Bitcoin dropped 10% from its $108K ATH, marking its first weekly decline since Trump’s election rally pushed it past six-figure.

Bitcoin has experienced its initial substantial weekly price decline since Donald Trump’s victory in the November presidential election, which initiated a rally that propelled the cryptocurrency to over six figures.

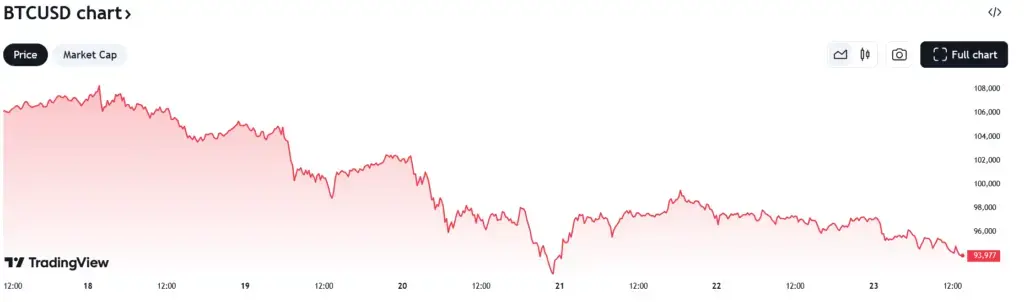

According to TradingView, BTC experienced a 10% decline in the week ending December 22 and ultimately closed at $94,645, a decrease of approximately $10,500 from its initial price of $105,185.

Its decline was precipitated by the Federal Open Market Committee of the United States Federal Reserve, which reduced the anticipated number of interest rate reductions for the upcoming year from five to two following its third consecutive reduction.

As opposed to the anticipated 3.4%, the federal funds rate may now stabilize at approximately 3.9% in 2025, which could result in a less favorable economic environment for risk-on assets such as BTC.

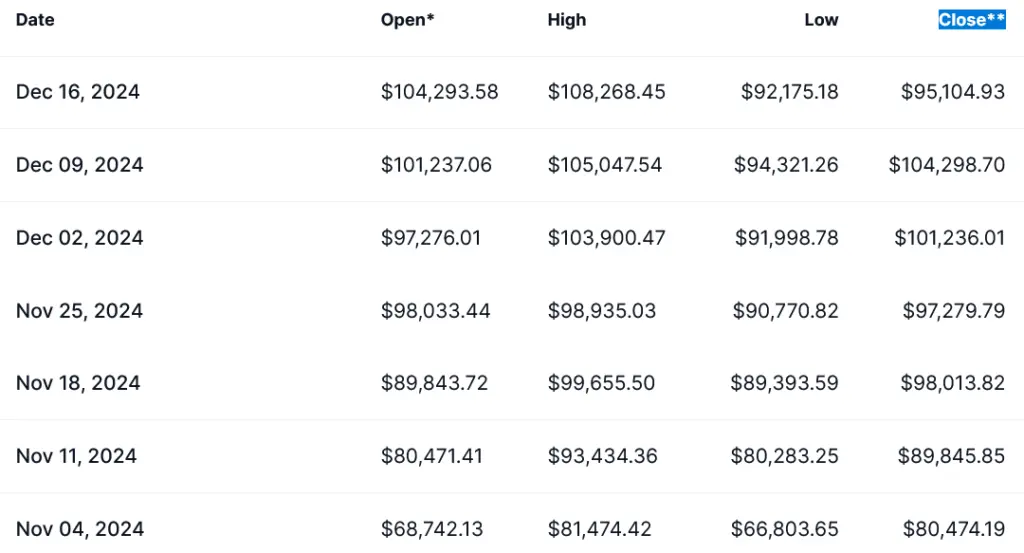

Bitcoin’s price had increased in six of the previous seven weekly closes since Trump’s victory until last week.

Bitcoin’s sole decline occurred during the week ending November 24, when it experienced a minor retracement of approximately 0.78% to $97,280, according to CoinMarketCap data.

Bitwise and VanEck, asset management firms, anticipate that BTC will surge into the $180,000 to $200,000 range in 2025, despite the retreat.

This growth could be driven by a strategic US Bitcoin reserve and increased institutional and corporate adoption.

Additionally, Trump has appointed the most pro-crypto US administration to date, selecting Howard Lutnick, CEO of Cantor Fitzgerald, to lead the Commerce Department and hedge fund manager Scott Bessent as secretary of the Treasury.

The majority of industry experts anticipate a more lenient regulatory environment for crypto, as crypto advocate Paul Atkins is scheduled to succeed Gary Gensler as the chair of the Securities and Exchange Commission on January 20, the same day as Trump’s inauguration.

Between 2002 and 2008, Atkins was an SEC commissioner.

TradingView data indicates that Bitcoin was trading at $96,073, a decrease of approximately 11% from its all-time peak of $108,135 on Dec. 17.

Traders were speculating as to whether the spot Bitcoin exchange-traded funds (ETFs) that have since been approved would be approved on Christmas Day of last year when the price was approximately $43,610.