BlockFi shuts down its platform and is partnering with Coinbase for crypto withdrawals of customers.

BlockFi, an unsuccessful cryptocurrency lender, has announced its intention to cease operations and decommission its web platform by May 2024. BlockFi intends to establish a collaborative partnership with Coinbase, a prominent cryptocurrency exchange, to facilitate customer withdrawals of funds.

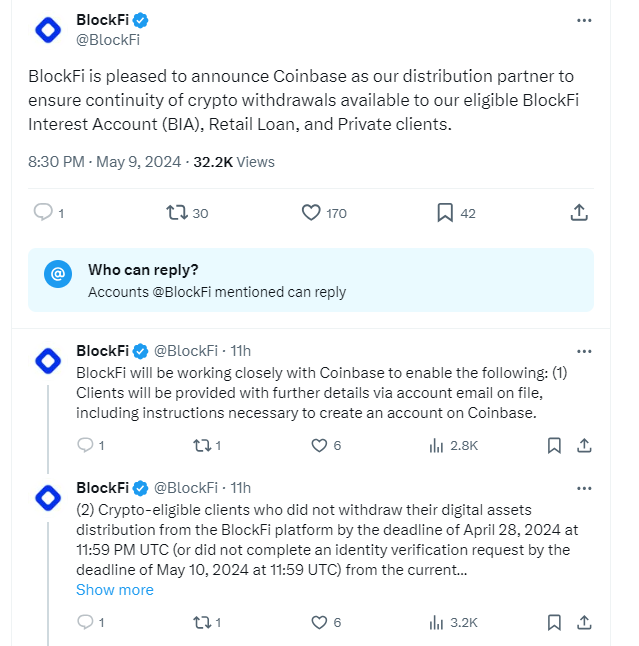

In a blog post, the New Jersey-based company announced that eligible BlockFi Interest Accounts (BIA), Retail Loans, and Private Clients can withdraw their cryptocurrency holdings through its partnership with Coinbase.

Following the failure of FTX, BlockFi initiated bankruptcy proceedings in November 2022. Subsequently, in 2023, BlockFi declared its insolvency and delineated strategies to restitute customers’ cryptocurrency assets by April 28, 2024, subject to the fulfilment of withdrawal requests.

The lender notified clients on Thursday that they will receive instructions on establishing a Coinbase account to effectuate withdrawals, regardless of whether they are utilizing an approved new Coinbase account or the expired deadline for withdrawing digital assets from the current estate distribution.

For those who failed to meet the withdrawal and verification deadlines of May 10 via the BlockFi platform, the organization is extending an additional opportunity. Without an approved Coinbase account, the assets of non-compliant clients may be liquidated into currency and subsequently distributed.

In future distribution cycles, which may involve funds recovered from FTX, the plan administrator will continue to utilize Coinbase. In its absence, subsequent distributions would be exclusively in currency.

BlockFi has declared that it has no plans to form strategic alliances with other providers in the cryptocurrency distribution industry. As a result, investors are urged to exercise caution to evade possible frauds perpetrated by third parties.

In the past, BlockFi has encountered instances of fraudulent activity wherein users were duped into receiving emails that imitated official correspondences and made false claims regarding the immediate withdrawal of their remaining balances.

BlockFi had achieved a noteworthy in-principle settlement worth $875 million with the FTX and Alameda Research estates. In addition to resolving BlockFi’s approximately one-billion-dollar claims against FTX, the settlement observed that FTX relinquished “millions of dollars worth of avoidance claims and other counterclaims” lodged against BlockFi.

According to Zac Prince, the CEO of BlockFi and a government witness in the criminal prosecution of Bankman-Fried, the bankruptcies of BlockFi were directly attributable to the founder’s actions at FTX.

The bankruptcy court authorized BlockFi’s Chapter 11 repayment plan to 10,000 creditors in September 2023. Estimates place BlockFi’s debt to more than one hundred thousand creditors at $10 billion, with $220 million owed to insolvent cryptocurrency hedge fund Three Arrows Capital and $1 billion to its three largest creditors.