A new Donald Trump administration may create a more favorable crypto environment, but Firdosh Sheikh, co-founder of DRIFE, doubts any U.S. policy shift will substantially impact the UAE’s momentum.

Firdosh contends that the Middle East, and the UAE in particular, has established a strong foundation that is not entirely reliant on geopolitical developments in other regions.

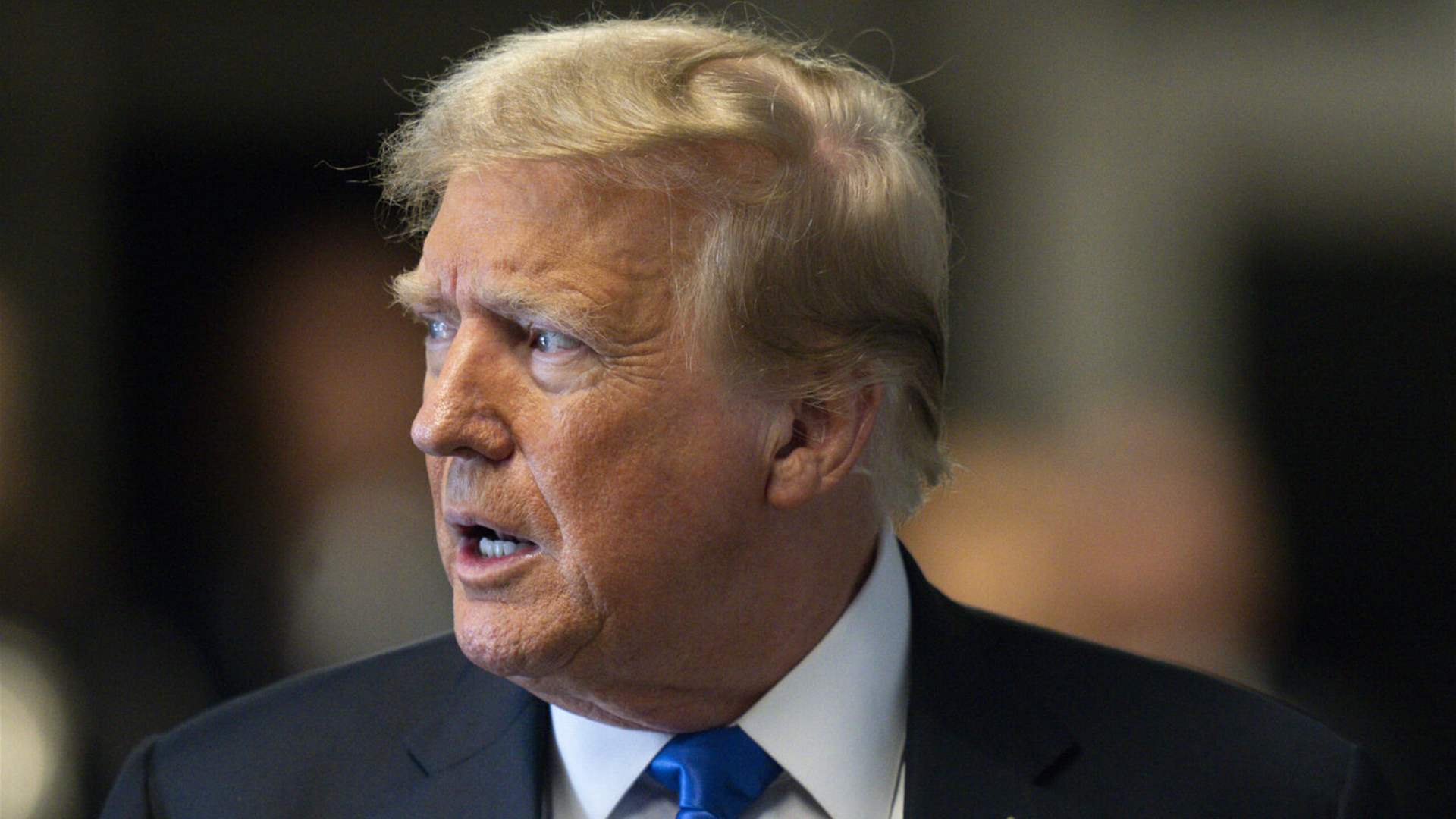

DRIFE’s Co-Founder Reaction to Trump’s Crypto Policy

Firdosh stated to Bitcoin.com News that the region’s competitive advantages are impervious to political disruptions due to its emphasis on supporting entrepreneurs through initiatives such as visas for tech talent and startup founders. The implementation of progressive frameworks has also facilitated the legal operation of startups in environments that are conducive to innovation.

A blockchain-based ride-hailing platform, DRIFE, was cited by Firdosh as an example. The regulators were receptive to the company’s engagement, as they were cognizant of the technology. Additionally, she asserted that regulators were attracted to the vehicle hailing platform’s compatibility with the UAE’s overarching objectives of fostering a more equitable and inclusive economy, which ultimately permitted DRIFE to operate in the region.

Firdosh’s comments are made in the context of apprehensions that Trump’s return, in conjunction with his pro-crypto cabinet, could potentially cause problems for the UAE and other nations that have reaped the benefits of the Biden administration’s perceived anti-crypto stance. Recent surveys and reports have demonstrated that the UAE, Hong Kong, and Singapore are perceived as regions that provide a haven for entrepreneurs and developers who are dissatisfied with U.S. policies.

For example, Singapore was the top-ranked country in a Henley & Partners study on the most advantageous investment migration programs for digital asset investors, with Hong Kong and the UAE following in that order. The United States was placed fourth. Certain observers are of the opinion that a Trump administration has the potential to propel the United States to the forefront.

Firdosh, on the other hand, refutes the notion that the UAE’s status as a prominent crypto center is exclusively attributable to its pro-crypto policies. Instead, she credits the region’s success to its status as a center for venture capital and private equity that concentrates on emerging markets, which draws startups in search of funding. Firdosh added:

Even if the U.S. becomes more crypto-friendly under Trump, the unique benefits offered by the UAE—including its strategic location, global connectivity, and investor-friendly environment—will continue to make it a top choice for entrepreneurs in the blockchain and Web3 sectors. The UAE is not just a fallback option; it’s a proactive choice for those looking to build and scale sustainable businesses in a rapidly evolving global market.

The DRIFE co-founder further stated that the region should leverage its position by promoting cross-border crypto and blockchain initiatives and nurturing regional collaborations, rather than viewing the U.S. President-elect’s return as a cause for concern.

Firdosh advised entrepreneurs seeking to establish and expand a successful venture in the Middle East to establish relationships within the ecosystem and capitalize on government-sponsored initiatives.

She also advised them to focus on creating solutions that correlate with the region’s forward-thinking approach to technology and innovation.