Bloomberg predicts MicroStrategy’s (MSTR) stock may join the Nasdaq 100 this December, with an announcement expected this week.

According to a post on the X platform by Bloomberg Intelligence analyst Eric Balchunas, MicroStrategy (MSTR) is anticipated to be included in the Nasdaq 100 stock index on Dec. 23. An announcement is expected to be made as soon as this week.

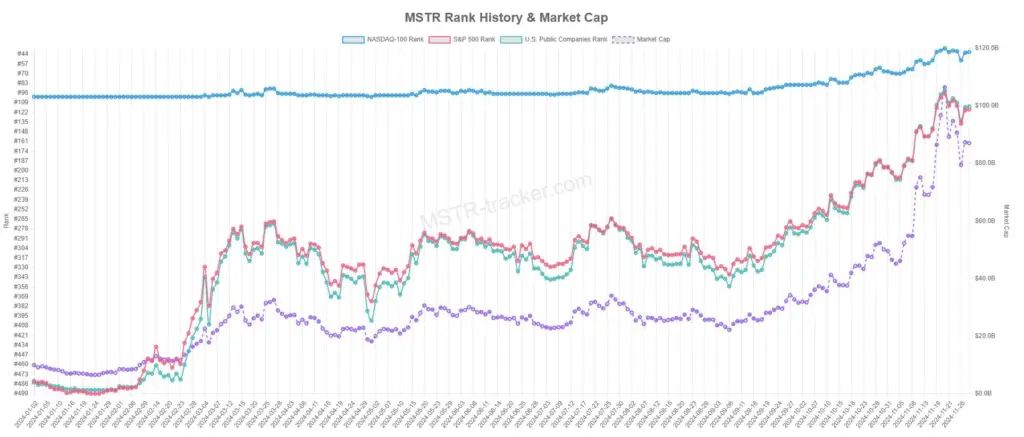

MicroStrategy, a software company that became a de facto Bitcoin hedge fund in 2020, will be ranked by placement among the 100 largest securities by market capitalization on the Nasdaq stock exchange.

It will also expose MSTR to hundreds of billions of dollars in institutional capital transactions tracked by the widely followed index.

“A 0.47% weight (40th largest holding) is probable for MicroStrategy,” Balchunas stated on December 10 that the index is tracked by $550 billion in exchange-traded funds (ETFs).

For example, the Nasdaq 100 will include MSTR in the portfolio of Invesco QQQ Trust (QQQ), an exchange-traded fund (ETF) with approximately $322 billion in assets under management (AUM).

“It is probable that $MSTR will be incorporated into $QQQ on 12/23, with an announcement scheduled for 12/13.” Balchunas stated that Moderna is likely to be terminated (symbolic).

Moderna is a biotechnology company that has developed vaccines that are effective against the COVID-19 virus.

Balchunas also stated that MSTR is likely to become a member of the S&P 500, the most extensively followed stock index in the world, in 2025.

Bitcoin Acquisition Frenzy

MicroStrategy has invested approximately $25 billion in Bitcoin since 2020 as part of a corporate treasury strategy led by co-founder Michael Saylor.

According to data from MSTR Tracker, its acquisition binge has generated over $17 billion in unrealized profits.

The data indicates that MicroStrategy currently possesses nearly 425,000 BTC, which are valued at over $42 billion.

The strategy was successful, as the price of Bitcoin (BTC) consistently increased, surpassing $100,000 per coin in December.

Since 2020, MSTR has gained about 2,500%, outperforming practically every sizeable public company except Nvidia.

The stock now trades at a more than 2x premium to the value of its BTC treasury.

Benchmark Research analyst Mark Palmer says the stock could continue to rise as MicroStrategy doubles down on BTC buying.