The Bitwise 10 Crypto Index Fund has been put on the SEC’s list by NYSE Arca

The goal is to turn the $1.3 billion trust into a controlled ETP.

A group of 10 cryptocurrencies is held in an exchange-traded product (ETP) handled by Bitwise Asset Management. NYSE Arca has asked the US Securities and Exchange Commission (SEC) to list this ETP.

There was news from Bitwise on November 15 that NYSE Arca had filed a 19b-4 form to offer the Bitwise 10 Crypto Index Fund (BITW) as an ETP. Bitcoin, Ether, Solana, XRP, Cardano, Avalanche, Bitcoin Cash Chainlink, Uniswap, and Polkadot are some of the top cryptocurrencies the fund has invested in.

As of October 31, 2024, 75.1% of the fund’s assets are Bitcoin, 16.5% are Ether, 4.3% are Solana, and 1.6% are XRP. None of the other assets comprise more than 1% of the fund’s interests.

The “most efficient” way for ETPs to offer crypto exposure

Hunter Horsley, CEO of Bitwise, said in the announcement that the company thinks ETPs are the “most efficient, convenient, and useful venues for providing crypto exposure.” He said the business is determined to turn the fund into an ETP.

The business said that ETPs have benefits like legal protections and better efficiency for shareholders. The company that makes the ETF said that an ETP would always be able to take orders and redemptions.

Bitwise said that this sets up a way for arbitrage to work, which lets the fund trade on the secondary market, where its value is more closely tied to its net asset value (NAV).

Bitwise is taking more steps to turn its $1.3 billion trust into an ETP structure with this report.

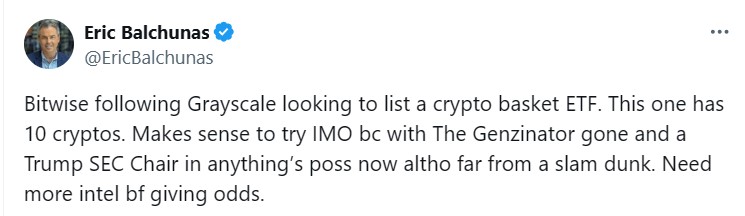

An analyst at Bloomberg called the move “sense” because “anything” would be possible if Donald Trump was chosen chair of the SEC. Even so, Balchunas said it’s not even close to a “slam dunk” and that the space needs more information.

Also, NYSE Arca wants to add the Grayscale crypto index ETF to its list.

This comes after NYSE Arca filed to list a Grayscale fund that holds a group of spot cryptocurrencies. No changes were made to the original sentence, as it was written on October 29. The fund holds crypto indexes like BTC, ETH, SOL, XRP, and AVAX.