Ether inflation returns after Ethereum’s Dencun upgrade.

The deflationary trend in the Ether supply has been resolved since the launch of Ethereum’s much-anticipated Dencun upgrade two months ago.

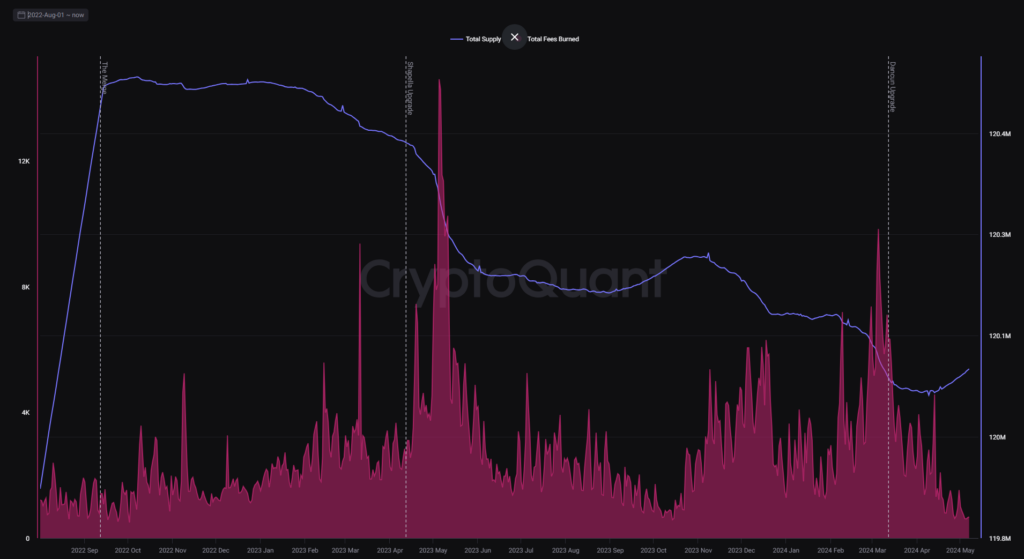

According to data from CryptoQuant, the total supply of Ether rose from 120 million on March 12, before the Dencun upgrade’s mainnet rollout, to 120.1 million on May 7.

This is the first time since September 2022, when the highly anticipated Merge transitioned Ethereum to its current proof-of-stake consensus model, that Ether supply became inflationary, albeit marginally.

According to the founder and CEO of Cryptoquant, a temporary deflationary state of Ether is not catastrophic for the Ethereum network because decentralized applications (DApps) provide the majority of its benefits. In an X post dated May 9, Ki Young Ju penned:

“Post-Dencun upgrade, $ETH lost deflationary status with reduced fees, departing from “ultrasound money.” Ethereum’s strength lies in DApps; it’s wiser not to compare it to Bitcoin’s sound money narrative.”

Ether supply first became deflationary following the merger on September 15, 2022, when a mechanism was implemented that burned transaction fees perpetually on the network, resulting in a depletion of Ether supply.

Since the Merge, more than 419,713 Ether tokens have been burned or removed irrevocably from circulation, as reported by Ultrasound Money.

Does “ultra-sound” money perish?

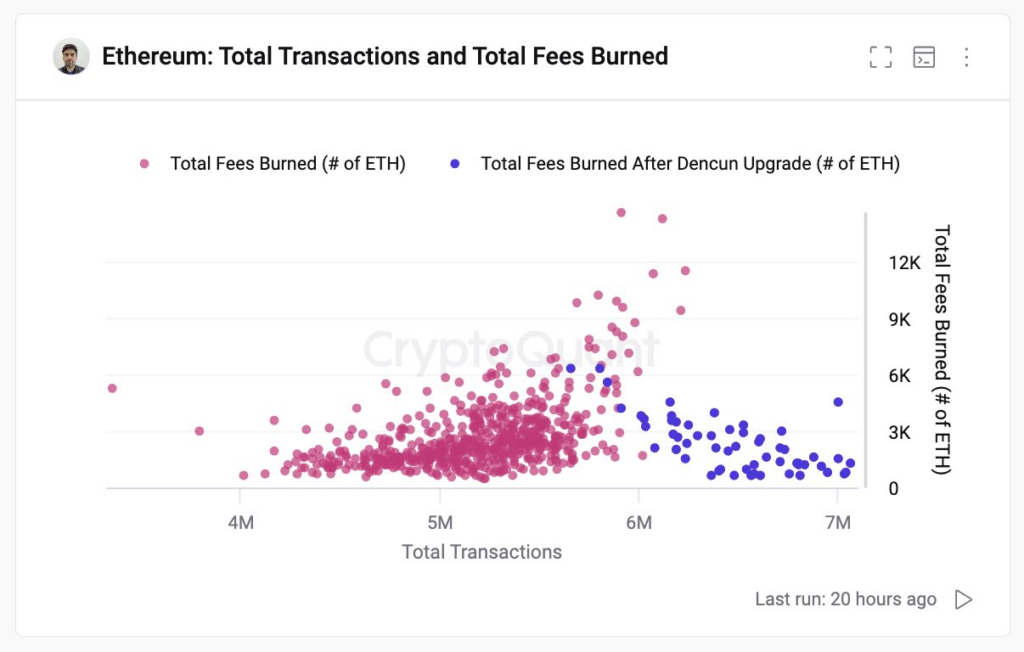

With the same level of network activity, the Dencun enhancement has ended Ether’s inflationary streak by making median transaction fees up to four times cheaper than before.

According to a report published by CryptoQuant on May 8, while this is a significant development for the Ethereum network and its users, it may signal the end of Ether’s status as an ultra-sound currency.

“The Dencun upgrade has made ETH inflationary again, potentially killing the narrative of “Ultra sound” money as a structurally lower amount of transaction fees burned on Ethereum have had the corresponding effect of not decreasing the total supply of ETH to keep it deflationary.”

The quantity of Ether being consumed has decreased to its minimum level since the Merge due to reduced transaction fees, whereas supply growth has increased to its peak since the upgrade.