Metaplanet, a Japanese investment firm, made its largest Bitcoin purchase yet, acquiring $60 million worth since starting in May.

Metaplanet, a Japanese investment firm, acquired nearly 620 Bitcoin, the largest transaction in the history of the cryptocurrency, as it trades below $100,000.

The firm disclosed on December 23 that it had acquired 619.7 Bitcoin, which was valued at approximately $59 million, at a price of approximately $96,000.

The firm’s most significant single purchase since it began purchasing Bitcoin in May was nearly quadrupled in value, surpassing its previous record purchase of 159.7 BTC on Oct. 28, as indicated by Bitbo data.

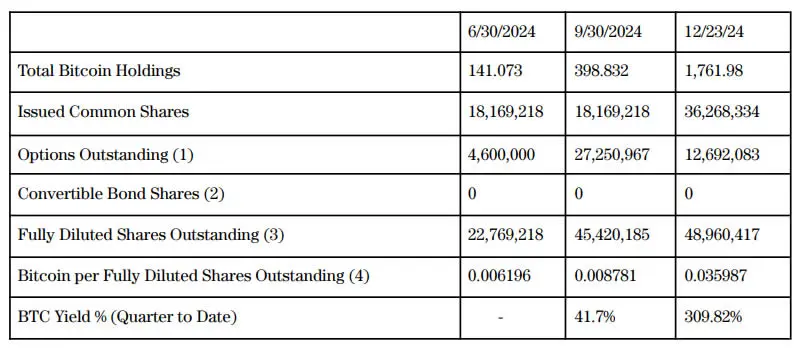

The recent acquisition of 1,762 BTC by the Tokyo-based company, Metaplanet, has earned it the moniker “Asia’s MicroStrategy” about the American Bitcoin-buying firm.

The average purchase price of each BTC is approximately $75,600. The company’s total Bitcoin holdings are estimated to be worth $168 million.

In the realm of public corporations, the most recent acquisition has elevated its Bitcoin stack to the 12th largest, trailing only medical technology manufacturer Semler Scientific.

Metaplanet reported a 310% BTC Yield from October 1 to December 23, which is significantly higher than the 41.7% yield from July to September.

It was stated that Metaplanet employs BTC Yield to evaluate the performance of its Bitcoin acquisition strategy, which is designed to be accretive to shareholders.

The Japanese investment firm announced on December 18 that it would generate its first operational profit since 2017 and that it intended to expand its treasury strategy beyond the acquisition of Bitcoin.

The company announced in an investor disclosure that it would establish a formal business line for “Bitcoin accumulation and management.”

This business line will include loans, equity, convertible bonds, and other financial instruments that can be used to purchase and hold BTC.

Metaplanet announced in late November that it intended to raise more than $62 million (9.5 billion Japanese yen) through a stock acquisition program to acquire additional Bitcoin for its treasury.

Metaplanet’s stock price experienced a 5% increase on the Tokyo Stock Exchange subsequent to its announcement; however, it has declined by nearly 13% in the past week, as indicated by Google Finance.

However, the company’s shares have surged by over 2,100% this year as a result of its incorporation of Bitcoin, reaching an all-time high of 4,080 Japanese yen ($26) on December 17.