The CRV Price rally may extend to $2 as Curve Finance infrastructure demand increases amid the accumulation of founder Michael Egorov.

Michael Egorov, the founder of Curve Finance, has recently acquired $1.2 million worth of CRV tokens, suggesting that the Curve DAO Token is poised for a significant increase. Market experts contend that the CRV price is currently stable at $1.10 and may be poised to surge to $2 and beyond. Additionally, the demand for Curve DEX is increasing in conjunction with the launch of the USDtb stablecoin by Ethena.

Due to significant developments, the CRV price is expected to increase to $2 shortly

The CRV price has been consolidating at $1.1 levels over the past week, following a remarkable 200% increase over the past month. Nevertheless, the altcoin may receive an additional boost from the recent purchases made by the founder of Curve Finance, potentially resulting in the next leg of the mega rally.

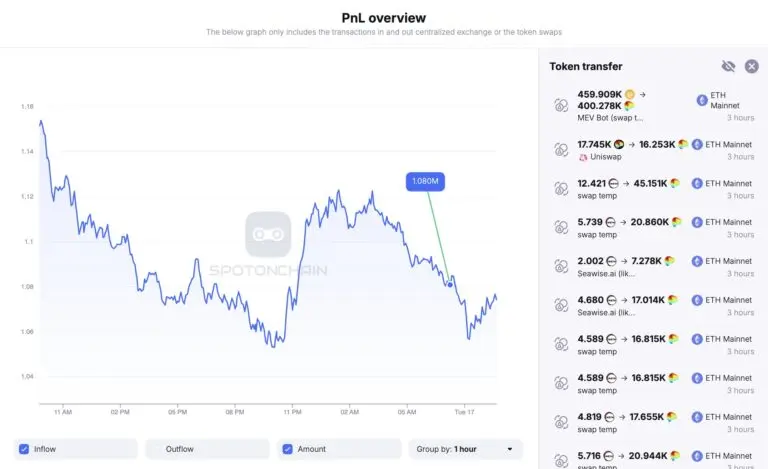

According to blockchain tracker Spot On Chain, Curve Finance founder Michael Egorov has executed a substantial CRV buyback, purchasing 1.08 million CRV tokens at an average price of $1.114, equivalent to approximately $1.2 million.

This is the first significant CRV purchase made by Egorov since the liquidation event on June 13, which indicates a resurgence of confidence in the token. The buyback occurred concurrently with a slight decline in the price of CRV to $1.0 over the past 24 hours, indicative of market volatility.

Strong confidence in the potential for growth of CRV is demonstrated by the founder’s $1 million investment. As the price of Bitcoin reaches new all-time highs, crypto market analysts are optimistic that capital will re-route to altcoins such as CRV, thereby establishing the foundation for a robust increase. According to certain market analysts, CRV will experience a brief period of accumulation before it achieves a breakout to higher levels, such as $5.

Curve Finance Infrastructure Demand Increases

The USDtb stablecoin was launched on Monday by the Ethena protocol in collaboration with Securitize and with the support of BlackRock’s BUIDL. The decentralized exchange Curve Finance will incorporate this new stablecoin.

Curve’s position as a cornerstone of the DeFi ecosystem is further emphasized by this partnership, which serves as a trusted platform for asset issuers, bridging the gap between Traditional Finance (TradFi) and Decentralized Finance (DeFi). In addition, the Ethena price is experiencing robust momentum as the USDe synthetic dollar surpasses a $6 billion market capitalization.

Curve’s AMM infrastructure has already facilitated substantial liquidity for Ethena’s stablecoins, with approximately $196 million in USDe and $20 million in sUSDe currently held in Curve pools. Two new Curve pools—USDC/USDtb and USDe/USDtb—have been established to facilitate USDtb’s December debut, capitalizing on this momentum.

At the time of publication, the CRV price is trading at $1.10, representing a 0.44% increase, and its market capitalization is $1.37 billion. The CRV open interest increased by 2.3% to $259 million, as indicated by the Coinglass data.