Gate.io exited the Japanese market due to regulatory pressures and “compliance requests” from local financial regulators.

Gate.io, a cryptocurrency exchange, has initiated the process of discontinuing services for Japanese clients, citing “compliance requests” from the country’s financial regulator.

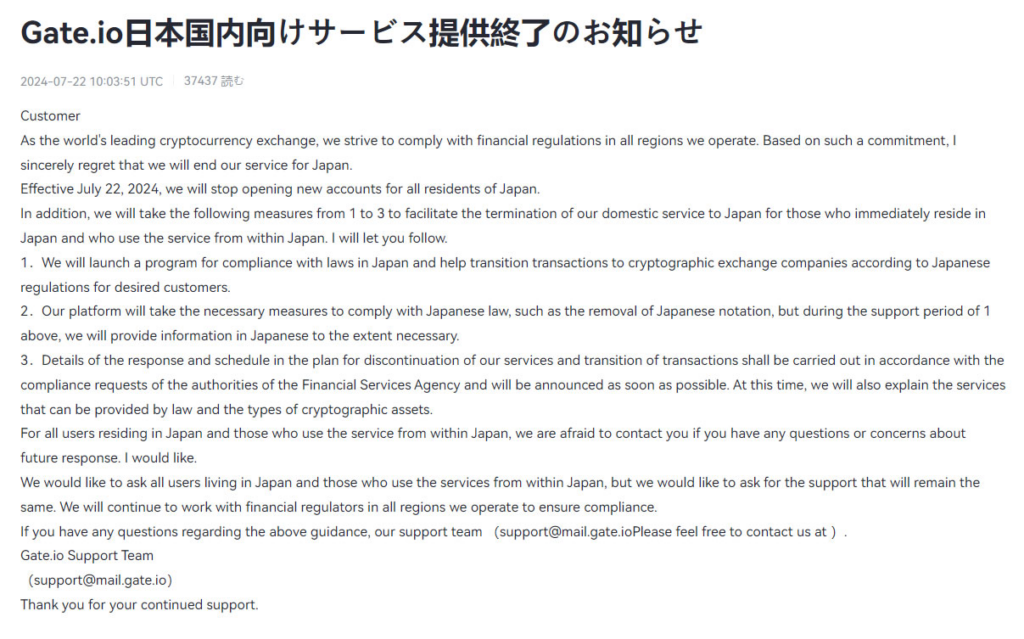

Gate.io announced the termination of services for all Japanese customers on July 22. The company also stated that it would assist affected customers in migrating their assets.

The Cayman Islands-based exchange will cease the creation of new accounts for all Japanese consumers on July 22.

The exchange stated that it was closing due to “compliance requests from authorities such as the Financial Services Agency.” It also indicated that it would provide additional information regarding the closure shortly.

Gate.io will implement a program to ensure compliance with Japanese laws and regulations and assist customers in transitioning to exchanges that adhere to Japanese regulations, as indicated in the notice.

Additionally, it stated that it would eliminate any information in Japanese from its website, but it would continue to provide updates to facilitate the account migration.

The service termination plan and transaction migration schedule will be implemented by the Financial Services Agency’s compliance requests.

However, it did not specify a date for the exchange’s closure in the country.

Despite its stringent regulations for crypto assets, Japan is widely recognized as an international crypto center and was one of the first countries to legalize crypto trading.

Japan’s Payment Services Act (PSA) regulates crypto assets, necessitating that exchanges register with the Financial Services Agency (FSA), adhere to anti-money laundering (AML) regulations, and conduct customer identity checks.

According to CoinGecko, Gate.io has a 24-hour trading volume of $19.5 billion globally and lists 3,557 pairs.

Cointelegraph contacted Gate.io for additional information; however, an instantaneous response still needs to be received.

Some Japanese corporations continue to place significant bets on Bitcoin investments despite the regulatory obstacles.

On July 22, Metaplanet, a Japanese investment and consulting firm, disclosed that it had acquired an additional 20.4 BTC, estimated to be worth approximately $1.2 million, to finalize its acquisition strategy, which was initially disclosed in June.