Metaplanet expects its first profit since 2017 and aims to expand its treasury strategy beyond simply holding Bitcoin.

Metaplanet, a bitcoin stacking firm, anticipates its first consolidated operating profit in seven years, just months after incorporating the cryptocurrency into its balance sheet for the first time.

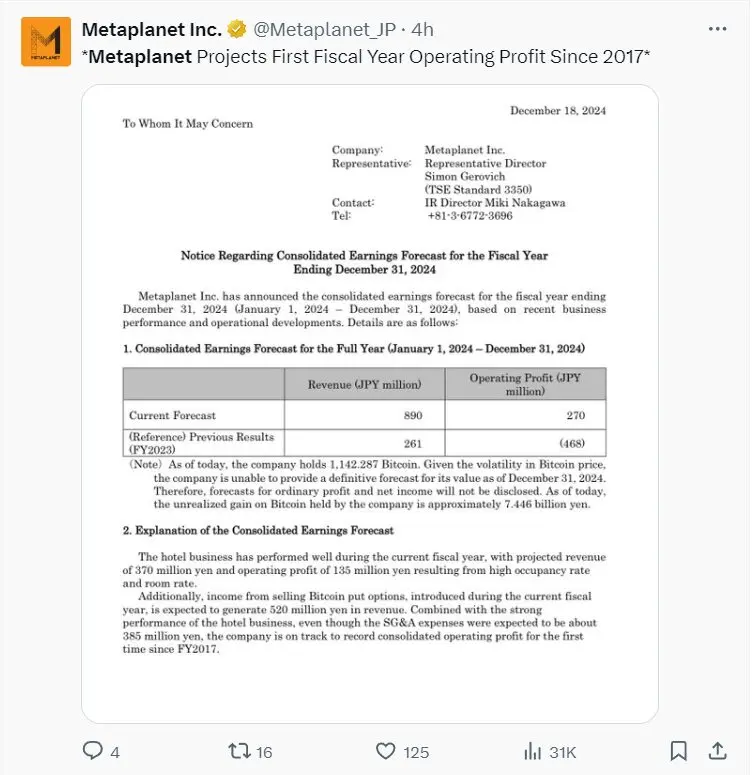

In contrast to the previous fiscal year, in which it generated only 261 million Japanese yen, the Japanese investment firm anticipates generating 890 million Japanese yen ($5.8 million) in revenue for the fiscal year ending Dec. 31, 2024. This announcement was made on Dec. 18.

The operating profit increased from 468 million Japanese yen in losses last year to 270 million Japanese yen.

According to Metaplanet, a significant portion of this revenue has been generated by the sale of Bitcoin put options, which have generated 520 million Japanese yen in income.

The price of BTC has been on the rise this year, which has resulted in a significant increase in the number of companies adopting a Bitcoin strategy.

This has often resulted in a rise in their stock prices and value.

“The company is on course to achieve consolidated operating profit for the first time since FY2017, in addition to the strong performance of the hotel business,” it stated in a statement.

Metaplanet, a Tokyo-based investment firm that is publicly traded, made a significant shift to Bitcoin in April of this year. The company adopted it as a treasury asset to protect against currency depreciation.

It also owns and operates the Royal Oak Hotel in Tokyo’s Gotanda district through its consolidated subsidiary, Wen Tokyo Co.

New Business Division Has Been Established To Encompass Bitcoin Treasury Operations

Metaplanet intends to expand its treasury management strategy beyond the mere accumulation of Bitcoin.

Metaplanet announced in a separate investor disclosure on December 18 that it will now be establishing “Bitcoin accumulation and management” as a formal business division.

This will involve the use of loans, equity, convertible bonds, and other financial instruments to acquire and maintain Bitcoin.

Additionally, it asserts that it will persist in employing put option sales as a significant revenue generator in the future.

Put options are contractual agreements that grant the owner who purchases the put option the capacity to sell an underlying asset to the issuer, Metaplanet, at a predetermined value known as the “strike price.”

It is a method by which investors can secure a minimum selling price for an asset they own in order to prevent additional losses.

Metaplanet, in turn, receives a premium for each put option contract it sells, regardless of whether the option is exercised.

If the option is exercised, it will enable it to acquire Bitcoin by its strategy.

Metaplanet also intends to generate revenue streams from Bitcoin-related marketing activities by utilizing its recently acquired license to operate a Japanese-language version of the news outlet Bitcoin Magazine.

Metaplanet is the second-largest corporate Bitcoin holder in Asia, following Boyaa Interactive.

Currently, the company possesses 1,142 Bitcoin, which is valued at approximately $119.4 million.

The objective of Metaplanet’s fourth bond issuance, which was valued at just under 4.5 billion Japanese yen ($30 million), was to accumulate additional Bitcoin.

Additionally, the company intends to issue an additional 5 billion Japanese yen in private placement ordinary bonds. This announcement was made on December 16.