The reserve requirement of XRP Ledger was reduced from 10 to 1 XRP, enabling users to finance wallets with as little as $2.56.

On December 2, blockchain data indicates that the base reserve requirements of the XRP Ledger have been reduced from 10 XRP ($25.60 at current XRP prices) to a mere 1 XRP ($2.56).

This has the potential to lower a barrier to adoption by enabling new network users to fund their wallets with a smaller quantity of cryptocurrency.

It also enables users to expend a portion of the XRP that they would have otherwise been required to keep in reserve.

Fundamental Reserve Requirements Are Reduced By XRP Ledger

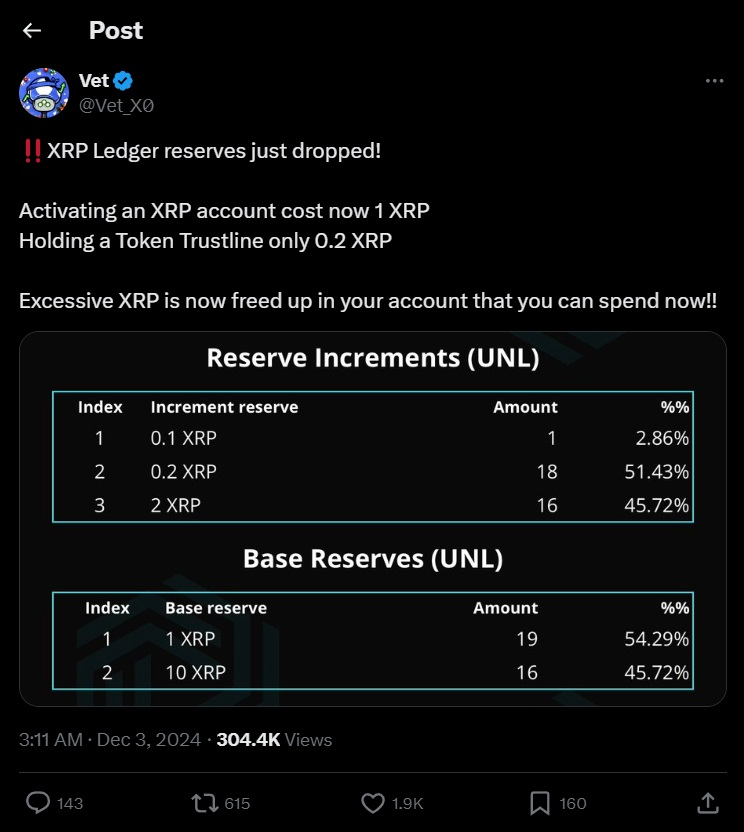

The reserve change took place at 10:45 p.m. UTC. The pseudonymous XRP validator operator Vet announced it on X.

Also, the proprietor reserve has been decreased from 2 XRP ($5.12) to 0.2 XRP ($0.51).

This implies that users are only required to maintain 0.2 XRP per object in their accounts.

According to the XRP Ledger documents, objects may consist of non-fungible tokens (NFTs), trust lines, signer lists, or proprietor directories. Additionally, certain oracles are considered objects and necessitate a proprietor reserve.

The reserve was established to prevent the ledger from expanding beyond the capacity of the nodes to store it.

The developers aimed to prevent the creation of spam accounts that contained minimal to no XRP.

To prevent this from occurring, they established the 10 XRP reserve requirement.

Nevertheless, some developers have criticized the high reserve, claiming that it has impeded the network’s adoption.

Developers Evaluate Advantages, Disadvantages Of Reducing Their Reserves

WietseWind, the developer of the XRP Ledger, announced on Oct. 16 that the XRPL Labs development team’s nodes had been configured to process a reduced reserve requirement, enabling them to vote in favor of the change.

WietsWind acknowledged certain disadvantages of a reduced reserve requirement in the post.

“The primary concern would be the escalation of activity on the ledger to the extent that it poses a challenge to the infrastructure,” he declared.

Nevertheless, he maintained that this was a “beneficial issue” in the sense that it could only happen if there were more consumers and more activity.

Additionally, he asserted that engineers would be able to manage the increased strain on the network and would devise methods to accommodate it.

Even though the change was implemented on XRPL Labs nodes on Oct. 16, the reserve requirement change required a validator reset and a vote from all validators, which was not completed until Dec. 2.

Election Optimism, SEC’s Ongoing Conflict Have Positive Impact On XRP

The XRP Ledger native coin has been experiencing a rapid ascent at the moment of the change.

XRP was valued at less than one cent per coin before Donald Trump was elected the President of the United States.

Nevertheless, it has reached its greatest level since February 2018, which is $2.65, since the election.

Ripple Labs, the development team that founded XRP, has been in a protracted legal dispute with the US Securities and Exchange Commission for several years.

Ripple maintains that XRP is not a security, despite the SEC’s assertion that it is legally a security and should have been registered with the SEC.

Ripple has appealed the $125 million sanction imposed in the lawsuit.