Ethereum price targets a breakout above $4,000, with analysts citing strong support and on-chain metrics as drivers toward a new all-time high.

The Ethereum price remains at a significant resistance level of $4,000, despite the recent rebound. Investors are anticipating a bullish breakout.

Investors are apprehensive about the possibility of another decline, as ETH is currently hovering around $3,900.

Nevertheless, on-chain metrics suggest that there is a potential for upward momentum shortly.

Ethereum Price Must Maintain This Critical Support

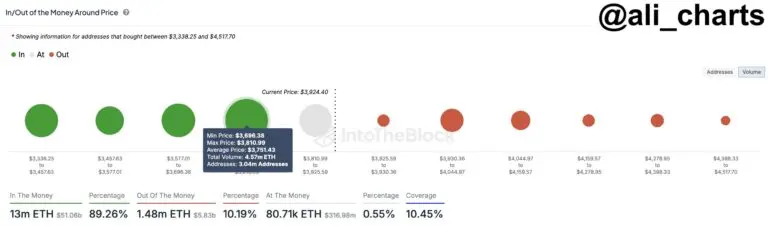

Ali Martinez, a crypto analyst, has identified a critical support zone for Ethereum, which spans from $3,700 to $3,810.

This level is of considerable significance, as approximately 3 million wallets collectively acquired 4.6 million ETH within this range.

According to Martinez, there is a robust purchasing interest at this level, which would serve as robust support for ETH and prevent further decline in the event of market volatility.

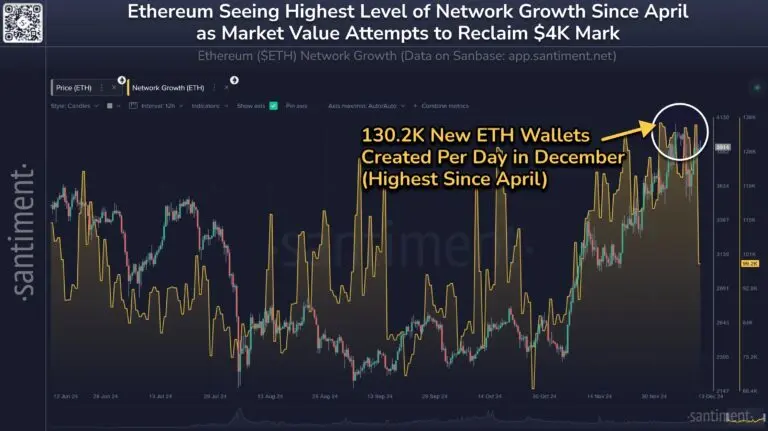

Additionally, Santiment, a blockchain analytics firm, observed a significant increase in Ethereum network activity, with the number of new wallet creations reaching an eight-month high.

A level of interest not observed since April was observed in December, as the network averaged 130,200 new addresses daily.

This indicates a growing level of interest among ETH enthusiasts who are considering the growth potential.

Conversely, the Ethereum ETF has experienced a substantial increase in inflows, which has contributed to the current optimism.

It is worth noting that the BlackRock Ether ETF has recently experienced a $3 billion inflow, which indicates that investors are increasingly interested in the investment instrument.

ETH On-Chain Metrics Demonstrate Strength

This week, Ethereum’s on-chain metrics have demonstrated substantial development, which is indicative of the cryptocurrency’s growing momentum and network activity.

This encompasses a 2.65% increase in the creation of new addresses and a 4.24% increase in the number of active addresses.

The following are a few additional indicators that demonstrate fortitude.

Additionally, the Ethereum behemoth activity indicates an additional potential for growth.

MVRV Bands For Ethereum Price

According to analysts, Ethereum’s MVRV pricing bands, a critical market indicator, are relatively unchanged, suggesting that the cryptocurrency may not have yet entered its primary bull market phase.

In the past, Ethereum has only approached cycle peaks after reaching 3.2 times its realized price (RP).

The current projection indicates that Ethereum’s potential apogee is $6,575, which is consistent with the projection of asset manager VanEck.

However, it is anticipated that this multiplier will increase during a bull run.

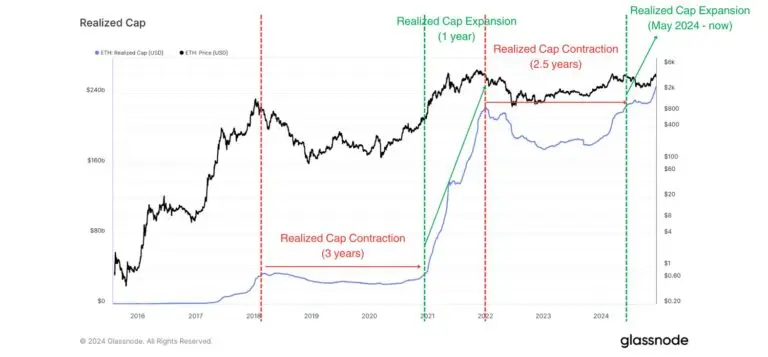

ETH Realized Cap Signals An Early Expansion

Throughout market cycles, Ethereum’s realized cap—a critical metric that monitors the aggregate value of all coins at their most recent price—experiences distinct phases of expansion and contraction.

Ethereum underwent a three-year contraction phase in the preceding cycle, which was succeeded by a one-year expansion that culminated in its cycle apex.

This cycle seems to adhere to a comparable pattern. The contraction phase concluded in May 2024, and the realized cap commenced its expansion phase in November.

This indicates that there is substantial potential for a sustained increase in the price of Ethereum.

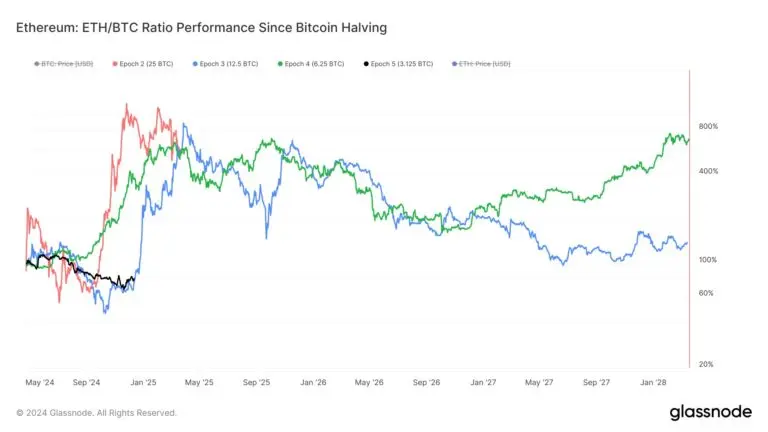

Ethereum vs. Bitcoin Chart Suggests Significant Increase

Venturefounder, a prominent crypto analyst, observed that the Ethereum vs Bitcoin chart established during the post-Bitcoin halving period suggests that the Ethereum price is poised for a significant increase.

Post-halving, Ethereum has historically underperformed Bitcoin for no more than eight months before experiencing a substantial increase in value relative to BTC.

ETH appears to be on the cusp of an upward surge, as the current halving cycle is in its eighth month.

If the trend persists, the ETH/BTC ratio could ascend to 0.39, a 700% increase from the halving.

The analyst observed that Ethereum’s value would be approximately $39,000 per coin at a projected Bitcoin price of $100,000.

Today, the price of ETH is $3,927, representing a 1% increase, with a market capitalization of $473 billion.

According to the Coinglass data, the 24-hour liquidation has increased to $16 million, while the open interest remains unchanged at $27 billion.