Ripple’s legal chief Stuart Alderoty claims U.S. regulators are targeting crypto through a coordinated effort, likening it to the 2012 “Operation Chokepoint” aimed at restricting certain industries’ banking access.

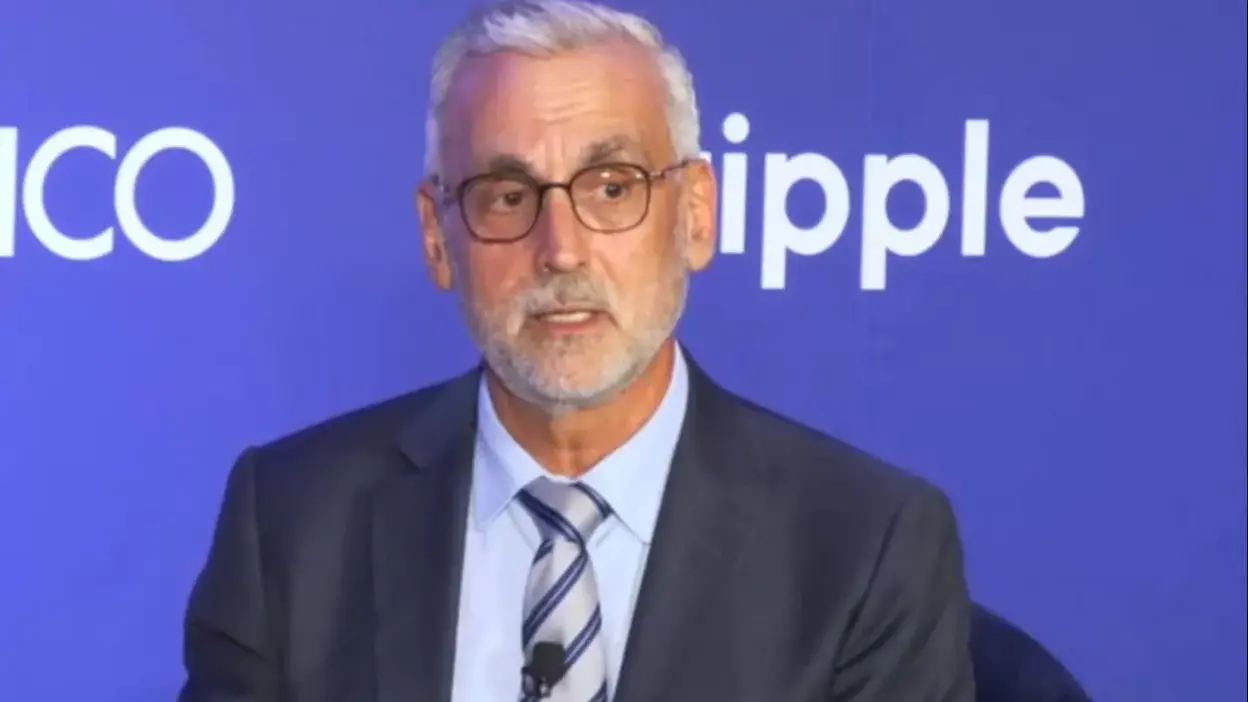

Stuart Alderoty, Ripple’s chief legal officer, has emphasized what he perceives as a deliberate attempt by U.S. regulators to suppress the cryptocurrency industry.

The crypto industry has encountered substantial obstacles in recent years as a result of what is commonly referred to as “Operation Chokepoint 2.0,” a coordinated initiative by U.S. regulators to restrict banking services for crypto-related businesses.

Ripple’s Legal Chief Opinion on Operation Chokepoint 2.0

On Saturday, Alderoty shared his perspective on Operation Chokepoint 2.0 on the social media platform X. He referenced a 2012 initiative in which agencies such as the Federal Deposit Insurance Corporation (FDIC), Federal Reserve, and Office of the Comptroller of the Currency (OCC) reportedly pressured banks to halt services to specific industries, including gun retailers and payday lenders.

Alderoty contended that cryptography has now become the principal focus of comparable strategies, as he stated:

In 2012, regulators (FDIC, OCC, Fed) weaponized banks against disfavored industries (gun stores, payday lenders, etc.) under the original ‘Operation Chokepoint.’ Fast forward to 2021: crypto is the new target.

Alderoty emphasized the significant events of the January 2021 rescission of the Fair Access to Banking Rule, which was implemented by the Biden administration with the objective of guaranteeing equal financial access.

In November of that year, the OCC implemented Interpretive Letter 1179, which required banks to obtain pre-approval before engaging in cryptocurrency activities.

The FDIC adopted its own directives in April 2022, following suit. The Federal Reserve, FDIC, and OCC issued warnings regarding “crypto risks” in January 2023, and additional advisories were issued in February.

These notices asserted that banks were not explicitly prohibited from servicing crypto clients; however, Alderoty perceived a more profound intention.

Previously, the Ripple legal director held the position of General Counsel at HSBC North America Holdings and CIT Group. Stressing his expertise as a bank general counsel, Alderoty emphasized.

Previously, the Ripple legal director held the position of General Counsel at HSBC North America Holdings and CIT Group. Stressing his expertise as a bank general counsel, Alderoty emphasized:Previously, the Ripple legal director held the position of General Counsel at HSBC North America Holdings and CIT Group. Stressing his expertise as a bank general counsel, Alderoty emphasized:

These warnings include the boilerplate: ‘Banks are not discouraged from serving crypto customers.’ As a former bank GC, I can decode that: ‘Don’t even think about it.’”

He argued that the language in question is a covert deterrent that is intended to discourage financial institutions from establishing relationships with crypto businesses.

Ripple’s CLO characterized these developments as part of a more extensive effort to marginalize the cryptocurrency industry under the pretense of regulatory caution.

Industry leaders, such as Marc Andreessen, co-founder of Andreessen Horowitz, have reported that over 30 tech and crypto founders have been “debanked” in the past four years, resulting in some of them leaving the country or transitioning to other industries.

On X Saturday, Tyler Winklevoss, the co-founder of Gemini, disclosed that “Operation Chokepoint 2.0 is a coordinated conspiracy by government officials to persecute their political opponents by debanking them.” This is an ongoing federal offense that warrants prosecution.