Botswana’s central bank sees low crypto risks but emphasizes money laundering and regulatory concerns as top priorities.

According to the Central Bank of Botswana, the country’s local crypto markets are currently undeveloped, posing only “minimal” hazards to financial stability.

However, the bank stated that regulations should be implemented to mitigate potential digital-asset hazards in the future.

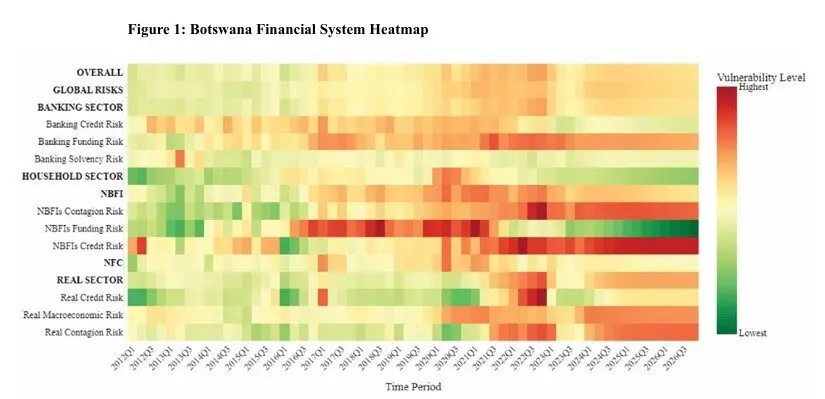

The central bank stated in its Financial Stability Report that the crypto market’s increasingly interconnectedness with the rest of the financial system poses potential future systemic risks.

A systemic risk is a cascading failure that is induced by links within the financial system in a financial context.

An economic recession may ensue as a consequence of the domino effect.

Cryptocurrency Poses Minimal Dangers To Financial Stability Of Botswana

Nevertheless, the bank asserted that the risks associated with cryptocurrency are negligible in its domestic markets.

Regulators should establish supervision frameworks for the sector to prepare for the future.

The Bank of Botswana composed the following:

“Domestically, risks emanating from crypto assets are minimal but ongoing misconduct in the segment presents regulatory concerns. Regulators therefore need to develop effective oversight frameworks for the sector.”

The central bank also stated that the hazards associated with financial technology are minimal, although they may increase as technological innovations enter local markets.

Money Trafficking Is Identified As Most Significant Security Threat In Botswana

The Bank of Botswana identified the use of digital payment instruments for money laundering and terrorist financing as one of the five top national security dangers that emanate from the financial sector, even though crypto does not pose a threat to financial stability.

Written by the central bank:

“The evolution of digital platforms and digital payment instruments that promote anonymity of transactions present an opportunity for money laundering in the financial sector.”

The bank stated that the complexity of financial technology developments enables the global transmission of illicit funds with minimal detection risks.

The central bank implored regulators to ensure that virtual asset service providers, such as crypto exchanges, comply with Anti-Money Laundering and Counter-Terrorist Financing regulations in order to mitigate these risks.

According to the bank, the identification of illicit operations may be facilitated by market surveillance and frequent collaboration with law enforcement.