As 2025 net flows turned positive, the Fidelity Bitcoin ETF (FBTC) saw $357 million in inflows, indicating rising institutional demand for BTC.

US spot Bitcoin ETF inflows have experienced a significant rebound, reaching $900 million on Friday, following a sluggish start to 2025. This time, the FBTC exchange-traded fund (ETF) from Fidelity is leading the charge, as it collected 3,640 BTC yesterday. Furthermore, the price of Bitcoin (BTC) is once again on the brink of $100K, and on-chain indicators suggest that a bottom is at hand.

Furthermore, the liquidation data indicates that traders and investors have a mixed perspective on Donald Trump’s inauguration day, as long and short liquidations are equivalent. This uncertainty is also evident in the daily flows of Bitcoin ETFs.

Bitcoin ETF inflows have resumed in a significant reversal

The US Bitcoin ETFs experienced a significant reversal on Friday, with nearly $900 million in inflows, following significant outflows earlier this week. According to Farside Investors data, Fidelity’s FBTC experienced the highest inflows of its peers yesterday, totaling $357 million. Following three consecutive days of outflows, BlackRock’s IBIT experienced a reversal, with $252 million in inflows, while Ark Invest’s ARKB saw $222 million.

On Friday, Nate Geraci, President of the ETF Store, celebrated the significant reversal after the outflow from iShares Bitcoin Trust (IBIT) the previous day. Today, IBIT experienced a considerable rebound, attracting over $250 million in new inflows. BlackRock’s IBIT achieved significant milestones this year, including over $37 million in inflows and $53 million in net assets under management.

Geraci commented on the aggregate ETF inflows, stating, “That is correct…” over $900 million. Just today, he noted that spot Bitcoin ETFs have now amassed approximately $700 million in net inflows since the beginning of the year.

The On-Chain Metrics of BTC Indicate Strength

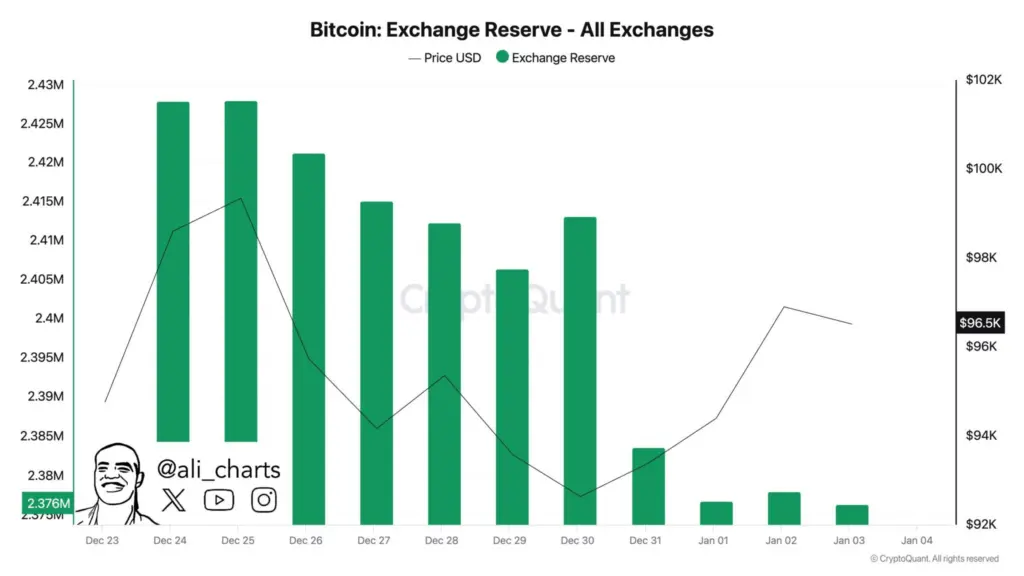

The on-chain data indicates that Bitcoin is performing well, suggesting that the bulls are prepared to overlook the current correction. Ali Martinez, a crypto analyst, has reported a substantial outflow of Bitcoin from exchanges in the past week. During this period, Martinez reports that over 48,000 BTC, valued at over $4.5 billion, have been withdrawn.

Investors are either preparing for long-term holding or opting for self-custody, as the substantial outflow indicates. This suggests a potential shift in market sentiment. Typically, these substantial withdrawals occur immediately before the significant upward movement.

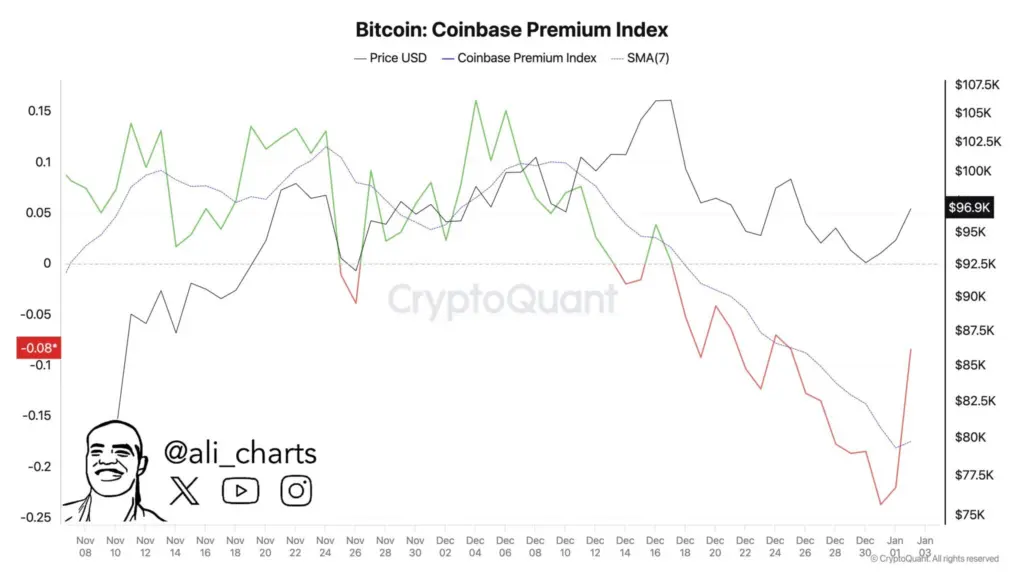

The Coinbase Premium Index, a critical indicator of institutional interest in Bitcoin, has recently declined to -0.23%, its lowest level in two years. Nevertheless, the index has recently rebounded rapidly, indicating a resurgence in the demand for Bitcoin among institutional investors in the United States. Inflows into US spot Bitcoin ETFs further substantiate this narrative.

The Bitcoin community enthusiastically anticipates Donald Trump’s oath-taking ceremony on January 20. Before the asset resumes its journey to $100K, traders expect BTC to experience some volatility. Robert Kiyosaki, the author of “Rich Dad Poor Dad,” anticipated that the price of Bitcoin would reach $175K and $350K this year.

In the vicinity of $98,000, the price of Bitcoin is trading at a 1.25% increase as of press time, with a trading volume that has decreased by 13%. The 24-hour liquidation has increased to $53 million, with over $33 million in short liquidations, according to the Coinglass data.