Uber’s stock plunges as quarterly loss shatters profit expectations, wiping $12 billion from market value

Uber shares are poised to incur their most significant daily percentage decline since October 2022, declining 8% to $65 per share shortly after the market opens. This would be the lowest intraday level for the stock since late January.

Following the company’s announcement on Wednesday of a $0.32 loss per share for the first quarter, which was significantly worse than the $0.22 profit per share that the consensus had predicted, the stock losses significantly reduced Uber’s market value, wiping out $12 billion in total.

Uber’s first consecutive profitable quarters came to an end with this quarter’s $654 million net loss, its steepest quarterly loss since the third quarter of 2022, and a significant decrease from the prior period’s $1.4 billion net profit.

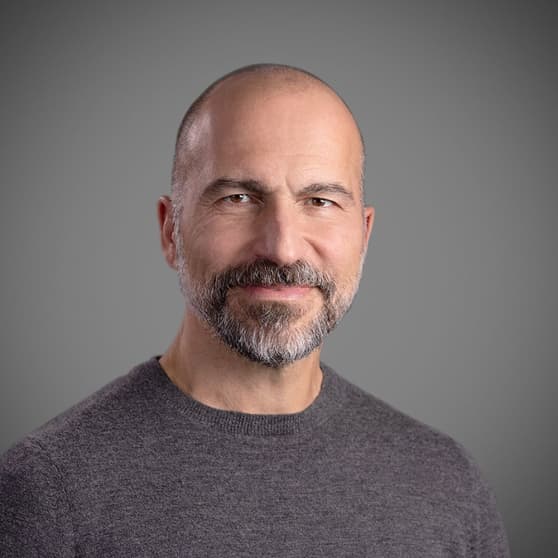

Uber ascribed the financial shortfall to a writedown of its equity investments in its earnings report. Uber CEO Dara Khosrowshahi told CNBC that the unfavorable net results were “absolutely unrelated to the company’s operational activities.”

The company’s adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) reached an unprecedented $1.38 billion, which is significantly higher than analyst estimates of $1.32 billion and approximately 82% higher than the first quarter of 2023.

Uber has surpassed initial projections with its record total revenue of $10.1 billion. However, the company’s gross bookings, which encompass the combined value of all journeys and food deliveries arranged through the Uber app, fell short of expectations at $37.7 billion.

“The initial sell-off in response to results is excessive,” JPMorgan stated. Neeraj Kookada and Doug Anmuth penned to clients regarding the precipitous post-earnings decline in Uber stock. Uber’s price target of $95 by the bank is one of the highest on Wall Street, representing an approximate 50% increase.

Uber encountered a formidable challenge in generating earnings, given that its highest-ever revenue, adjusted earnings, and gross bookings occurred prior to the most significant decline in nearly two years.

The severe response signifies the impatience of investors with respect to Uber’s profitability as the company nears its fifth anniversary of going public.

On average, analysts anticipate Uber to generate a $2.7 billion net profit in 2024, which is nearly fifty percent greater than the $1.9 billion profit recorded in 2023 and an astronomically superior amount than the $9.1 billion net loss incurred in 2022.

However, a substantial portion of the remarkable turnaround in Uber’s bottom line has already been priced into the stock market performance, as shares are still trading over three times higher than their nadir in 2022.