According to the ecosystem investor chief of Stacks, the BitGo integration results from the increasing institutional demand for Bitcoin.

BitGo, a digital asset service provider, has recently supported the Stacks blockchain to improve Bitcoin functionality. This is the most recent indication of institutional adoption of Bitcoin-native decentralized financing.

BitGo’s users will be able to earn Bitcoin BTC through the incorporation of Bitcoin layer-2 (L2) network Stacks rewards through “stacking,” a process that enables Stacks STX holders to generate native BTC yield directly in their wallet without the need to lend or expose the assets to additional risks.

Kyle Ellicott, the ecosystem investor lead at Stacks, has stated that the new partnership underscores the sustained institutional adoption of Bitcoin. He composed the following:

“Allowing institutions to earn native Bitcoin yield with their STX is a huge step for Bitcoin as part of Bitgo’s goal to put institutional capital to work with DeFi and staking. Making Bitcoin a productive asset is crucial for Bitcoin to succeed long term as rails for a decentralized economy.”

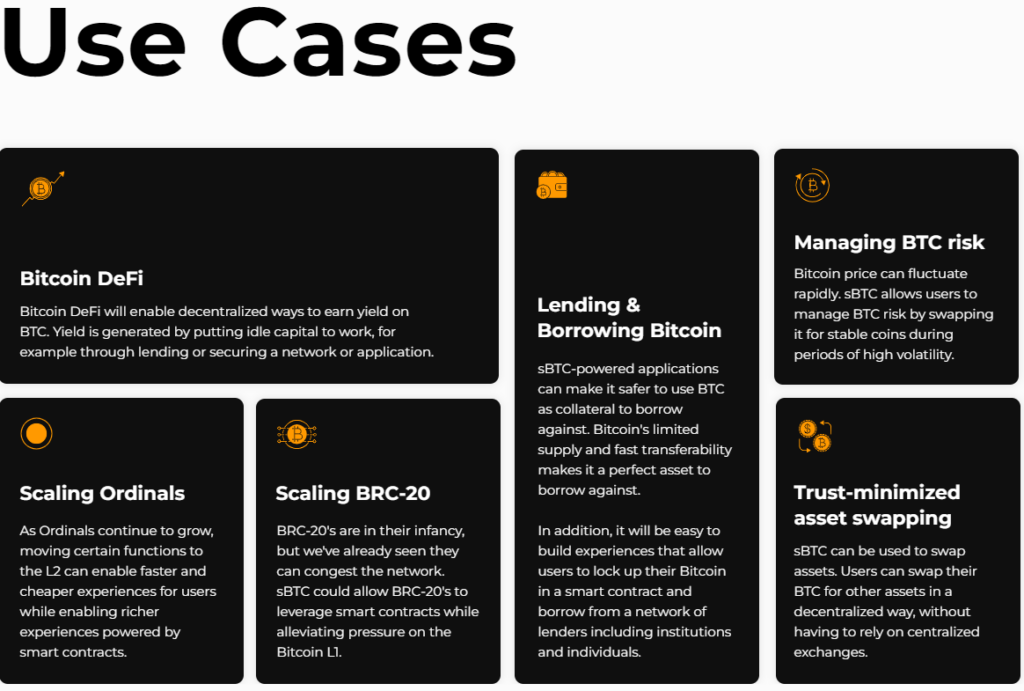

The integration has the potential to provide Bitcoin holders with a novel method of interacting with decentralized finance (DeFi) protocols, particularly for Bitcoiners who have refrained from DeFi protocols due to the risks associated with smart contracts and proof-of-stake (PoS) methods.

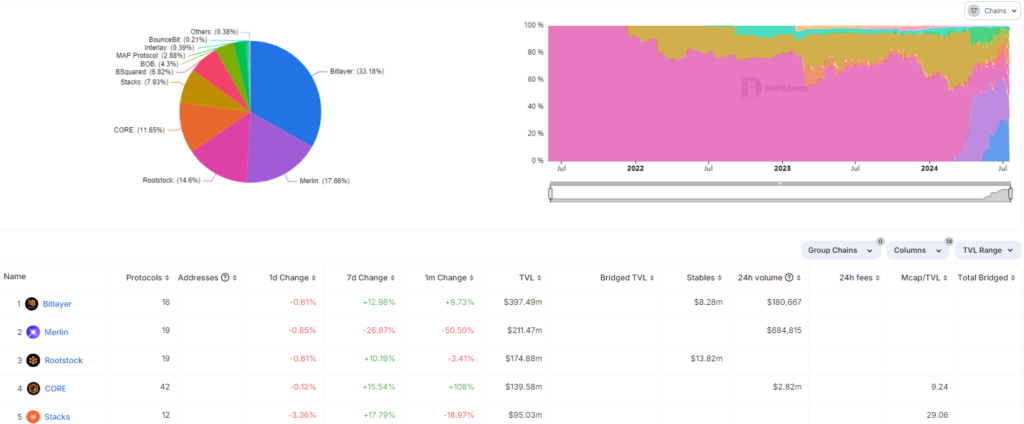

Stacks is acknowledged as the smart contract layer of Bitcoin and is the fifth-largest Bitcoin layer-2 solution. According to DefiLlama, it has a 7.9% market share among all Bitcoin layer-2 solutions and has over $95 million in total value locked (TVL).

BitGo will support sBTC as a network Signer

To contribute to block production and consensus, BitGo will become a “Signer” on the network and support the new Stacks token standard (sBTC) as part of the new partnership.

The programmability of the world’s first blockchain network will be enhanced by the entire release of sBTC, a non-custodial, 1:1 Bitcoin-backed asset. BitGo will support the conversion of BTC to sBTC across L1s and L2s, as well as the facilitation of deposits and withdrawals for sBTC, in its capacity as a Signer.

Figment, Blockdaemon, Near Foundation, Luganodes, and Chorus One are additional sBTC signers.

The objective of Stacks’ sBTC is to simplify the process of developing DeFi applications on the Bitcoin network for developers.

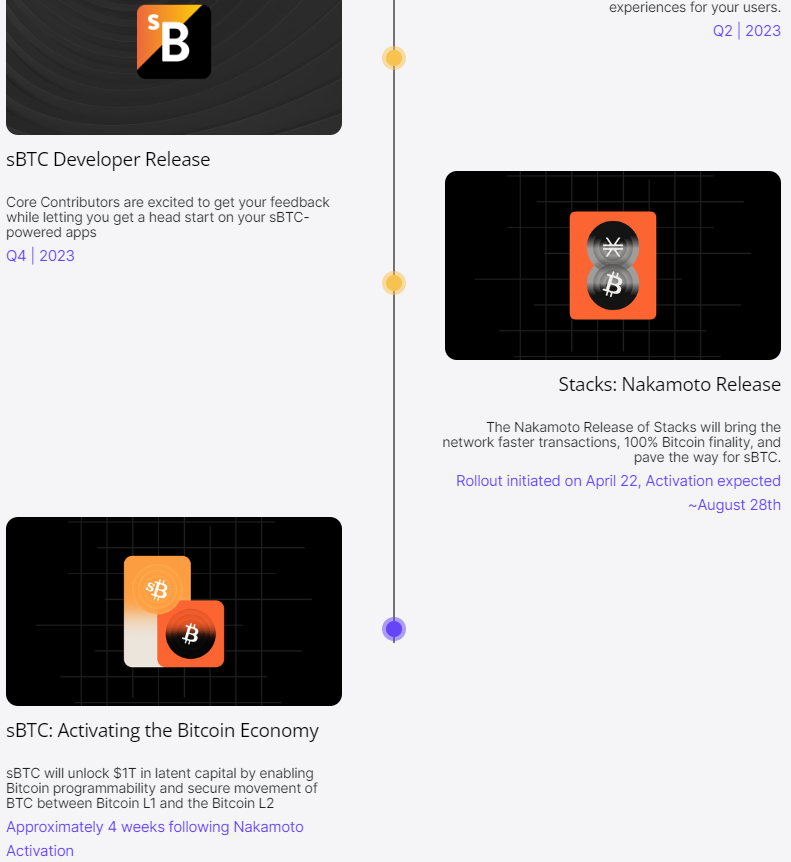

Stacks still needs to activate its Nakamoto Release, which is necessary to facilitate the finality of 100% Bitcoin and sBTC. The activation is anticipated to occur on August 28, as indicated by Stacks’ roadmap, and the release was initiated on April 22.

Nakamoto will usher in a “renaissance” for Bitcoin DeFi

The partnership represents a new development for Bitcoin DeFi or BTCFi, an emerging developer movement that seeks to enhance the utility of the Bitcoin network.

Stacks’ Ellicott has stated that the complete activation of the Nakamoto release will bring about a renaissance in Bitcoin DeFi.

“Stacks will inherit 100% of Bitcoin’s security budget, making transactions as irreversible as Bitcoin and enabling sBTC to facilitate decentralized BTC movement into the L2. This release will begin another renaissance of new Bitcoin builders, technical upgrades, and growth in user interest, providing a promising spotlight for the future of Bitcoin DeFi.”

Revolutionary new products for the crypto space, such as the first-ever Bitcoin-backed synthetic dollar with yield-generating capabilities, are introduced by Bitcoin DeFi. USDh, Hermetica’s synthetic dollar based on Bitcoin, was introduced in June. It offers a 25% annual yield (APY) calculated using futures funding rates.