Monica Long, the president of Ripple, anticipates that the stablecoin Ripple USD (RLUSD) will be listed “imminently” on significant cryptocurrency exchanges.

Monica Long, president of Ripple, said that XRP’s certification as a spot ETF is probably “very soon.”

Long affirmed that Ripple is actively seeking more exchange listings for RLUSD in an interview with Bloomberg on January 7.”We’re still working to increase Ripple currencies’ availability and distribution on additional exchanges. Therefore, I believe you may anticipate additional availability and announcements shortly,” Long stated. She refused to elaborate when asked about RLUSD listings on well-known websites like Coinbase.

According to the Ripple website, RLUSD can be found on Bitso, MoonPay, CoinMina, Bullish, Mercado Bitcoin, B2C2, Keyrock, Archax, Independent Reserve, and JST Digital.

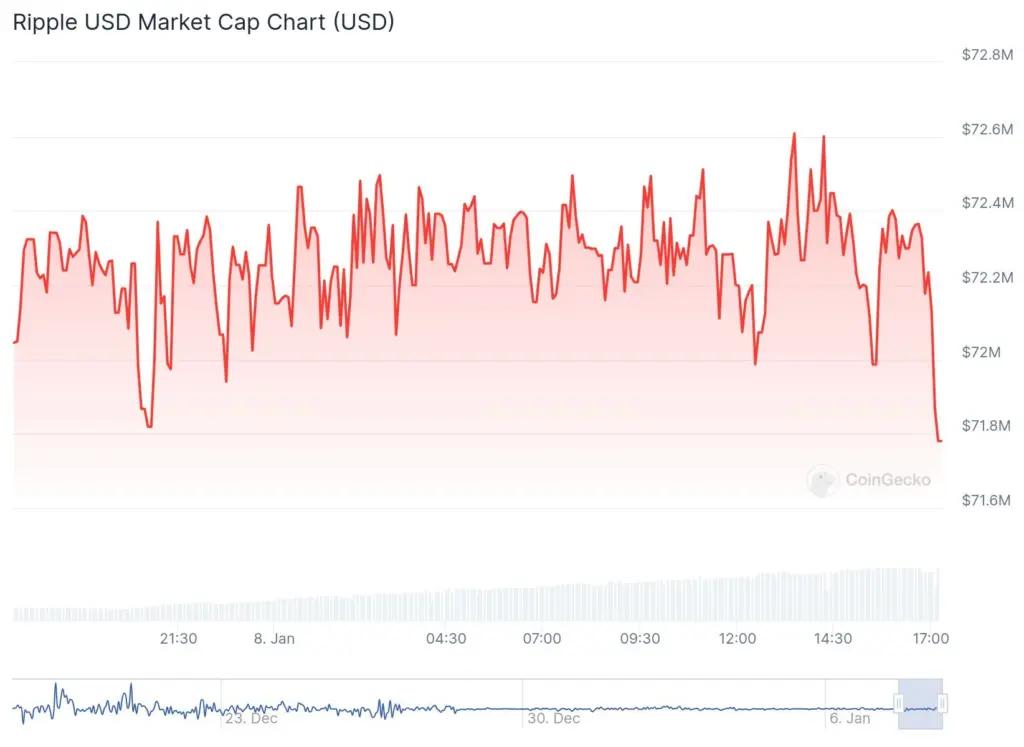

On December 17, Ripple introduced RLUSD, a stablecoin that is 1:1 correlated with the US dollar. According to CoinGecko, the stablecoin has a $71.8 million market capitalization at publication.

The two main trading pairings, RLUSD/USD Coin USDC$1.00 and XRP XRP$2.32/RLUSD, account for more than 76% of the RLUSD trading activity, which is centred on the bullish crypto exchange.

Meanwhile, a smaller percentage of the market is managed by the decentralized exchange Sologenic. The 24-hour trading volume for the XRP/RLUSD pair on Sologenic was $3.4 million, or 3.56% of the total.

“Business doubled,” the president of Ripple claims.

Ripple’s payments division, which Long pointed out has grown in the last 12 months, is the main factor driving demand for RLUSD.

“We see a robust growth trajectory for our payment solution, as our business doubled within payments last year.” The US dollar will play a premium role as a result,” she stated.

Long expects stablecoins to rise rapidly.

This year will be significant for cryptocurrencies in general, so stablecoin demand will rise. “It’s the best way to get on and off the ramp,” she remarked.

According to DefiLlama data, the stablecoin market has increased by 55% since the previous year to reach $206.2 billion. With 66% of the market, USDt USDT$0.9996 is still the biggest stablecoin.

“Very soon” XRP ETF

According to Long, XRP might be the next to have its exchange-traded fund (ETF):

“I think we will see one very soon […] XRP is likely to be next in line after Bitcoin and ETH.”

Several businesses have already started introducing an XRP ETF, such as WisdomTree, which applied for approval from the US Securities and Exchange Commission on December 2, 2024. Canary Capital, 21Shares, and Bitwise have all submitted applications for comparable goods.

According to Long, the approval of ETF applications will “accelerate” with the shift in the US administration.

Ripple and Chainlink collaborate.

On January 7, Ripple teamed up with Chainlink to connect RLUSD price feeds on Ethereum and the XRP Ledger, further enhancing the usability of RLUSD.

The partnership seeks to enable DeFi applications, offer accurate and impenetrable pricing data, and lower risks such as price manipulation and outages.