Sky, formerly MakerDAO, faces scrutiny for using an EOA to manage $756M in USDC reserves, sparking security and transparency concerns.

The use of an externally owned account (EOA) to maintain $756 million in USD Coin reserves within its light peg stability module (PSM) has drawn criticism against Sky, formerly known as MakerDAO.

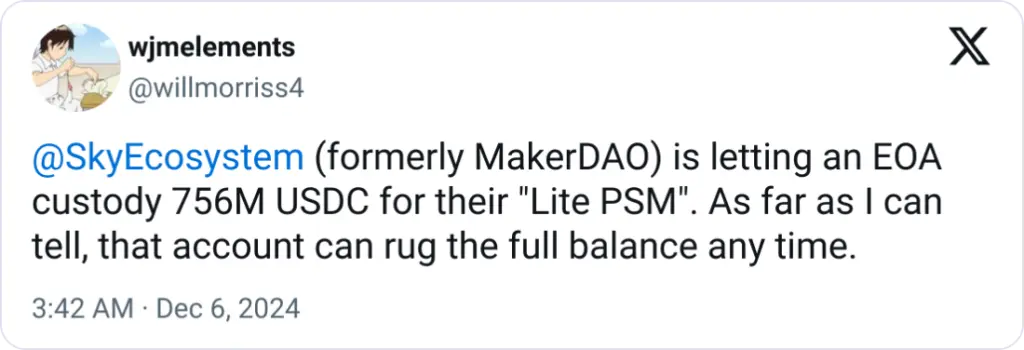

An X user has expressed concerns about the protocol’s reliance on an EOA to oversee a sizeable percentage of its reserves, which total $756 million in USD Coin.

According to critics, this custodianship approach may expose funds to insider misuse or other vulnerabilities.

The possibility of a breach or exploitation of these EOA-managed funds might further harm the protocol’s reputation and user trust, especially in light of its recent rebranding to Sky and worries about its potential implementation of a freeze function.

Lite PSM: What Is It?

By enabling users to exchange the stablecoin for USDC at a predetermined rate, the lite PSM is a mechanism created to help Sky maintain the peg of its stablecoin to the US dollar.

Sky will move $20 million in reserves from the older PSM to the lite PSM in three stages as part of the migration strategy.

However, according to the X user’s social media post and the Sky forum page on the Lite PSM, the funds are reportedly under the control of an EOA, which raises questions about security and accountability.

“The private keys required to reconstitute the MPC [multiparty computation] account were destroyed as part of the setup process with Coinbase Custody,” Sky co-founder Rune Christensen told Cointelegraph.

Criticism Of Custodianship Based On EOA

In contrast to a smart contract, which may follow preprogrammed security requirements without intervention, an EOA is a typical Ethereum wallet that is managed by a private key.

Because EOAs lack characteristics like time-locked transfers and multi-signature authentication, detractors of EOA-based custodianship contend that they are intrinsically less transparent and safe.

Without measures to limit the movement of the assets, this fund management approach would leave the $756 million reserve vulnerable to potential hostile actions or the compromise of private keys.

This worry is allayed by Christensen’s explanation that the private keys required to “reconstitute the MPC account” were destroyed, which removes the possibility of a compromised private key.

Concerns about who ultimately owns the wallet, how transactions are approved, and whether governance decisions may compel fund management actions are not entirely addressed by the Sky co-founder’s insight, though.

Christensen did not respond to Cointelegraph’s questions about these topics by the time of publication.

Sky Advocates For Tokenomics That Are Deflationary

Christensen previously stated that he was working on a plan to reduce the protocol’s overall supply and stop the generation of new tokens.

According to Christensen, the plan would employ a “burn-only” deflationary strategy, gradually reducing the supply of core tokens by a systematic burning mechanism.

At the time, he told Cointelegraph that the protocol would “plug the hole” via token emissions, “just like the original tokenomics always worked,” at the risk of going bankrupt.