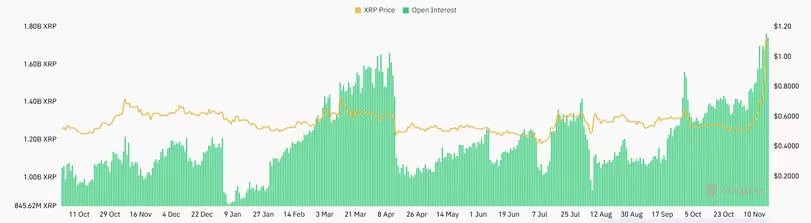

A rise in both open interest and prices generally suggests new capital is flowing into the market, signaling a bullish trend in XRP-tracked futures.

With open interest soaring to all-time highs on Saturday and prices rising more than 20% in a single day, regulatory clarity and impending technical changes are driving growth in XRP-tracked futures.

With more than 2 billion tokens (worth around $2 billion at present prices) in futures positions betting on additional market volatility, XRP and open interest denominated in US dollars are at record highs as of Sunday.

With 51% of bets against future price increases, the long/short data indicates a modest tilt toward shorts among traders.

(The bias reveals how astute traders are positioning over a relatively short period, like 24 hours, even though the ratio should theoretically always stay 50:50 because there is always a short trade for every long trade.)

The entire amount of outstanding derivative contracts that have not been paid for an asset is known as open interest or OI.

When both OI and prices rise, it usually means that fresh capital is joining the market, which is a sign of a bullish trend.

However, the rebound may be fueled by short covering rather than fresh purchasing if the price increases but the OI declines, which could indicate a worse trend.

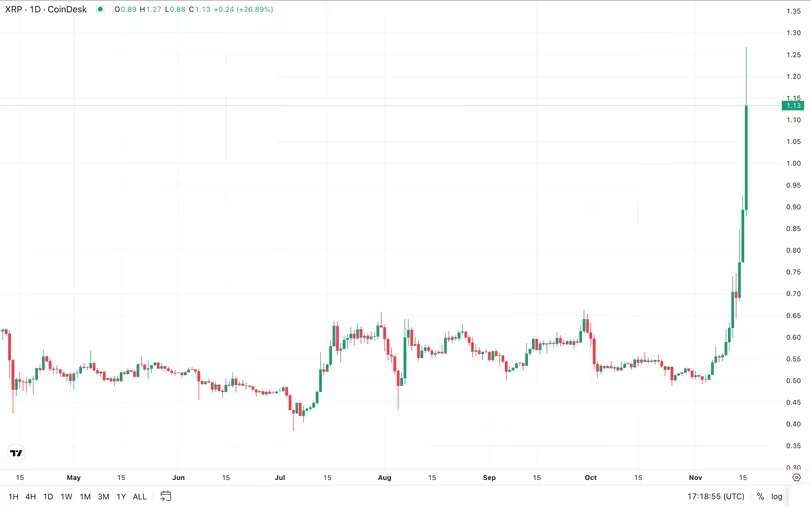

The price of XRP surged past $1.20 on Saturday morning in the United States, bringing weekly gains to over 87% and setting a three-year high for the coin.

As 18 U.S. states launched a lawsuit against the SEC and its commissioners, including chairman Gary Gensler, alleging unconstitutional intrusion into the cryptocurrency business, gains in XRP began late Thursday.

Traders’ speculative optimism is that a Trump administration that is friendly to cryptocurrency could help tokens associated with U.S.-based businesses like Uniswap (UNI) and Ripple Labs (related to XRP), as the companies are more focused on increasing value for token holders now that regulatory obstacles seem to have been removed.

Furthermore, the impending RLUSD stablecoin from Ripple Labs, a business directly associated with XRP’s issuance, is a significant fundamental development that could enhance future gains in XRP.

As previously reported, Ripple intends to incorporate RLUSD into its cross-border payments product, offering liquidity, enabling quicker and less expensive transactions, and possibly combining with different Decentralized Finance (DeFi) protocols across many blockchains.

Over the last day, XRP has outperformed a flat bitcoin (BTC) and a 2.7% increase in the larger cryptocurrency market as measured by the liquid CoinDesk 20 index (CD20).