According to Real Vision CEO Raoul Pal, crypto markets are approaching a “Banana Singularity,” a phase where “everything goes up.”

Raoul Pal, the co-founder and CEO of Real Vision, has stated that the cryptocurrency markets are on the brink of a “Banana Singularity” period, during which “everything goes up.”

Pal coined the term “Banana Zone” to denote a period of substantial upward price movement.

On January 10, macro investor Raoul Pal stated on X, “Yes, we are still in the Banana Zone.”

He then went on to explain that the initial phase of this bull market was the breakout in November of the previous year.

Pal stated that the present period of consolidation, which is comparable to the 2016/2017 cycle, has been initiated.

He also stated, “This will not persist for an extended period.”

Pal anticipates that the “Banana Singularity” will be the subsequent phase of the “Banana Zone,” which will be characterized by a period of altcoin growth, followed by a more significant consolidation.

Altseason typically occurs after a decrease in Bitcoin’s dominance, which is currently at 58%, as per TradingView.

DeFi researcher ‘0xNobler’ appeared to agree with Pal in a separate X post on Jan. 10.

He informed his 225,000 X followers that “Bitcoin just entered the acceleration phase” and made a significant prediction of a pump to $500,000, which he claimed would “ignite the biggest altseason in history.”

Nevertheless, futures trader ‘CoinMamba’ was more pessimistic: “This selloff is so severe that we will have an altseason simply by the prices returning to their previous level one week ago.”

In the interim, Pal stated that the third phase of the Banana Zone is “the ‘concentration phase,’ during which the core winners explode on to achieve significantly higher highs.”

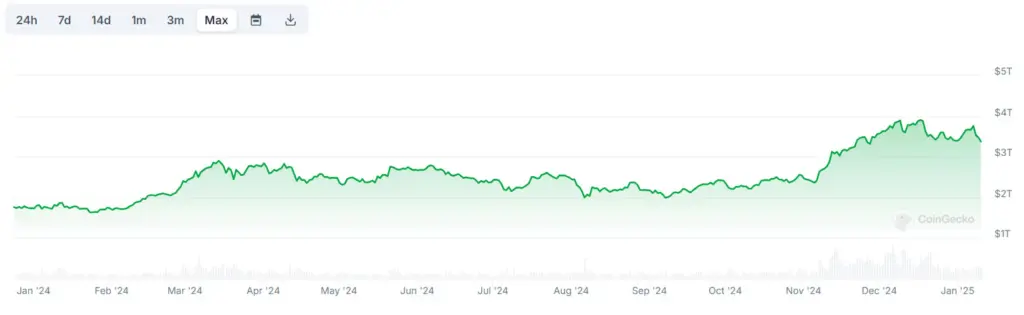

The total capitalization of crypto markets has increased by 90% year-on-year, from approximately $1.8 trillion to the current level of $3.4 trillion, despite the market correction that occurred this week.

This increase was largely because the majority of 2024 was spent in consolidation.

Furthermore, on December 17, the total market capitalization attained an all-time high of $3.9 trillion, which is 27% higher than its peak in the previous cycle.

Last year, Raoul Pal accurately predicted that the cryptocurrency markets would experience a rise in September before their initial breakout from consolidation.

He stated at the time that cryptocurrencies, as well as other markets such as the Nasdaq, would experience an increase in value as global liquidity increases.

In a separate post on January 10, Pal shared charts that illustrated the correlation between Bitcoin and the global M2 money supply.

The charts demonstrated similarities to the 2016/2017 cycle, during which Bitcoin experienced a decline before regaining momentum.

“It’s all going to be just fine. Maybe a bit lower or maybe it’s done already. Either way, higher over time. Don’t expect an exact repeat but a rhyme. Valhalla waits.”

Global Macro Investor (GMI) chief of research Julien Bittel also predicted a Bitcoin Banana Zone in June, stating, “Basically, it’s the boring zone before the Banana Zone,” following four months of sideways trading for BTC in 2024.

Markets have been in the Banana Zone since they emerged from consolidation in early November, a process that was expedited by Donald Trump’s presidential election victory.

At the time of publication, BTC was still in a state of correction, having lost an additional 1.3% on the day to trade at $93,370.

This represents a loss of approximately 9% from its weekly high of just above $102,000 on Jan. 7.