The Solana price is poised for a significant rebound to $300 following the launch of the Solana staking ETP in Europe by asset manager Bitwise.

An asset manager, Bitwise, has launched the Solana staking ETP in Europe under the ticker BSOL despite the broader market pullback. The Solana price is currently trading at $217, up 1.74%. Solana investors have been waiting on the sidelines for the past few weeks as SOL consolidated around $210, but the announcement has reignited hope.

Will the price of Solana reach an all-time high of $300 shortly?

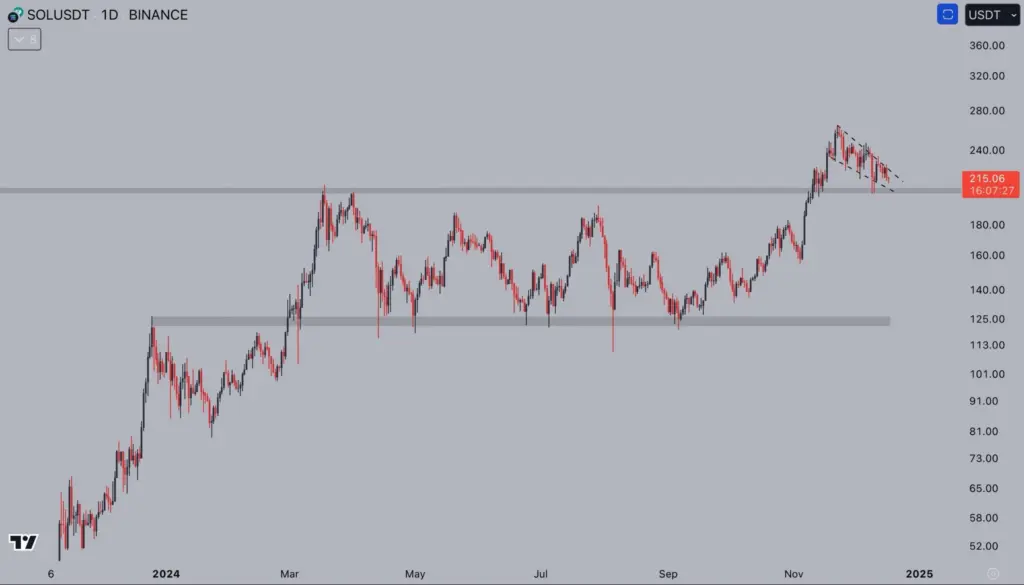

In the past few weeks, the Solana price has fluctuated sideways after reaching a high of $263 on November 22. However, it is exhibiting signs of recovery after reaching a low of $203 last week. Despite the Bitcoin price drop and broader market correction, SOL bulls demonstrate greater strength today. Crypto Jelle, a prominent cryptocurrency analyst, has presented a contrarian perspective on Solana (SOL), which challenges the prevailing bearish sentiment.

Crypto Jelle observed that “many have written off SOL,” but the charts indicate otherwise.” He observed that the asset forms a falling wedge, a bullish technical pattern, near a critical resistance level that has recently transitioned into support. Despite the prevailing skepticism, the analyst remains optimistic and anticipates a potential Solana price rally to new all-time highs before the end of the year.

The Solana price must surpass the resistances of $244 and $265 in the midpoint as it prepares for its subsequent increase to $300. Nevertheless, the SOL price rally has the potential to continue to $400 following the cup-and-handle breakout. According to Coinglass data, the SOL price is currently trading at $217, and open interest has increased by 2.25% to $5.34 billion as of press time.

The Bitwise Solana Staking ETP has been activated

On Monday, Bitwise, a renowned crypto asset manager, introduced the Solana Staking ETP (BSOL) in collaboration with Marinade, its staking provider. The development occurred within a month of Bitwise’s filing for a spot in Solana ETF in the United States. Nevertheless, market analysts believe that the approval of the Solana ETF in the United States may be delayed, and other altcoins, such as Litecoin (LTC) and Hedera (HBAR), may receive the first pass.

Bitwise has established a presence in the European Solana ETP market with its ESOL product, which currently manages $24 million in assets. Nevertheless, ESOL has been the subject of investor criticism for its failure to provide staking rewards, a feature that has proven increasingly profitable for Solana investors. The recently introduced Bitwise Solana ETP (BSOL) resolves this issue by incorporating staking rewards.

Solana ETP issuers do not offer the full staking reward rate; however, Bitwise’s BSOL will pay 6.48%. This is marginally higher than the 5.49% offered by 21Shares’ Solana staking ETP, the fifth-largest crypto ETP in Europe. Furthermore, 21Shares charges a 2.5% annual management fee, while BSOL charges a competitive 0.85%.