Bitcoin price falters as long-term holders increase sell-offs, overshadowing institutional inflows from Bitcoin ETFs and MicroStrategy.

Despite institutional inflows, the price of Bitcoin is encountering strong resistance and is unable to surpass the $100,000 mark.

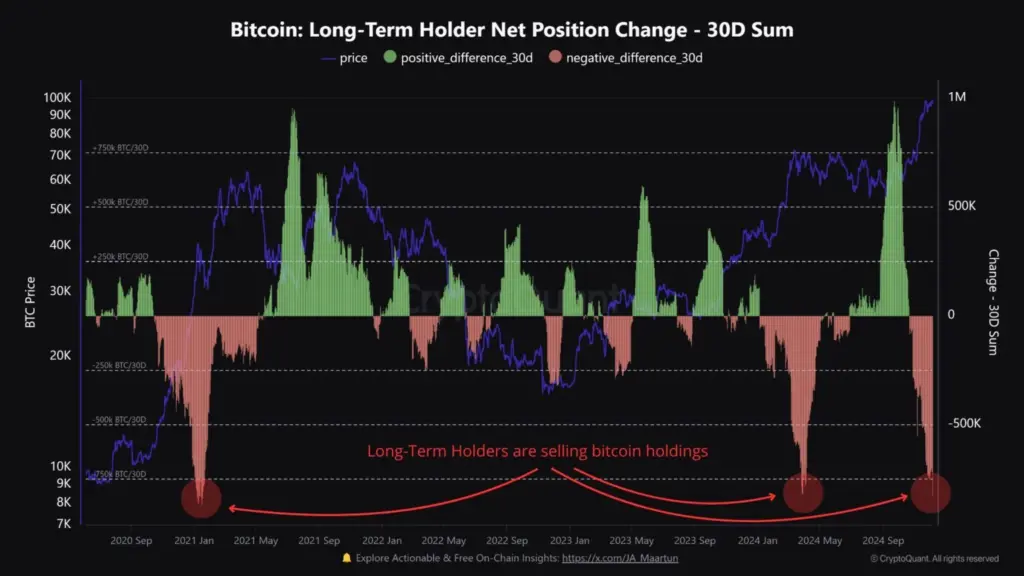

Despite the large purchases from companies like MicroStrategy and Bitcoin ETFs, investors should be aware of the increased selling of BTC by long-term holders.

Why Is $100K Bitcoin Price Rejected?

Long-term holders are selling off a significant portion of their holdings, even after the massive Bitcoin gain that followed Donald Trump’s victory.

This cohort has offloaded 827,783 BTC in the past 30 days, which has left on-chain activity with a strong negative signal.

However, institutional investors have kept up their aggressive buying, flooding into spot Bitcoin ETFs.

According to well-known cryptocurrency analyst Maartunn, MicroStrategy has bought 149,880 BTC over the past 30 days, while spot Bitcoin ETF inflows total 84,193 BTC.

Their combined inflows, nevertheless, have been far less than the long-term holders’ overall sell-off.

With $2.73 billion in inflows last week, spot Bitcoin ETFs saw their largest weekly inflows since launch.

Just the BlackRock Bitcoin ETF IBIT saw inflows of $2.6 billion, surpassing $50 billion in total assets under management.

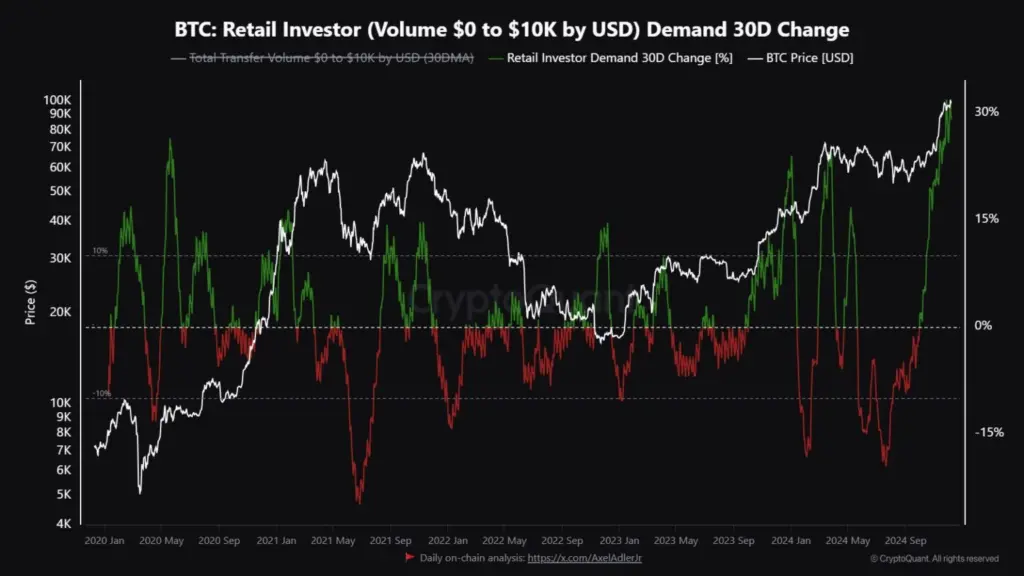

What, then, caused the price of Bitcoin to spike to its highest point ever—$104K? The retail frenzy and short-term holders are taking center stage, just like in prior bull periods.

Retail demand has risen to annual highs over the last 30 days, according to recent data, indicating heightened activity within a robust upward trend.

The majority of the supply is being consumed by short-term holders, who are frequently made up of retail investors.

Additionally, with the open interest in altcoins rising to $53.3 billion and Bitcoin to $30.6 billion, Maartunn pointed out that retail engagement goes beyond spot markets.

According to the analyst, the significant retail presence in both the spot and futures markets highlights a high-stakes “musical chairs” dynamic, although caution should be exercised when market sentiment changes.

Indications Of Severe Fear, Greed

The market is showing “extreme greed,” as shown by the Crypto Fear & Greed Index’s recent spike to 84. This level is frequently linked to increased risk and possible market tops.

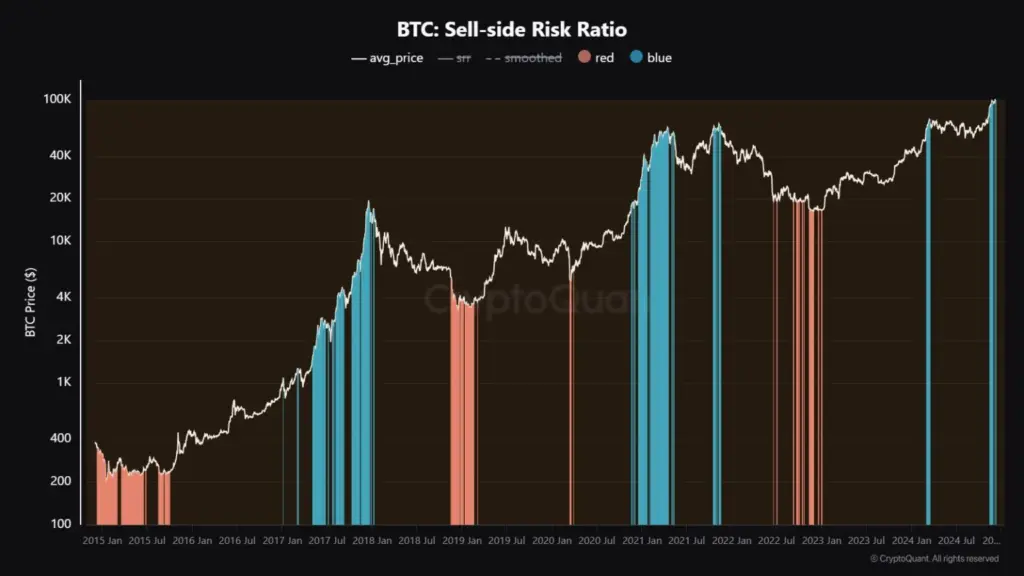

Other indicators, such as the Sell-Side Risk Ratio and Net Taker Volume (ETH), also suggest that a market peak is possible in addition to the Fear & Greed Index.

The bearish on-chain data seen throughout the market swings of the previous week is consistent with these signals.

When the U.S. Consumer Price Index (CPI) inflation data is released, the movement of the price of bitcoin will be influenced by macro factors.

This week will also see the release of the U.S. Producer Price Index (PPI), a crucial inflation indicator that the Fed regularly monitors when deciding whether to lower interest rates.