With its most recent round, Gelato has raised $23 million to grow its platform for smart contract automation.

With Kraken’s upcoming blockchain, Ink, joining as a client, Gelato, a network specializing in smart contract automation, has raised $11 million in a Series A+ fundraising round led by Hack VC.

It will be able to grow its platform with the help of the extra cash, allowing businesses and entrepreneurs to introduce their blockchain-based apps.

Animoca Brands, IOSG Ventures, and Bloccelerate VC are among the notable investor organizations involved in this most recent round, which brings the total fundraising to $23 million.

Gelato co-founder Hilmar Orth said that the money would enhance the network’s user experience to assist Web2 and Web3 businesses develop scalable onchain applications.

“Gelato is committed to a future where every company operates onchain. Achieving this vision requires scalable and affordable access to blockspace for millions of businesses.”

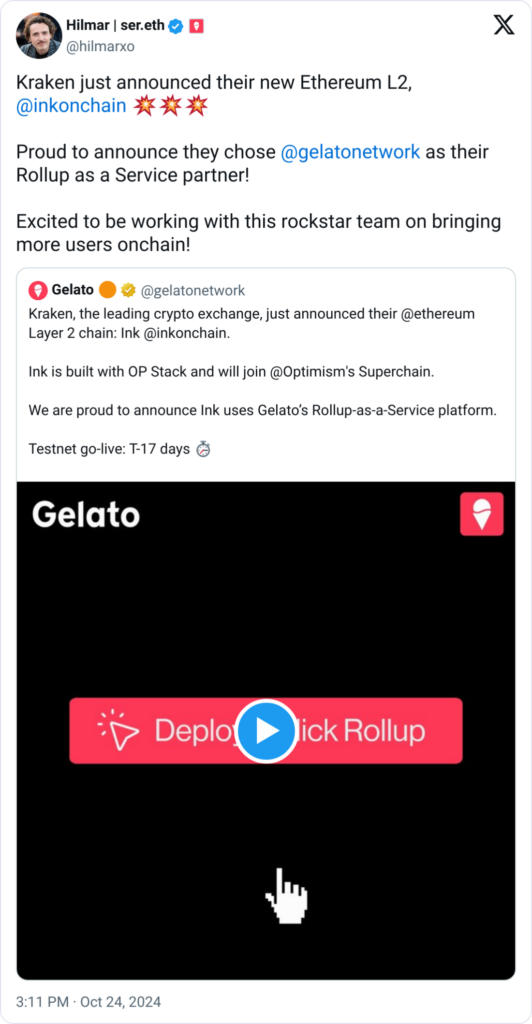

Kraken’s Ink joins Gelato.

Adding Kraken’s Ink, a novel layer-2 (L2) blockchain solution, as a client of the Gelato roll-up platform is a noteworthy development in the fundraising announcement.

On October 24, Kraken’s cryptocurrency exchange unveiled Ink, expected to start in early 2025. The goal of Ink is to allow users to trade, borrow, and lend without intermediaries.

The platform “prioritizes” collaborating with Web3 teams positioned “to advance adoption beyond its current status quo,” Orth said. He stated:

“[Kraken] are in a pole position to guide its crypto-savvy user base onchain, aligning well with Gelato’s mission of scaling onchain compute to the world.”

Resolving the constraints and difficulties of Web3

Scalable solutions are becoming more and more necessary as the number of decentralized applications (DApps) rises. Slow processing times and high transaction fees still need to be fixed.

Orth clarified that a modular approach is “key to scaling Web3 applications” and that “the belief that all applications can fit on a single blockchain is outdated.” He stated:

“Like Web2 companies scaling across millions of servers, Gelato aims to scale onchain compute horizontally. Its platform will enable developers to achieve this scale while maintaining security and interoperability.”

A second one-month hike of $11 million

Gelato revealed on October 8 that it had secured $11 million in Series A funding from cryptocurrency venture capital firms, including Stani Kulechov, the founder of Aave, Dragonfly Capital, and ParaFi Capital.

The money was raised to grow the network’s staff of 15 and add other blockchains.

Gelato’s Ethereum smart-contract automation network, which tackles liquidity and volatility concerns in cryptocurrency trading, is its primary use case.