Although it did not surpass the inflation-adjusted value of 2021, Bitcoin did hit a new all-time high of $73,880 in USD terms earlier in 2024.

The price of BTC is currently only 14% below its all-time high, and due to favorable conditions, targets of over $80,000 in the upcoming weeks have been set.

However, considering inflation, a new all-time high (ATH) of roughly $100,000 might not be as remarkable a performance as initially thought.

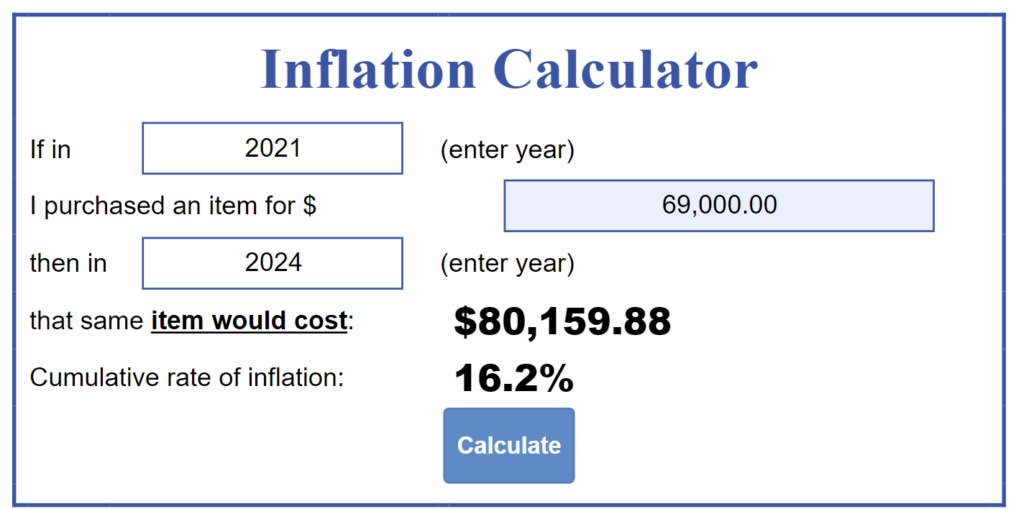

Inflation-adjusted Bitcoin price differences between 2021 and 2024

Analyst Luke Broyles believes that when Bitcoin reaches the coveted $100,000 milestone in 2021, it will “barely” equal its purchase price. In a post on X, Breakers emphasizes that the 2021 ATH price, after accounting for inflation, is currently $83,000.

This is reasonably accurate based on data obtained from the US inflation calculator. Assuming that BTC was purchased at its peak in 2021, an item purchased for about $69,000 today costs $80,159.88, with a 16.2% cumulative inflation rate.

The US inflation calculator calculates the purchasing power of the dollar over time. In light of that, Broyles continues,

“By the time we have the next round of printing in the next 6-18 months, it will be $95,000. $100,000 nominal BTC price in 2025 is (quite possibly) barely getting us to 2021 levels.”

Bitcoin aims for a higher high of $65K.

September has historically been a gloomy month, yet over the last 14 days, the price of Bitcoin has increased by 18%. Before going through a positive trend shift, Bitcoin is going through its previous test.

Since March 2024, Bitcoin has exhibited lower highs and lower lows on the one-day chart, as seen in the above chart.

The current goal for Bitcoin is to cross over the supply/resistance zone at $65,000, which will cause a shift in the market’s perception of itself or ChoCH.

The long-term downtrend should shift, and a higher high, higher low pattern will emerge, resulting in a new uptrend if $65K can be turned into support. Around $71,500 is where immediate resistance over $65,000 is located.

Cointelegraph revealed last month that there may be a September breakout, which may lead to a surge toward $86,000.

Thus far, the price movement has followed the expected path, and over the next few weeks, a 34.37% upswing is scheduled according to the “megaphone” pattern still in place.

Similar higher and lower highs are present in the megaphone pattern, which supports either a macro top or macro bottom. The price is rising, indicating that Bitcoin is getting closer to verifying a bottom and heading higher.