The UK FCA plans to introduce comprehensive crypto regulations by 2026, responding to rising UK crypto ownership and the need for oversight.

The growth of UK crypto ownership among other investors has drawn more regulatory attention from the nation’s leading financial authority.

In the UK, more than 12% of individuals already own cryptocurrencies, with an average value of up to 1,842 British pounds ($2,318), the Financial Conduct Authority (FCA) announced on Nov. 26.

Compared to June 2023, when only 10% of UK citizens owned digital assets, the 12% is a substantial gain, according to a prior FCA poll.

George McDonaugh, co-managing director and co-founder of KR1, claims that the rising number of cryptocurrency holders demonstrates an “extremely strong” market for cryptocurrency.

According to George McDonaugh, co-managing director and co-founder of KR1, the rising number of UK crypto ownership indicates a “very strong” appetite for cryptocurrencies.

It’s time for UK regulators to catch up, McDonaugh added.

“It also shows that digital assets are now mainstream because people are seeing crypto as part of a broader investment portfolio, including for the long term,” he said.

If nothing else, this study demonstrates that cryptocurrency is already highly well-liked by UK consumers; policymakers and regulators need to catch up.

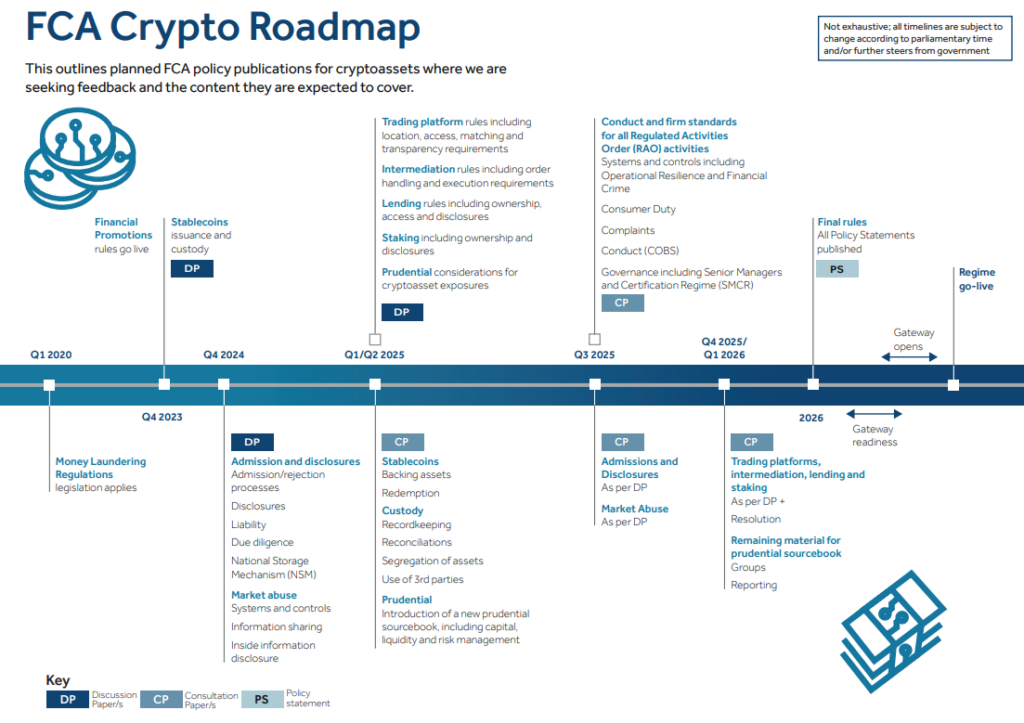

The FCA, the UK’s top financial regulator, released a regulatory roadmap aiming to establish comprehensive cryptocurrency regulations by 2026 in response to the increasing interest from investors.

FCA Crypto Plan Until 2026- Current Knowledge

According to McDonaugh, the government has an opportunity to obtain a worldwide edge in Web3 innovation because the planned legal framework coincides with a pivotal moment for cryptocurrencies.

He stated:

“It’s important that the UK government outlines its regulatory framework for the crypto industry so digital asset businesses can help the country’s economy grow, boost skills and create jobs.“

The plan suggests several consultations to improve the efficiency and transparency of the regulatory process.

In the fourth quarter of 2024, the first discussion and consultation documents about stablecoin issuance and custody are scheduled to be released.

Additional consultation papers on trading platforms and decentralized finance (DeFi) operations, including lending and staking, will be released in the upcoming year.

In 2026, when the new system is expected to fully take effect, the financial authority intends to publish the final set of regulations.

The FCA’s director of payments and digital assets, Matthew Long, stressed that the findings of the study underscore the necessity of unambiguous regulation.

“Our goal is to create an industry that values innovation and is supported by consumer trust and market integrity,” he stated.

The Markets in Crypto-Assets Regulation (MiCA), the first comprehensive regulatory framework in the world, is expected to be fully implemented in the European Union by the end of 2024, sparking increased interest in cryptocurrency regulation.

Ezra Reguerra provided further reporting.