When Nvidia’s Q2 earnings beat Wall Street estimates but did not wow investors, tokens tied to artificial intelligence fell.

Following the announcement of Nvidia’s second-quarter 2024 earnings, which beat projections but did not wow investors, major cryptocurrencies tied to artificial intelligence fell.

Only a few hours following Nvidia’s earnings announcement, Artificial Superintelligence Alliance (FET) dropped 7.8% to $1.1663. According to CoinMarketCap data, Render (RNDR) fell 6.8% to $5.47, and Bittensor (TAO) lost 4.5% to $295.22.

It appears that Nvidia’s $30 billion in sales in Q2 2024—a 15% increase from Q1 and around $1.32 billion more than projected—was insufficient.

“For Nvidia, better-than-expected is insufficient. After Nvidia’s release on August 28, market analyst Lisa Abramowicz commented in an X post, “Apparently, investors expect this company to blow away expectations.”

A few analysts projected that it would surpass Wall Street projections by a minimum of 10%.

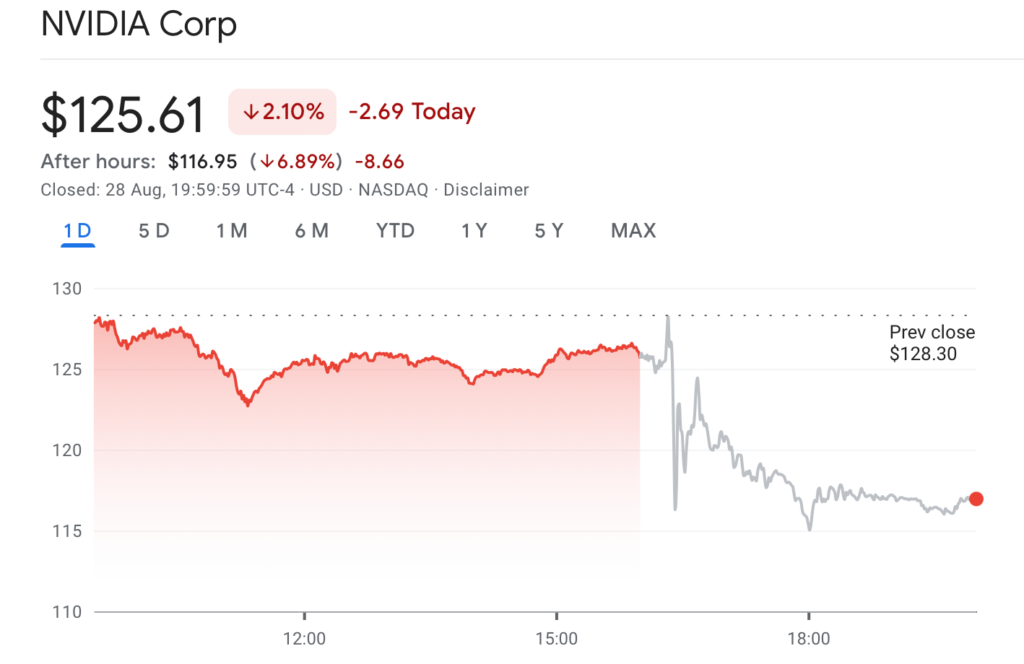

Google Finance data shows that the price of Nvidia’s (NVDA) stock fell 6.89% in after-hours trading to $116.95 after closing the trading day on August 28 at $125.61.

In prior quarters, Nvidia’s performance and earnings reports have been closely correlated with the performance of AI cryptocurrency tokens.

Before the earnings announcement, a few individuals in the cryptocurrency market had forecast that AI crypto tokens would decline.

“You might catch gains being long until a day before, but I’d bet you’re better off shorting for the dump after,” a user on X named “Shogun” remarked on August 23.

Businesses use chips from Nvidia to develop and implement AI models. AI cryptocurrency tokens fell after the company’s Q1 earnings were released in May, even though its Q1 revenue increased by 18% over Q4 2023.

Though he thinks Nvidia’s business is not slowing down, Bloomberg’s Ed Ludlow stated on August 28 that “the very lofty estimates were very lofty indeed.”

“The narrative remains complete. Here, demand is not a problem. In essence, he clarified that the companies that run data centers and provide cloud computing—known as hyperscalers—continue to purchase Nvidia’s products.

It follows a three-week spike in the market capitalization of AI and big data cryptocurrency projects and tokens, which peaked on August 5 at BTC$59,394, breaking below $50,000 for the first time since February. This is known as “Crypto Black Monday.”

At that point, the combined market capitalization of cryptocurrency projects related to AI and big data fell to a low of $18.21 billion.