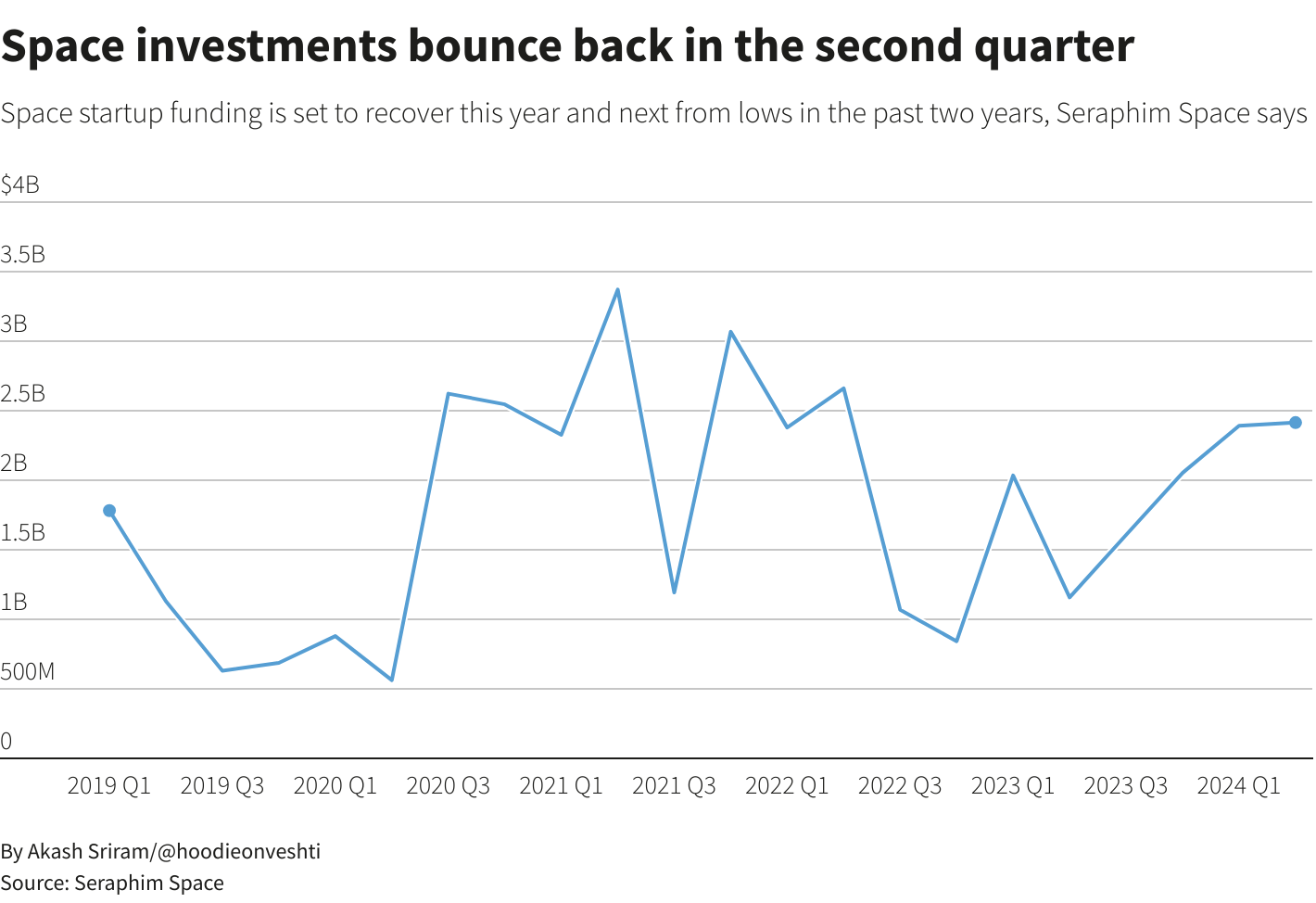

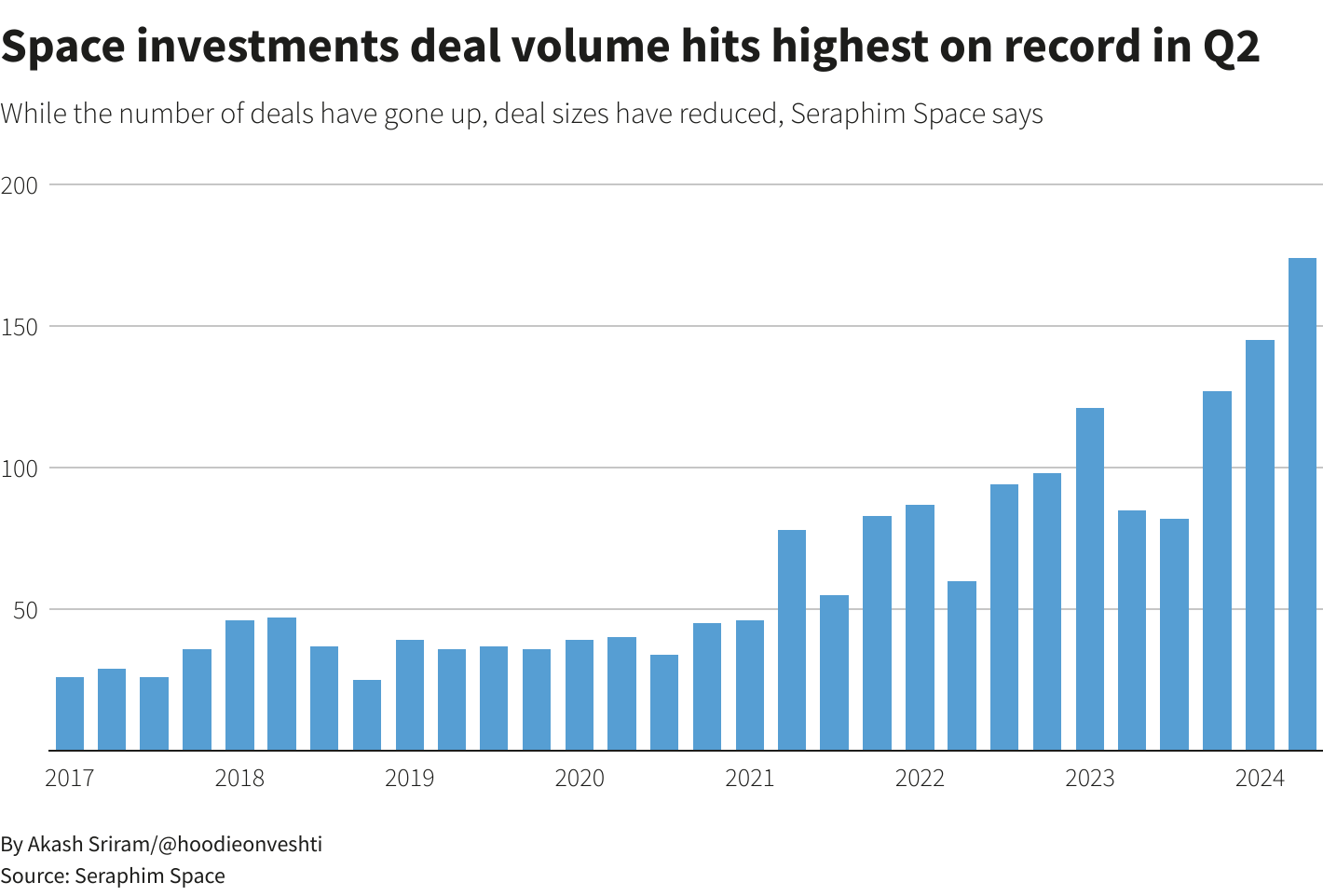

British investment firm Seraphim Space reported $2.41 billion in global investments in space startups from April to June, a third straight quarter of growth

This upward trajectory follows a period of elevated interest rates that discouraged investors from funding companies specializing in space-based data services, satellites, and rockets.

Due to geopolitical tensions, SpaceX and Planet Labs have become increasingly critical as countries invest more in satellite-based imagery and assets for intelligence gathering and communications.

Investments in Europe remained unchanged from the previous quarter, while they experienced a 50% decline in North America. Nevertheless, the space technology investment firm stated that it is too early to determine whether a decline in the United States indicates a feeble 2024 or a bumpy recovery, as deals are frequently announced after the end of a quarter.

The largest Chinese space technology transaction to date, a $943 million investment in Shanghai Spacecom Satellite Technology, was the catalyst for the strong quarter.

According to the report, this development indicates a developing resolve among Chinese investors to challenge the United States’ space capabilities.

“I’m optimistic in predicting that, at least in terms of growth, the space investment market in 2025 is going to be better than 2024 because, unfortunately, I don’t see the geopolitical challenges around the world resolving themselves in the course of the next 18 months,” said James Bruegger, the chief investment officer at Seraphim Space.

According to Seraphim Space, global space investments in the second quarter totaled $2.41 billion, higher than the $2.39 billion in the January-March period and the $1.16 billion a year prior.

Investments in space enterprises rose from $5.1 billion in the corresponding year-ago period to $8.5 billion in the 12 months ending in June