On January 19, 2025, FDIC Chairman Martin Gruenberg will retire as Operation Choke Point 2.0, and workplace misconduct is currently causing legal issues.

In a high-profile House Financial Services Committee hearing, Martin Gruenberg, the Federal Deposit Insurance Corporation (FDIC) Chairman, is scrutinized. The market participants have cited his controversial role in “Operation Choke Point 2.0,” prompting lawmakers to demand his urgent removal. Under his leadership, the allegations of regulatory overreach and a toxic workplace environment were particularly noteworthy, as they raised concerns regarding the integrity of the FDIC.

Martin Gruenberg, the mastermind of Operation Choke Point 2.0, is currently under fire

Today’s House hearing, entitled “Oversight of Prudential Regulators,” has prompted discourse in the financial markets. The hearing is predicated on the demand that FDIC Chairman Martin J. Gruenberg be immediately removed from his position. The hearing witnesses include Federal Reserve Vice Chairman Michael Barr, FDIC Chairman Martin Gruenberg, National Credit Union Administration Chair Todd Harper, and Michael Hsu.

At the same time, Congressman Tom Emmer accused Gruenberg of directing Operation Choke Point 2.0, a policy that allegedly weaponizes federal banking regulators against law-abiding Americans. According to Emmer, Gruenberg failed to protect FDIC employees from a hazardous work environment, in addition to misusing his authority.

In addition, Custodia Bank CEO Caitlin Long reiterated these sentiments, accusing Gruenberg of employing federal regulators to target individuals and institutions unjustly. She emphasized Gruenberg’s involvement in the collapse of Signature Bank, describing it as one of numerous egregious actions during his tenure.

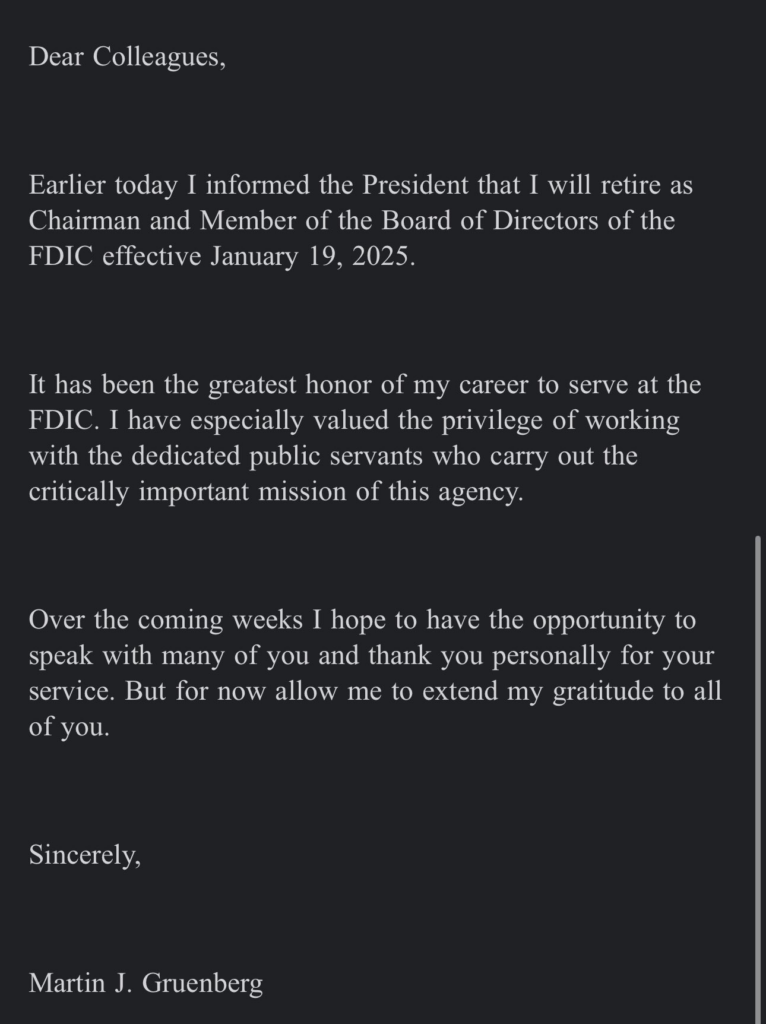

An internal correspondence was discovered, which disclosed Gruenberg’s intention to resign before Donald Trump’s presidency, further arousing the controversy. Critics contend that this action indicates a recurring pattern of evading accountability.

Investors are maintaining a vigilant vigil following the disclosure of the Coinbase CLO

The FDIC Chairman’s removal is being called for shortly after Coinbase CLO Paul Grewal disclosed a substantial court order that required the FDIC to disclose documents associated with Operation Choke Point 2.0. These “pause letters,” disclosed through a Freedom of Information Act (FOIA) request, indicate that federal regulators pressured banks to terminate their relationships with specific businesses.

In the interim, there has been a significant increase in the number of demands for Gruenberg’s removal, as industry leaders have accused him of abusing his regulatory authority. According to his critics, his actions unjustly targeted businesses without due process and undermined trust in the financial system. Additionally, the market anticipates regulators will adopt a dovish posture toward the financial markets and establish clear regulations.

Gruenberg’s supporters emphasize that his policies were intended to safeguard consumers and preserve market stability. Nevertheless, his leadership has been intensely scrutinized due to the accumulating evidence of regulatory overreach and accusations of fostering a toxic work culture.

In the interim, legislators and industry stakeholders anticipate responses regarding Gruenberg’s involvement in these controversial policies as the hearing progresses. Furthermore, it has also prompted speculation that he will be removed from his position before his intended resignation period in January 2025.