According to MARA Holdings, the US government should be more aggressive in securing positions in Bitcoin and Bitcoin mining.

According to a filing with the US Securities and Exchange Commission, cryptocurrency miner Marathon Digital has spent over $600 million on Bitcoin purchases in the past two months.

MARA Holdings stated in a filing dated December 2 that it paid $96,250 for 6,484 Bitcoin BTC between October 1 and November 30. At an average of $95,352 per bitcoin, $618.3 million in cash was used to buy the coins.

Furthermore, MARA Holdings said it plans to conduct a private offering of convertible senior notes due in 2031 for $700 million. The money raised will be used to buy more Bitcoin and back convertible notes, which are due in 2026.

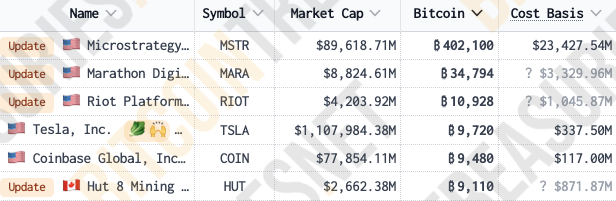

By market capitalization, MARA Holdings continues to be the most prominent cryptocurrency mining firm that is publicly listed. MARA Holdings is the second-largest corporate Bitcoin holder after MicroStrategy, according to the BitcoinTreasuries website.

MARA Holdings calls on the US government to expedite the acquisition of Bitcoin.

MARA Holdings called for the US to increase its efforts to acquire stakes in Bitcoin and mining on November 26. The business asserted that the nation’s economic and security interests must be protected immediately.

“Having significant gold reserves is still a matter of national security even though the dollar is no longer directly backed by gold,” MARA stated. The company also noted that these reserves give the US the flexibility to conduct business if other countries lose faith in the currency.

Although US President-elect Donald Trump made a public pledge to include Bitcoin in the US government’s Treasury reserve, other doubters, such as Mike Novogratz, CEO of Galaxy Digital, stated that there was a “low probability” that Trump would create a Bitcoin strategic reserve while in office.

In May, MARA Holdings sold 63% of its mined bitcoin.

Earlier this year, MARA sold some Bitcoin while actively promoting its mining and accumulation in the United States.

Previously known as Marathon Digital Holdings, MARA sold 390 Bitcoin, or 63% of the 616 BTC it produced monthly.

Shortly after Bitcoin’s fourth halving event, which effectively decreased the mining block reward from 6.25 BTC to 3.125 BTC in April 2024, the sale occurred.