Fidelity’s spot Ethereum ETF saw $115.5M inflows on Nov. 11, with BlackRock, Grayscale, and Bitwise’s Ether ETFs also gaining inflows.

As the cryptocurrency market continues to surge following Trump’s election victory, the United States spot Ether exchange-traded funds (ETFs) saw their largest day of inflows in history.

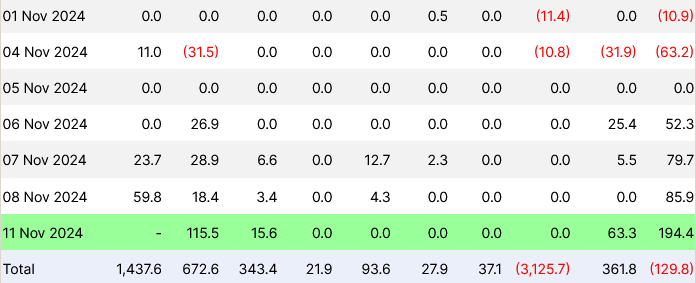

Launched in July, the ETFs saw inflows of $294.9 million on Nov. 11, shattering the previous record of $106.6 million on the same day.

According to Farside Investors and early data from crypto news aggregator Tree News, the Fidelity Ethereum Fund (FETH) led the field with $115.5 million in inflows, setting a record for the fund.

The iShares Ethereum Trust ETF (ETHA), issued by BlackRock, came in second with $100.5 million.

The Bitwise Ethereum ETF (ETHW) reported $15.6 million in inflows, while the Grayscale Ethereum Mini Trust ETF (ETH) completed the top three with $63.3 million. There was no inflow into any of the other US spot Ether ETFs.

US Elections 2024, Donald Trump, Data, Staking, Ethereum ETF, BlackRock

According to CoinGecko data, Ether rose 8.4% to a 14-week high of $3,384 on November 11th, matching the market’s over ten percent price increase during the same period.

However, according to a message to Cointelegraph from BTC Markets crypto researcher Rachael Lucas, Ether is lagging behind rivals like Bitcoin, Solana, and others that have excelled during the market cycle.

“Ethereum is starting to catch a bid after being a laggard for most of this cycle,” Lucas stated, pointing to Ether ETFs gaining traction following a comparatively slow start.

According to Lucas, as traditional investors consider Ether’s bull case, they will also find Ether staking returns—which are not available through US spot Ether ETFs—more alluring.

“There’s no reason to think ETH won’t function properly.”

ZX Squared Capital president CK Zheng told Cointelegraph that a Trump administration that supports cryptocurrency would probably help Ether in the upcoming months:

“ETH and SOL will perform well in the next few months if the new Trump administration actively promotes blockchain technology and speed up the digitalization in the financial industry.”

Except for withdrawals from the Grayscale Ethereum Trust (ETHE), which has lost about $3.13 billion since its inception, US spot Ether ETFs have received inflows totaling nearly $3.1 billion.

Since the investment products’ July 23 launch, BlackRock’s ETHA has seen inflows totaling more than $1.5 billion, leading the pack.