Bitcoin price surpassed $100K again after US CPI data, with traders expecting increased volatility ahead of next week’s FOMC meeting.

The Bitcoin price has experienced a significant rebound in the past 24 hours, gaining 3.5% and surpassing $101,000 after a period of consolidation at approximately $96,000.

The bullish sentiment was precipitated by the publication of the US CPI inflation data on Wednesday.

Consequently, market analysts are optimistic about the possibility of a new all-time peak in BTC ahead of the FOMC meeting next week.

Will FOMC Serve As Bullish Catalyst For Bitcoin Price?

The US CPI inflation report released on Wednesday ignited optimism in the global crypto market and the US equity market.

Investors are optimistic about a modest 25 basis points interest rate reduction during the FOMC meeting next week, as the CPI numbers were consistent with expectations.

The prospering U.S. and global economy could be bolstered by a 96-97% likelihood of rate cuts, as estimated by experts.

The Bitcoin price has experienced a rapid increase above $100,000 as a result of the robust correlation between the crypto and equity markets.

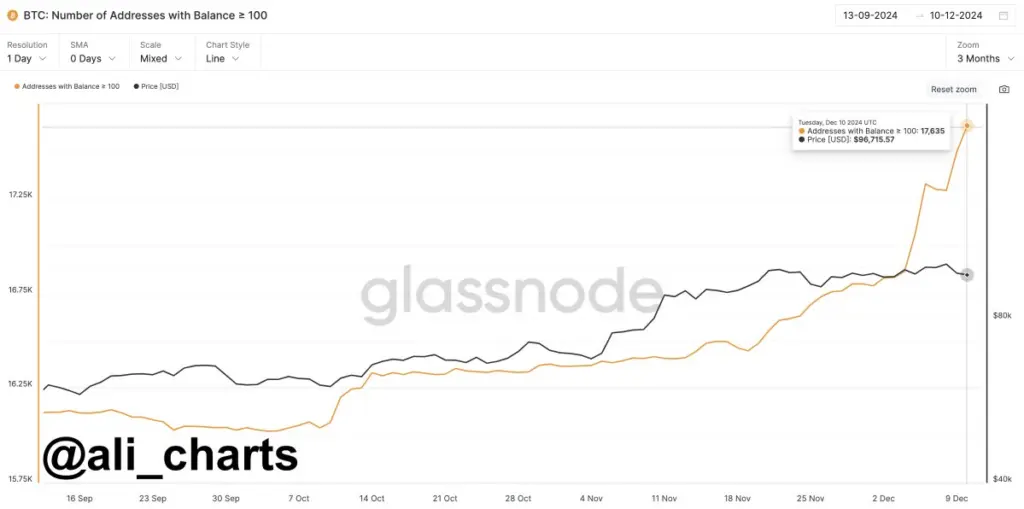

The BTC billionaires have conducted a significant accumulation during the Bitcoin consolidation at approximately $96,000 levels.

As Bitcoin’s price plummeted from $104,000 to $90,000, 342 wallets containing over 100 BTC were established, according to crypto analyst Ali Martinez.

The data indicates that large-scale investors are leveraging the opportunity to accumulate Bitcoin at reduced prices.

Conversely, the velocity of inflows into spot Bitcoin ETFs has remained robust over the past week.

BlackRock Bitcoin ETF (IBIT) has achieved a new milestone by surpassing $35 billion in net inflows since inception, with the US Bitcoin ETFs experiencing net positive inflows for the past nine trading sessions.

Ali Martinez, a crypto analyst, has made a daring prediction regarding Bitcoin, predicting that it may reach $275,000. Martinez’s objective is predicated on the construction of a “cup and handle” pattern.

The analyst cautioned investors against overleveraging and recommended that they “buy the dip.”

What Will Happen To Bitcoin After Recent Breakout?

10x Research reports that the Bitcoin price has exceeded the $94,500 to $98,000 trading range in response to U.S. inflation data that exceeded expectations.

According to analysts, the Bitcoin price frequently experiences a rebound after experiencing a decline in anticipation of inflation reports.

This is because stable data tends to alleviate market concerns regarding inflation increases.

Although Bitcoin’s price may continue to increase through the end of the year, 10x Research anticipates that there will be minimal market volatility as a result of the fact that numerous investors will close their accounts after the FOMC meeting.

Nevertheless, it observes that altcoins are demonstrating a higher degree of relative strength than Bitcoin.

Even today, the altcoin sector is experiencing a significant increase, with Ethereum’s price surging by over 7% and presently trading at the critical resistance level of $3,920. XRP, BNB, SOL, and DOGE have all experienced modest gains of 4-5%.