Bitcoin price could fall to $50k or below, according to the predictions made by experts, just as it did in 2021.

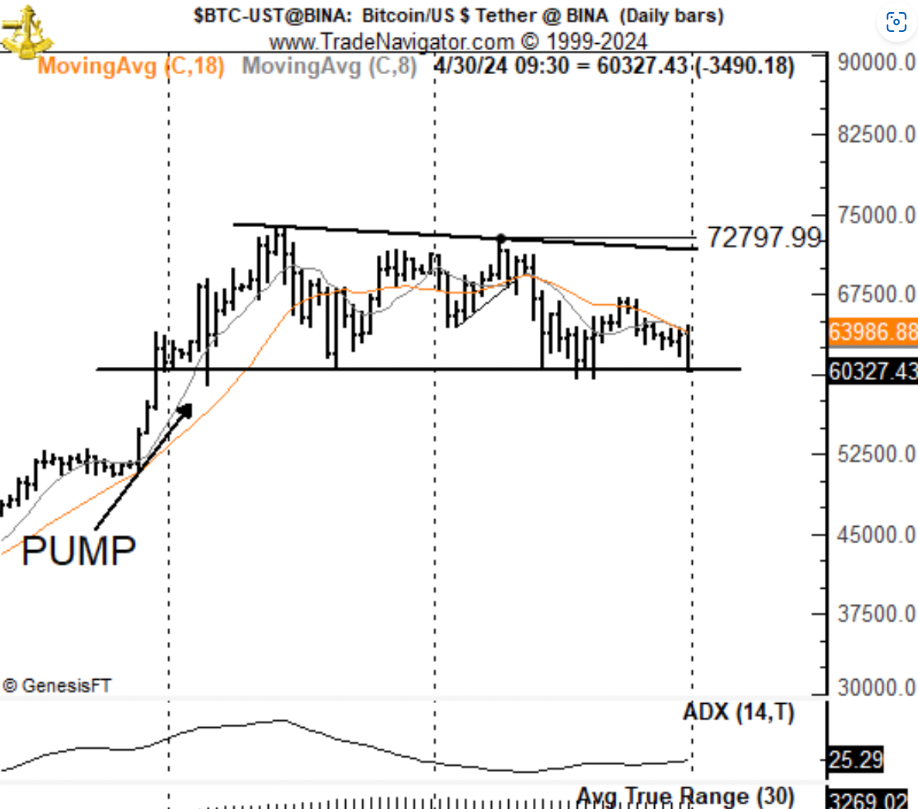

As of May 9, the price of Bitcoin has decreased by approximately 3.70% week-to-date, or to around $61,650. This is approximately 16.50% less than on March 14, when it reached a new all-time high of around $73,835.

The recent decline in Bitcoin’s price has occurred concurrently with a lackluster reaction to the introduction of spot Bitcoin and Ethereum exchange-traded funds (ETFs) to the market in Hong Kong, the adoption of a higher and longer interest rate policy by the United States Federal Reserve, and a reduction in inflows into spot Bitcoin ETFs in the United States.

What is the potential minimum price for Bitcoin during the current corrective cycle?

As a result of increasing wedge consolidation, Bitcoin now stands at $54,000.

The ongoing price correction in Bitcoin is characterized by a falling wedge pattern, wherein two trendlines sloping downwards converge at approximately $54,000 apogee. If the BTC/USD pair continues to consolidate within the wedge range, it may reach above by June.

Notably, the wedge’s apex is near Bitcoin’s 200-day exponential moving average (EMA, represented by the blue wave in the chart above). This provides a dual-layered support system that may facilitate a price recovery.

This corresponds to the typical behavior of falling wedges, in which the price surges to a level surpassing the pattern’s upper trendline and increases by the utmost distance between the upper and lower trendlines, as visually depicted below.

Utilizing the identical technical principle, the falling wedge target for Bitcoin’s daily chart is around $63,880, representing an approximate 3.5% increase from the present price levels. Put another way, additional downward trends in the Bitcoin market may create favorable conditions for purchasing the dip.

BTC might “fall into the high 40s”

Peter Brandt, an experienced trader, forecasts that Bitcoin’s price will fall to between $40,000 and $50,000. He bases this prediction on the formation of a descending triangle pattern, which emerged subsequent to the cryptocurrency’s inability to firmly reclaim its prior peak of $69,000.

“Over the years, I have witnessed dozens of significant market peaks with charts resembling this descending triangle,” Brandt argued, citing the following chart.

His further statement was:

“A simple fact needs to be resolved — that Bitcoin has not exceeded the tops made three years ago despite the halving and ETFs […] Perhaps dip into high 40s, then bull resumes.”

Brandt’s pessimistic outlook on Bitcoin is noteworthy because it posits a reversal scenario reminiscent of a classic descending triangle. In this scenario, the price might traverse the lower trendline of the triangle and experience a decline equal to the maximal distance between the upper and lower trendlines.

By Brandt’s “high 40s” forecast, confirmation of the descending triangle reversal scenario will increase the likelihood that Bitcoin will decline toward $48,550, a decrease of over 20% from its present price level.

A 2021 Bitcoin fractal predicts further suffering

The ongoing Bitcoin price correction has transpired concurrently with a weekly relative strength index (RSI) decline from overbought territory from a technical standpoint. Thus, The RSI has fallen below a support line consisting of a multimonth ascending trendline, comparable to the trend that preceded a significant price correction in 2021.

BTC’s price declined toward its 50-week moving average (the red wave) at that time, increasing the likelihood that the same situation could reoccur in 2024. This places Bitcoin’s downside target at approximately $46,110 by June, which corresponds to the level of its 0.618 Fibonacci retracement line.

A significant decline below the 50-week moving average (EMA) could cause the price to approach the 200-week EMA at approximately $32,410, representing a reduction of around 58% from the present price levels.