Toncoin is booming right now as the Telegram-based cryptocurrency is increasing fast in May and gaining popularity.

To reach $7.10 on May 10, the price of the cryptocurrency Toncoin (TON), associated with Telegram, has increased by about 50% month-to-date, with a 15% surge in the last twenty-four hours. This is the highest level in three weeks.

During the same period, the valuation of the broader cryptocurrency market increased by 15%, while Toncoin outperformed it.

Based on this performance, it can be inferred that while Toncoin’s fluctuations are comparable to those of other prominent cryptocurrencies, its growth has been propelled by more robust catalysts. Consider taking a deeper look.

Airdrops of Notcoin increase TON demand

The price increase of Toncoin takes place before the May 16 introduction of the play-to-earn game Notcoin. Notcoin functions as a social tapping game within the Telegram application. Engaging with the Notcoin bot requires participation, and players are encouraged to invite their peers to join.

Tap-and-drag on a golden coin frequently appearing on-screen generates Notcoin, a virtual currency that serves as the game’s primary transaction means. Over 34.5 million participants have engaged in the “mining” of these Notcoin tokens.

The Notcoin team has confirmed that the 34.5 million holders of Notcoin tokens will receive an airdrop of a new native cryptocurrency, NOT. This cryptocurrency will commence operations on the TON Blockchain, a component of the Open Network’s layer one proof-of-stake (PoS) ecosystem, on May 16.

Furthermore, on May 16, NOT will become operational for trading on prominent cryptocurrency exchange platforms, such as Binance and Bybit.

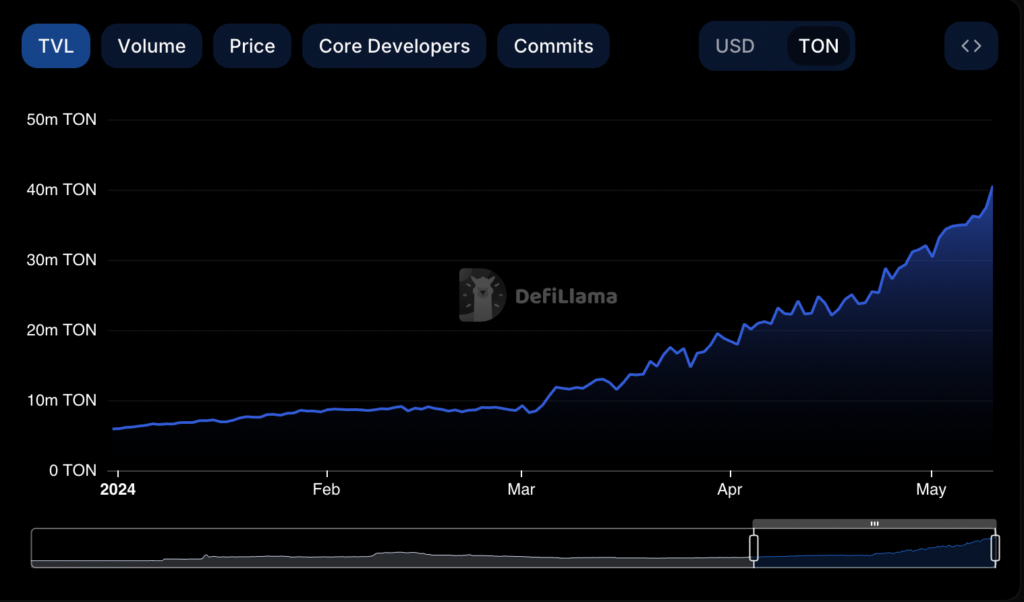

The total value secured (TVL) across the TON blockchain’s network increased substantially in the days preceding the NOT launch. The TVL was recorded at 40.58 million TON as of May 10, 2024, representing a 33% growth in May and a sevenfold increase thus far in 2024, indicating strong demand for Toncoin.

Further, integrating Tether (USDT) stablecoins onto the TON blockchain coincides with the ascent of TVL.

Unidentified investment by Pantera Capital

Pantera Capital disclosed an undisclosed investment in The Open Network on May 2, citing the April integration of the PoS ecosystem with the Telegram messaging service as the primary impetus for the investment.

Pantera Capital contends that the Open Network’s potential to become one of the largest cryptocurrency networks is due to its partnership with Telegram, which boasts 36.7 million monthly downloads and 900 million monthly users.

The upward movement of Toncoin’s value by around 46% since the announcement signifies the optimistic reception of these developments on the market.

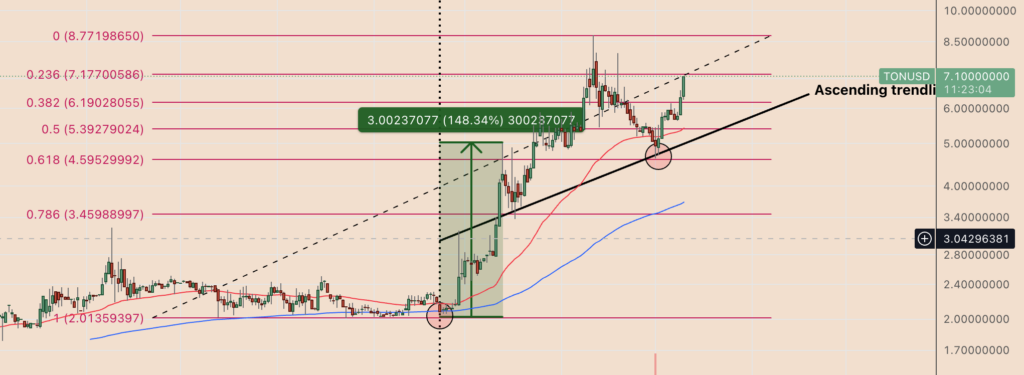

Technical price rebound for TON

Recent gains for Toncoin have been propelled by a revival that commenced after it arrived at a critical confluence of support, which is delineated by an ascending trendline, the 50-day exponential moving average (EMA), and the 0.618 Fibonacci retracement level.

A red circle is employed to denote this critical support zone on the chart visually.

Concurrently, TON’s price recovery was accompanied by a decline in the daily relative strength index (RSI) to 37.45, a situation reminiscent of a February price recovery. The RSI approached a similar low point during the same time frame, which coincided with a confluence of the 50-day and 200-day EMAs and the 1.0 Fibonacci retracement line, which provided support.

Fractal analysis reveals that Toncoin’s price movements around the support levels, as indicated by the daily RSI and EMAs, resemble those of the cryptocurrency in the past.

May TON prices may increase by more than 20%

As of May 10, the price of TON encountered resistance at its 0.236 Fib line near $7.17 but was anticipating a lengthy rebound toward the 0.0 Fib line at around $8.77, representing an increase of approximately 22% from the current price levels in May.

In contrast, a pullback from the resistance at the 0.382 Fib line might cause the price of TON to target the 0.382 Fib line near $6.19 as its immediate downside objective. A significant breach beneath the 0.382 Fib line would expose the price to the danger of descending towards $5.40 in May, a level that corresponds to both the 0.5 Fib line and the ascending trendline support.