As bulls confront the last bit of resistance, Bitcoin adds a Chinese rate cut to its impressive bag of bullish BTC price occurrences.

At the Wall Street opening on July 22, Bitcoin BTC$66,814 targeted $68,000 as a Chinese interest rate drop added more positive cryptocurrency catalysts.

Rate cuts are “unexpected” in China.

Following a decline below $67,000 earlier in the day, TradingView and Cointelegraph Markets Pro data indicated that BTC price movements were aiming for range highs.

The upward reversion coincided with Asia’s stock market’s mixed results as China startled investors by lowering several significant interest rates.

According to reports including Reuters, the People’s Bank of China (PBOC) said it would lower the one-year and five-year loan prime rates (LPR) and reduce the seven-day reverse repo rate by 0.1% to 1.7%.

Larry Hu, chief China economist at international financial services company Macquarie Group, told the publication, “The cut today is an unexpected move, likely due to the sharp slowdown in growth momentum in the second quarter as well as the call for ‘achieving this year’s growth target’ by the third plenum.”

In response, market analyst Holger Zchaepitz pointed out that the last Chinese rate cut was a year ago.

He wrote, in part, “Chinese stock market not enthusiastic” on X.

Lower global interest rates are a necessary component of risky asset performance, which includes cryptocurrency. As Cointelegraph noted, markets anticipate that the United States will start a cycle of rate cuts in September, although it has yet to follow Europe and China in doing so.

Popular macro and cryptocurrency analyst TMXC Trades took a more conservative position, arguing that China’s selective cuts would not have the intended outcome.

“Traders were speculating that a massively coordinated cycle of global easing will reverse half or more tightening by 2024 (after they completely overestimated rises). It concluded that nearly all of it has yet to materialize as of mid-July.

Bitcoin traders encourage discussion about record highs.

In the meantime, Bitcoin stood in front of the final resistance group before reaching all-time highs, including the $69,000 mark that has been in place since late 2021.

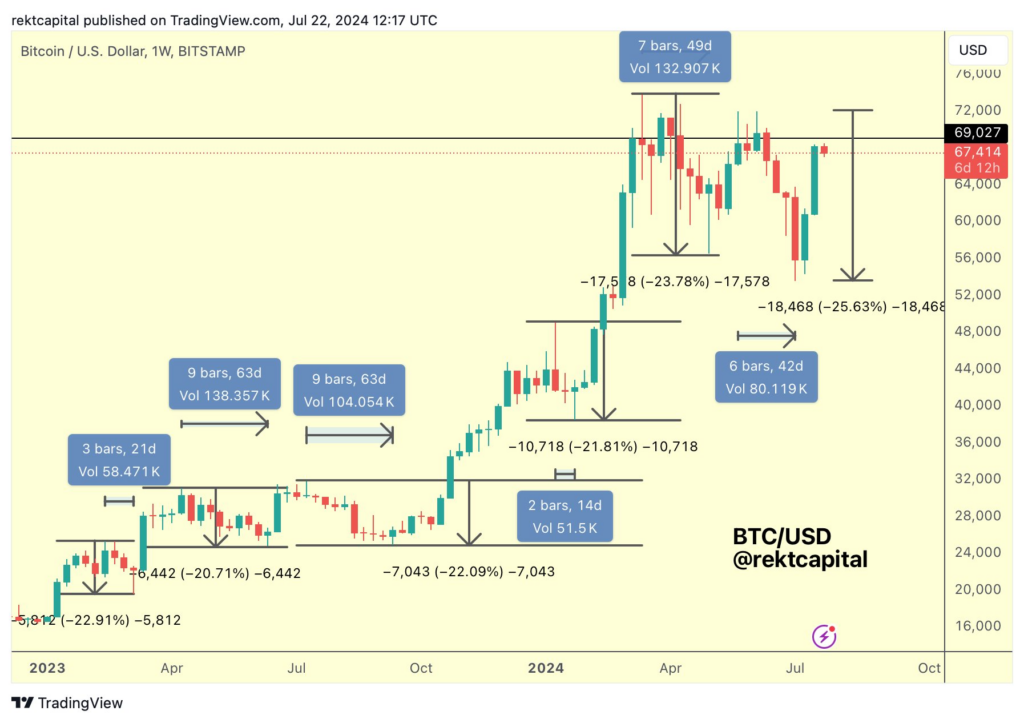

In his most recent X analysis, a well-known trader and analyst, Rekt Capital, stated, “Bitcoin has canceled out almost the entire of the -25.6% retrace.”

“It took two weeks to almost fully cancel out a five week retrace.”

An accompanying chart calculated the last retracement as the deepest upswing by comparing recent Bitcoin price behavior to previous ones during the bull market.

Another post stated, “Any dips to retest $65,000 would not be out of the ordinary, but generally, Weekly Closes have preceded upside to $71,500.”

Rekt Capital emphasized that fresh all-time highs should occur “at the latest” in September.

The CEO and founder of MNTrading, Michaël van de Poppe, said on the day that “Bitcoin is back in the range and provides a lot of strength.”

In the future, Van de Poppe identified $65,000 as a crucial level of support to keep, with the range low at roughly $61,000 as the following line of defense below.

“We should be good for continuation toward the ATH if that’s going to happen this week,” he said.