Advanced Micro Devices reported Q2 earnings, with over $1 billion in MI300 chip sales and a 115% annual increase in data center business, as investors watch for market share gains from Nvidia

On Tuesday, Advanced Micro Devices disclosed second-quarter earnings that exceeded Wall Street’s revenue projections and demonstrated ongoing expansion in the company’s AI chip sales.

In extended trading, AMD shares experienced a 7% increase.

The following is AMD’s performance in comparison to the LSEG consensus expectations for the quarter ending on June 29:

Adjusted earnings per share were 69 cents, compared to 68 cents.

Revenue: $5.83 billion, as opposed to the anticipated $5.72 billion

AMD anticipates sales of approximately $6.7 billion in the current quarter, which is lower than the Wall Street consensus of 93 cents per share on $6.61 billion in sales.

The chipmaker’s net income was $265 million, or 16 cents per share, in contrast to $27 million, or 2 cents per share, in the previous year.

Despite AMD’s status as the second-largest vendor of data center GPUs after Nvidia, its shares have declined by approximately 6% in 2024.. Nvidia’s stock has more than doubled this year due to the necessity of AI GPUs for the training and deployment of advanced AI such as ChatGPT, and Nvidia has emerged as the preferred chip.

Investors are interested in AMD’s MI300X AI technology, which is expected to erode market share from its long-standing competitor Nvidia, and in the expansion of its data center AI business. AMD anticipated $4 billion in AI chip sales this year, which accounts for approximately 15% of its anticipated revenue.

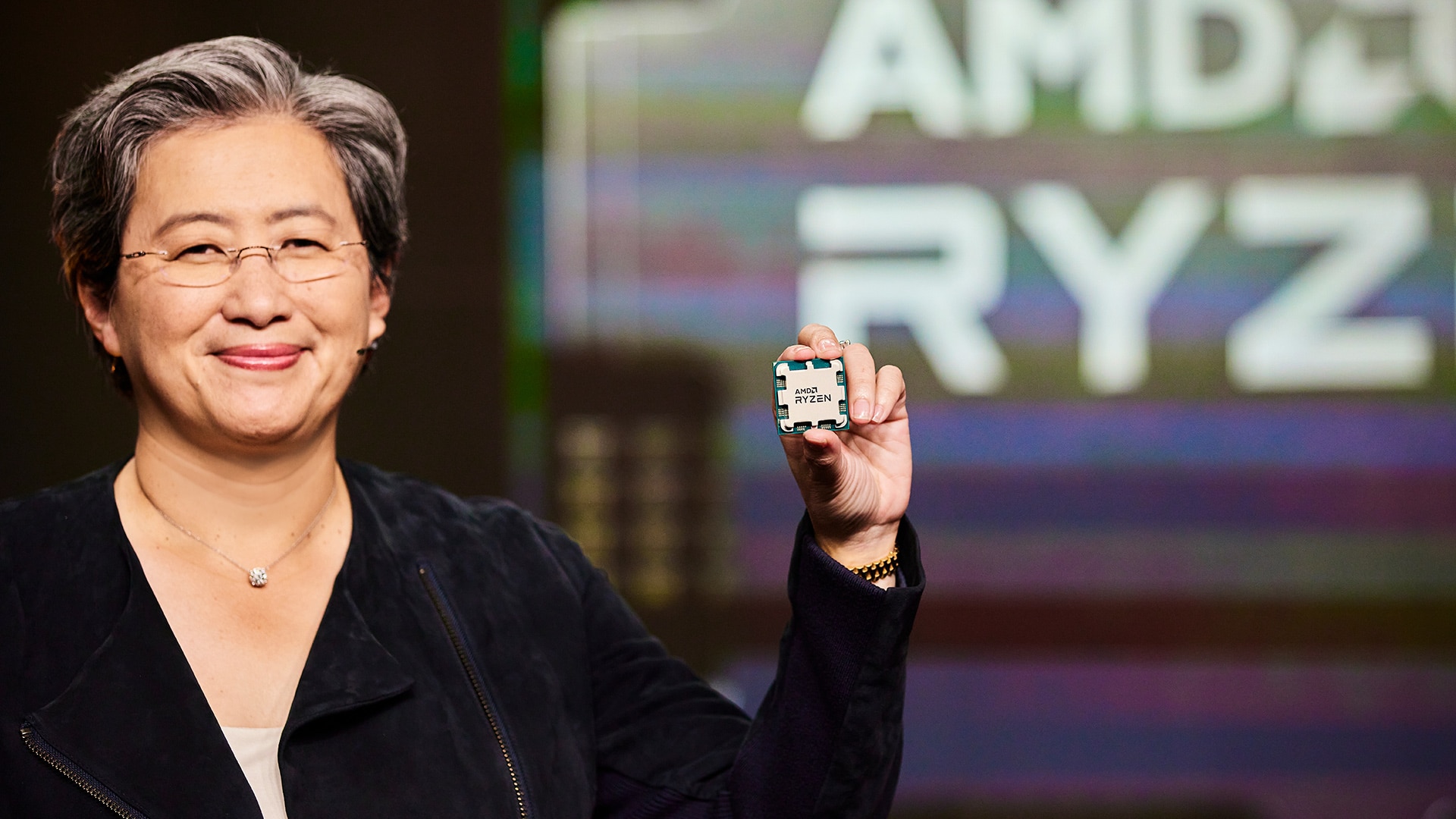

Lisa Su, the CEO of AMD, disclosed during a conference call with analysts that the company’s AI chip sales exceeded expectations and that revenue from its MI300 processors exceeded $1 billion during the quarter.

“As a consequence, we now anticipate that data center GPU revenue will surpass $4.5 billion in 2024, a significant increase from the $4 billion we projected in April,” Su stated during a conference call with analysts.

According to AMD, the company’s Data Center segment reported a 115% year-over-year increase in AI GPU shipments, which resulted in $2.8 billion in AI processor sales. Data Center revenue was anticipated to reach $2.75 billion, according to analysts surveyed by Street Account.

AMD’s primary industry is the production of central processors (CPUs) for servers and laptops. PC sales are reported in the company’s Client segment, which increased by 49% year-over-year to $1.5 billion, surpassing Street Account’s projection of $1.43 billion. The growth in the PC market indicates that it is beginning to recover from the post-pandemic decline that it experienced a few years ago.

In addition, AMD produces GPUs for 3D graphics and processors for gaming consoles, which are tracked under the gaming category. In gaming revenue, AMD reported a decline of 59% year over year, with $648 million reported. According to Street Account, analysts anticipated sales of $676 million.

The embedded segment of the company, which comprises products acquired through the Xilinx acquisition in 2022 for industrial customers, reported $861 million in sales, a 41% decrease year-over-year. This figure exceeded Wall Street expectations of $856 million.