Yield opportunities in DeFi are more than just profits; they are engaging in a new financial era that values decentralization, autonomy, and innovation.

Table of Contents

What are Yield Opportunities?

Yield opportunities in finance, particularly in decentralized finance (DeFi), are any mechanism or platform that enables investors to earn returns on their assets. Yield opportunities in DeFi frequently involve earning returns through lending, staking, or providing liquidity across many protocols or platforms.

These yield opportunities have gained popularity because of DeFi’s potential for higher, more flexible yields than traditional finance alternatives, as well as the transparency and decentralization inherent in blockchain technology.

Here’s a summary of the most prevalent types of yield opportunities in DeFi:

- Staking: Investors get yield by storing their crypto assets in a network to support operations such as transaction validation. Over time, rewards are distributed in the form of additional tokens.

- Lending: DeFi platforms enable users to lend their crypto to others and earn interest. Smart contracts simplify the process, and interest rates can be lower than those offered by traditional lenders.

- Automated Market Makers (AMMs) such as Uniswap and Curve rely on liquidity pools to provide crypto assets. In return, they receive a share of the trading fees.

- Yield Farming: This strategy frequently entails switching between several DeFi platforms or “farms” to obtain the maximum potential returns, with incentives typically in the platform’s native tokens.

- Real-Yield Protocols: Newer protocols derive yields from actual economic activity, like transaction fees or other platform income, resulting in more stable returns.

Yield opportunities in DeFi are projected to evolve in 2025 as new innovations and platforms emerge, providing investors with multiple options to earn returns based on their risk tolerance and investing preferences.

The Evolving DeFi Landscape in 2025

Current Market Trends

As DeFi matures, numerous major trends shape the ecosystem and provide new prospects for yield growth. Among these is the shift to real-yield protocols, which prioritize long-term revenue streams supported by fees and other real-world value over token inflation.

This model appeals to investors looking for more secure and predictable returns. Furthermore, multi-chain platforms are gaining popularity, allowing assets and yield techniques to move smoothly between chains such as Ethereum, BNB Chain, and Solana, increasing yield farming opportunities.

To improve security, DeFi protocols prioritize comprehensive audits and integrate insurance solutions, lowering risk and increasing investor confidence. This shift is intended to overcome historical vulnerabilities and make DeFi a more stable and dependable investment space by 2025.

Investor Interest and Growth Projections

Investor interest in DeFi is growing, with projections estimating that the market might exceed past records by billions of dollars as more institutional investors look into decentralized alternatives.

Yield farming remains one of the most profitable aspects of DeFi, with returns that frequently outperform traditional financial products.

According to 2023 research, DeFi assets under management (AUM) are already increasing, and this trend is likely to accelerate as more capital flows into high-yield protocols and new DeFi products.

In the fast-evolving DeFi market, these trends are boosting yield potential, establishing 2025 as a promising year for investors seeking to maximize returns in decentralized finance.

Top 5 Yield Opportunities in DeFi for 2025

Here are the top 5 yield opportunities in DeFi for 2025:

- Yield Opportunity: Real-Yield Protocols

- Cross-Chain Yield Opportunity

- Liquid Staking for Major Cryptocurrencies

- Stablecoin Yield Farms

- Automated Market Maker (AMM) Liquidity Pools

Yield Opportunity: Real-Yield Protocols

Real-yield protocols are a game-changer in DeFi, generating income through economic activities like transaction fees, lending, and liquidity provisioning rather than just token inflation.

Unlike traditional yield farming, which greatly subsidizes returns with native token rewards, real-yield protocols aim to provide more sustainable and predictable revenue streams.

This is accomplished by extracting value directly from the protocol’s basic processes, which is subsequently distributed to participants, resulting in a more stable and resilient ecosystem.

Examples

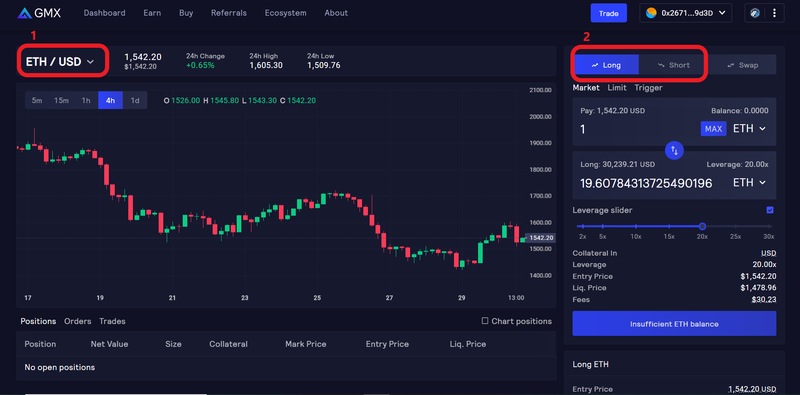

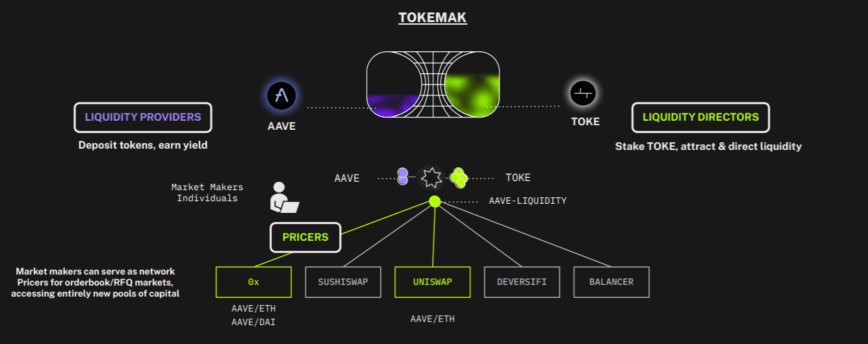

GMX and Tokemak are two of the most widely used real-yield protocols. GMX, a decentralized exchange, distributes transaction fees among token holders and liquidity providers, making it an appealing option for investors seeking stable profits.

Tokemak, known for its unique liquidity-directing strategy, creates income by allowing token holders to direct liquidity to various projects while collecting fees and rewards. Both platforms demonstrate how real-yield protocols are turning DeFi’s focus towards more sustainable and long-term value generation.

Yield Potential

In 2025, real-yield protocols are predicted to provide enticing yield opportunities, with possible yields ranging from 10% to 25%, depending on the platform and strategy adopted.

Their revenue-focused model not only broadens their appeal but also adds a layer of security, which is especially appealing to investors skeptical of high-risk, speculative yield farming.

As DeFi investors seek solutions that align with risk tolerance, real-yield protocols will likely become one of the most appealing yield prospects in DeFi.

Real-yield protocols present some of the most attractive yield chances in DeFi by focusing on realistic revenue streams, allowing investors to participate in long-term earnings that correspond to real economic value.

Cross-Chain Yield Opportunity:

Cross-chain yield platforms allow investors to access yield farming opportunities across many blockchain networks rather than being limited to a single chain.

Cross-chain platforms enable users to optimize their portfolios by facilitating interoperability between chains like Cosmos and Polkadot, spreading assets and rewards across various ecosystems.

This flexibility is crucial because it allows investors to capitalize on the highest yield opportunities available, independent of blockchain.

Benefits and Examples:

Cross-chain platforms offer several advantages, including enhanced asset flexibility, investors can swiftly move assets between chains to reap high-yield opportunities, and lower transaction fees, which are obtained by picking the best routes across platforms.

Cosmos and Polkadot are the leading candidates in this space, with Cosmos’ IBC protocol and Polkadot’s parachain architecture improving compatibility. Leading cross-chain yield platforms, such as Osmosis on Cosmos and Acala on Polkadot, offer streamlined access to cross-chain assets, allowing investors to maximize profits.

Yield Potential

Yields on cross-chain platforms vary by chain, platform, and asset type, with popular assets typically yielding 8% to 20%. With cross-chain infrastructure constantly improving, yield potential is likely to rise as more protocols use multi-chain connectivity.

This strategy to produce opportunities in DeFi reduces risk while maximizing rewards across ecosystems.

The rise of cross-chain platforms provides some of the most diverse yield potential in DeFi, allowing investors to farm returns across several chains and expand their portfolios more efficiently.

Liquid Staking for Major Cryptocurrencies

Liquid staking allows crypto holders to earn incentives for staking without affecting asset liquidity. Typically, when users stake assets like as Ethereum (ETH), Solana (SOL), or Polkadot (DOT), their tokens are locked for a fixed period.

However, liquid staking provides investors with a staked token (such as stETH on Ethereum) that symbolizes their original stake and can be utilized in other DeFi protocols.

This structure lets stakers earn staking rewards while also using their assets for yield farming or lending, which increases their yield prospects in DeFi.

Examples:

Lido and Rocket Pool are major players in liquid staking. Lido enables Ethereum holders to earn staking incentives while still making their holdings available for DeFi activities.

Rocket Pool offers decentralized Ethereum staking with comparable benefits and is particularly popular among those seeking decentralized staking options without relying on a single platform.

Yield Potential

In 2025, liquid staking on large assets is predicted to generate returns ranging from 4% to 10%, with extra earnings possibilities when staked assets are leveraged in other DeFi applications.

Liquid staking is thus a dual-yield strategy, making it an appealing yield potential in DeFi for investors seeking flexible but profitable options.

Liquid staking provides enticing yield options in DeFi, allowing investors to earn rewards without locking up their assets while maximizing return potential by 2025.

Stablecoin Yield Farms

Stablecoin yield farming appeals to risk-averse investors since it provides steady profits while minimizing exposure to crypto price volatility.

Stablecoins such as USDC, USDT, and DAI are tied to fiat currencies, reducing the risk of significant price volatility and allowing investors to focus entirely on yields.

Stablecoin farms provide a safe and profitable way to capitalize on yield opportunities in DeFi without taking on major market risk.

Leading Platforms & APY

Top DeFi platforms, such as Aave and Compound, consistently provide competitive annual percentage yields (APYs) for stablecoins. Aave offers opportunities to earn yields from stablecoin lending pools, which typically have APYs between 2% and 8%.

The compound provides stablecoin yield chances and has established a reputation for security and quick interest distribution, making it a popular choice among stablecoin farmers.

Yield Potential

The APYs on stablecoin yield farms may appear low, ranging from 2% to 10%, but the consistency they offer makes them extremely appealing. In a volatile market, stablecoin yields remain a safe haven, establishing them as dependable yield opportunities in DeFi by 2025.

For conservative investors, stablecoin yield farming is one of the most secure yield opportunities in DeFi, as it provides consistent profits without exposure to price volatility.

Automated Market Maker (AMM) Liquidity Pools

Automated Market Makers (AMMs) transformed DeFi by allowing for decentralized trading without reliance on traditional order books. Instead, AMMs enable users to offer liquidity to pools, so facilitating trading via smart contracts.

In exchange, liquidity providers receive a portion of trading fees, creating lucrative opportunities in DeFi. By putting assets into AMM pools, investors get passive income based on the pool’s trading activity.

Best Pools to Watch in 2025

Leading AMM liquidity pools like Uniswap, SushiSwap, and Curve are expected to maintain high yields in 2025, particularly for high trading volume pairs. Uniswap is popular for its liquidity pools, particularly in Ethereum-based tokens, with APYs ranging from 5% to 20%.

SushiSwap offers multi-chain alternatives and incentivized pools, whereas Curve focuses on stablecoin pools that deliver consistent rewards without substantial price volatility. These platforms are likely to provide strong yield opportunities in DeFi as more users engage in decentralized trading.

Yield Potential

Depending on the pool and token pairs, AMM liquidity pools can generate annual yields ranging from 5% to 50%, with additional incentives during high-volume periods. Liquidity providers should consider token pairs and potential short-term losses, as asset price movements and trade volume influence returns.

For those seeking passive income, AMM liquidity pools offer attractive yield opportunities in DeFi, allowing investors to profit from trading activity in a decentralized ecosystem.

When exploring yield opportunities in decentralized finance (DeFi), it’s crucial to understand the associated risks and considerations to make informed investment decisions.

Risks and Considerations in Yield Opportunity

Here are some of the key risks and points to consider:

Market Volatility:

Risk: Crypto assets are very volatile, and price fluctuations can significantly affect yield returns. For example, if you stake a token and its value drops, your yield could be drastically reduced.

Consideration: Investors should carefully assess the volatility of assets utilized in yield farming and consider diversifying among stable assets to reduce these fluctuations.

Smart Contract Vulnerabilities:

Risk: DeFi platforms rely on self-executing blockchain smart contracts, posing risks. If a contract contains bugs or weaknesses, malicious actors can exploit them, causing huge losses.

Consideration: Consider using platforms that have undergone rigorous third-party audits, as well as smart contract insurance on some DeFi protocols, to increase security.

Liquidity Risks and Impermanent Loss:

Risk: Providing liquidity in pools can expose investors to impermanent loss, which occurs when assets in a pool lose value owing to price swings. Furthermore, withdrawing assets from a pool with insufficient liquidity can result in lower earnings.

Consideration: Investors should comprehend the concept of impermanent loss and consider aligning assets with similar price movements or using stablecoins that are less volatile.

Platform Reliability and Reputation Risk:

Risk: While newer DeFi platforms may provide a high yield to entice investors, they may not be as reliable or secure as established platforms. In the worst-case scenario, developers may carry out a “rug pull,” withdrawing funds and abandoning the project.

Consideration: Consider researching the platform’s history, community input, audits, and the team’s transparency. Established platforms are more trustworthy, even if they provide lower yields.

Regulatory and Compliance Risks:

Risk: DeFi operates in a gray area, and governments are increasingly regulating these platforms. Regulatory changes could have an influence on particular protocols or result in asset freezes, reducing investor yields.

Consideration: Stay updated on regulatory developments, particularly in regions where you operate, as these changes might affect the functionality and availability of DeFi services.

Transaction Fees and Network Congestion

Risk: High transaction fees, particularly on networks like Ethereum, can lead to reduced profits or even losses. During periods of high demand, network congestion may cause transactions to be delayed, perhaps resulting in missed opportunities.

Consideration: Consider using less congested or alternative blockchains (e.g., Solana, Polygon) or optimizing transaction time when network activity is low.

Scams and “Rug Pulls”

Risk: Some DeFi initiatives are scams, where creators raise funds from investors only to abandon the project, leaving investors with worthless tokens.

Consideration: Avoid projects that appear too good to be true, validate platform credentials, and prioritize platforms with established reputations or transparent development teams.

Conclusion

As DeFi expands, so do the opportunities for yield farming and staking. However, it is critical to stay informed about the risks, which range from market volatility and short-term loss to platform security.

By carefully choosing reliable platforms and adjusting to evolving trends, investors can maximize yield prospects in DeFi in 2025.

Explore the evolving space to uncover the potential of decentralized finance and remain ahead of the game as new yield opportunities emerge.