Post-Binance listing, the prices of Ethereum-based Across Protocol (ACX) and Solana-based Orca tokens experienced a significant increase.

The world’s largest cryptocurrency exchange, Binance, intends to list the Across Protocol and Orca tokens today. The crypto exchange will incorporate the crypto tokens into the USDT spot trading pairs in response to the demand from the crypto community. After the announcement, ACX and ORCA prices experienced immediate increases of 140% and 95%, respectively.

Binance provides a comprehensive list of trading pairs for Protocol and Orca Spot

On December 6, Binance officially announced that it would list the tokens of the decentralized exchange Orca and the intents-driven interoperability bridge Across Protocol. Nevertheless, the crypto tokens will be listed with a seed tag, indicating that they are expected to be volatile and rife with risks.

These tokens will be available for trading on the exchange at 13:00 UTC on December 6. Users can trade the crypto in the ACX/USDT and ORCA/USDT spot pairs. Additionally, withdrawals will commence at 13:00 UTC on December 7.

Additionally, the tokens will be included in Trading Bots and Spot Copy Trading for the token above within 24 hours of listing on the top crypto exchange. Innovative projects that are widely used by the crypto community are the Ethereum-based Across Protocol and the Solana-based decentralized exchange.

The price of ACX has increased by 140%, while ORCA has experienced a 95% increase

Following the Binance announcement, there has been a significant increase in the value of Across Protocol (ACX) and ORCA. Traders in the spot and derivatives markets have promptly purchased these crypto tokens.

The current price of ACX is $1.41, which has increased by more than 140%. The 24-hour low and high are $0.56 and $1.50, respectively. Additionally, the trading volume has experienced a significant increase of 2268% in the past 24 hours, suggesting a substantial level of interest among traders.

Early investors and whales are selling the Across Protocol token. The whale sold 2.4 million tokens (equivalent to $2.85 million) as the token price surpassed $1, resulting in a $2.56 million profit.

Bybit’s listing of the ACXUSDT perpetual contract, which provides up to 50x leverage, is noteworthy. It is the inaugural listing of an ACX perpetual contract.

In the interim, the price of ORCA has increased by 95% in the past 24 hours, and it is currently trading at $7.13. It achieved a 24-hour high of $7.84, bolstered by a substantial 2021% increase in trading volume.

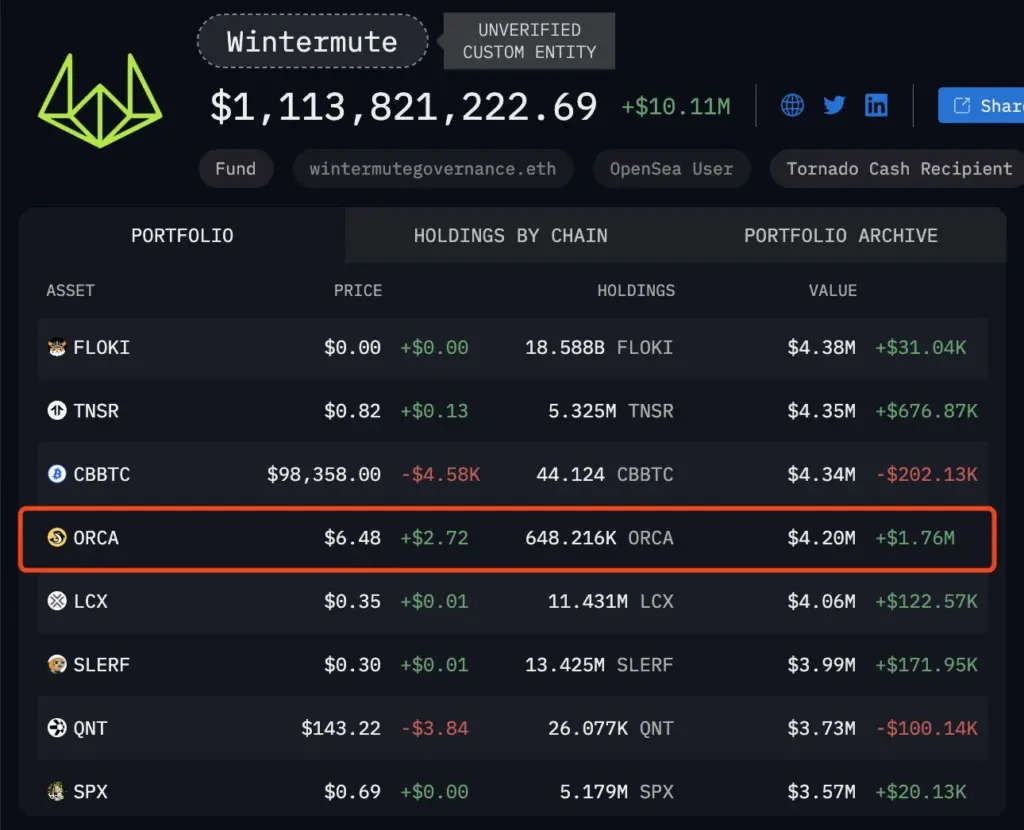

Wintermute, a market maker, currently has ORCA tokens valued at $4.2 million. The market maker withdrew 125,000 tokens from Coinbase just 12 hours before this announcement.

Shortly, Binance will also delist the USD-Margined perpetual contracts of MAVIA, OMG, and BOND, which has sparked concerns about a potential price decline.