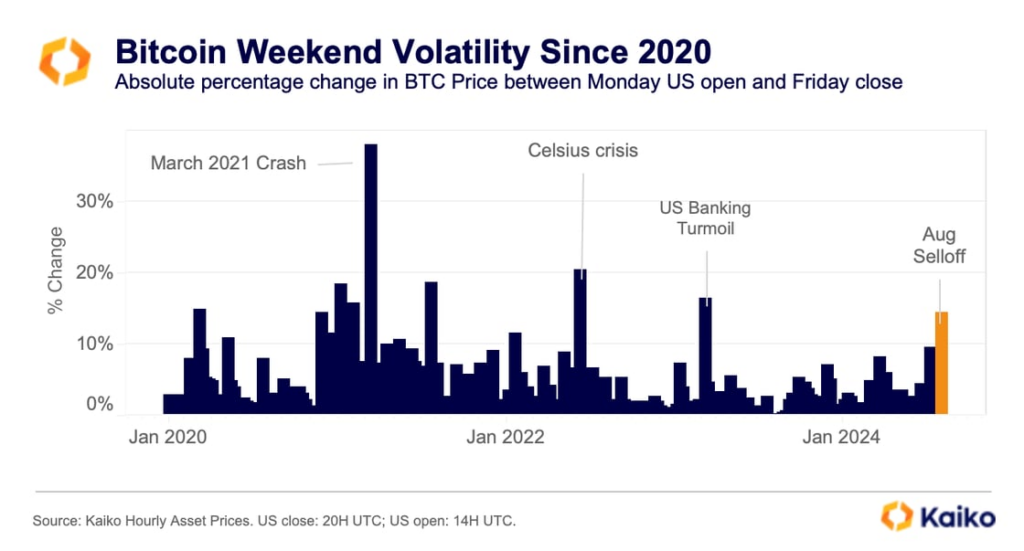

Due in part to ETFs, bitcoin trading volume and liquidity are concentrated on weekdays, which may lead to more extreme price movements over the weekends.

According to Kaiko Research, with the introduction of spot Bitcoin exchange-traded funds (ETF) in the US, the price of Bitcoin has grown more prone to extreme weekend volatility.

The crypto researchers at Kaiko said on August 12 that there is now a greater concentration of Bitcoin liquidity on weekdays, especially in the BTC/US dollar exchanges.

It has been stated that Bitcoin’s weekend trading volumes have decreased as institutional and ETF activity has increased. It also observed that weekend trading volatility has generally declined since 2021.

However, Kaiko noted that shifting to trading BTC during the weekdays “heightens the risk of sharp weekend price swings during market stress.”

Kaiko noticed “liquidity fragmentation” in the cryptocurrency markets during the most recent significant sell-off of BTC$59,347 on August 5, when it fell below $50,000. This phenomenon causes price differences between exchanges, significantly harming smaller, less liquid exchanges.

Between the US market’s closing on Friday, August 2, and its reopening on Monday, August 5, it was observed that BTC had moved 14% during the sell-off, “similar to major sell-offs since 2020.”

“Unlike traditional markets that close on weekends, crypto markets operate 24/7. This causes sell-offs that start on a Friday to worsen weekend uncertainty, amplifying price impacts.”

According to Kaiko, depending on the exchange and trading pair, a $100,000 Bitcoin sell order during the August 5 sell-off would have resulted in considerable price slippage.

While kucoin’s BTC/euro pair hit around 5.5%, Zaif’s Bitcoin/yen pair had slippage as high as 5.53%. US dollar stablecoin pairs are available on Binance and BitMEX in the meantime. In the US, slippage reached 4% for the day.

With $17.3 billion in net inflows since January, the 11-spot BTC ETFs in the US have a good grip over the cryptocurrency’s liquidity since they presently own 4.7% of its supply.